Standard Chartered HK introduces keyboard-based banking solution

The bank has launched a keyboard-based banking solution in Hong Kong.

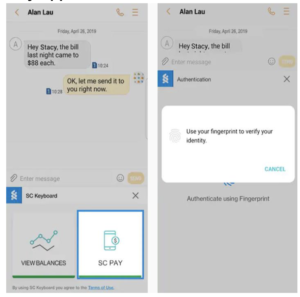

Standard Chartered Bank (Hong Kong) Limited announces the launch of a keyboard-based banking solution. Following the launch of mobile account opening, SC QR Cash cardless cash withdrawal, mobile FX with order watching services, the bank introduces SC Keyboard which allows clients to send money via SC Pay (Faster Payment System) and instantly check balances while messaging or shopping online.

To make use of the new solution, customers have to download SC Mobile, set up SC Keyboard and configure it as the default keyboard on their smartphones.

SC Keyboard is embedded into SC Mobile which can be used in any application that supports the use of a keyboard. By tapping the Standard Chartered logo and authenticate by fingerprint, clients can pay their friends for meals via SC Pay while chatting or check account balances when shopping online. Clients can make transfer in HKD or CNY according to their source account currency with a maximum daily transfer limit of HK$10,000 or equivalent.

SC Keyboard is embedded into SC Mobile which can be used in any application that supports the use of a keyboard. By tapping the Standard Chartered logo and authenticate by fingerprint, clients can pay their friends for meals via SC Pay while chatting or check account balances when shopping online. Clients can make transfer in HKD or CNY according to their source account currency with a maximum daily transfer limit of HK$10,000 or equivalent.

To enjoy the seamless and easy access to banking by SC Keyboard, clients need to:

- • Have an Android phone with fingerprint support;

- • Install SC Mobile app; enable Touch Login and SC Mobile Key;

- • Register for SC Pay.

Let’s recall that, in March this year, Standard Chartered, PCCW Limited, HKT Trust and HKT Limited,and Ctrip Financial Management (Hong Kong) Co. announced the establishment of a strategic joint venture to deliver a new standalone digital retail bank in Hong Kong. The joint venture will be conducted under a new entity, which has been granted a licence to operate a virtual bank in Hong Kong by the Hong Kong Monetary Authority.