Swissquote launches new CFD on WTI Crude Oil

Swissquote announces the launch of «OIL100», its new CFD on WTI Crude Oil.

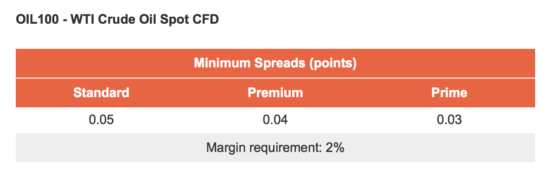

Switzerland’s most prominent online trading bank Swissquote has announced the launch of «OIL100», its new CFD on WTI Crude Oil – the world’s most traded commodity. The instrument is available for trading now.

The company explains that, as a growing number of countries are easing their mobility curbs against COVID-19, the oil market is showing signs of recovery.

OIL100 is an OTC financial derivative which tracks the price variation of the WTI Crude Oil benchmark. It is structured by Swissquote as a non-expiring CFD product and serves as an alternative to the Swissquote’s offering on monthly expiring exchange traded WTI Futures.

Swissquote forms its proprietary estimation of the spot price by extrapolation based on the underlying Futures curve. Subsequently, a constant is added.

Spot price = CL1 – basis estimation* time factor + X

where:

- basis estimation = (slope adjustment – curvature adjustment)

- CL1 is typically the earliest maturing active contract provided that liquidity and other factor are sufficient.

- Slope adjustment is a positive resp. negative quantity when the curve is in contango resp. backwardation.

- Curve adjustment is a positive/negative quantity when the part of the futures curve on which the extrapolation is based is convex/concave.

- Time factor is a diminishing function of the CL1 remaining days to expiry X is a discretionary constant = 100.

Due to the non-expiring feature of the product, overnight funding is credited/debited as a cash adjustment in clients’ accounts on a daily basis for positions opened before 23:00 CET and still held after this moment. For positions held from Friday’s trading session to Monday, triple funding is applied.

Overnight funding is a positive function of Swissquote’s basis estimation.

Typically, long/short positions pay/receive in a contango market (positive basis) and vice versa when in backwardation (negative basis).