Tech issues affect IG platforms for second time in less than one week

This time the problems appear to have been swiftly resolved, with the IG team saying it is monitoring the situation.

Some clients of IG experienced a rough patch today, as issues closing positions once again plagued the normal operations of the platforms of the brokerage. This is the second time in less than a week that IG’s platforms are affected by such issues. Given the comments on social media and the IG Community, it appears that some clients of the brokerage have not gotten their problems solved.

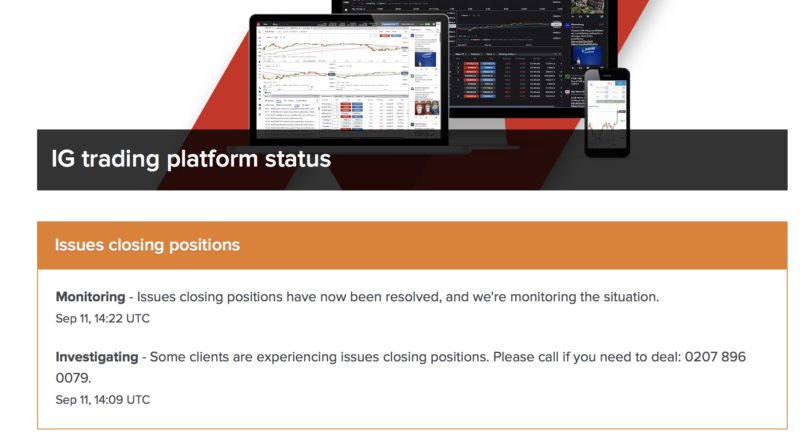

The issues today did not last long. At present, the IG status page says:

Issues closing positions

- Monitoring – Issues closing positions have now been resolved, and we’re monitoring the situation.

Sep 11, 14:22 UTC

- Investigating – Some clients are experiencing issues closing positions. Please call if you need to deal: 0207 896 0079.

Sep 11, 14:09 UTC

The reaction of the IG team appears to have been much faster this time, especially when compared to the outage reported last Thursday. Back then, all of the platforms of the brokerage were affected by a global outage for approximately two hours. The traders were especially frustrated by the impossibility to contact the IG support team.

After the two hour outage, the IG team posted a brief notice about how they are sorry and will furiously work to reply to all queries. Many traders, however, still appear to be experiencing issues and do not have their problems resolved.

Apart from the “we’re sorry” message, the company has not published any official stance on the tech issues from last week. There is no information on what actually caused them, who is responsible for the losses suffered by the traders who could not close their positions, and whether there will be any compensation for them.