This day in History: April 1, 2013 – The dawn of the opensource trading platform

In the first of a new series on FinanceFeeds, we take a look back at “This day in history” within the world of FX. Every Friday morning, we take a look back through the various groundbreaking developments that continue to take place in our fascinating industry. On April 1, 2013, Spotware Systems, developers of retail […]

In the first of a new series on FinanceFeeds, we take a look back at “This day in history” within the world of FX. Every Friday morning, we take a look back through the various groundbreaking developments that continue to take place in our fascinating industry.

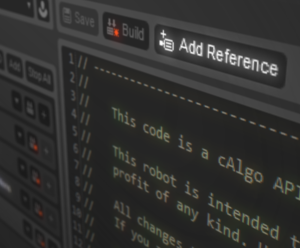

On April 1, 2013, Spotware Systems, developers of retail FX platforms cTrader and cAlgo, released the first details about the introduction of a new API called Spotware Connect.

This was the inaugrual effort by the company to allow third-party application developers easily build their own cTrader systems, and integrate existing FX related products into the cTrader platform.

At the time, then encumbent Vice President EMEA at Spotware Systems Brian Martin said that the open API will allow for the creation and access of API capabilities as they are added. “We know that, just like any other software business, we need to be open to third-party integrations. There will be certain times at which users may want extra platform or analytic functionality, and Spotware Connect is about putting that power in their hands.

“We had 3 main principles in mind when we started this project” said Mr. Martin.” The first was that it should be open to absolutely everybody. You don’t need to be a customer of a broker or anything like that. Secondly, we’ve made it extremely simple to start using, as we want to encourage people to really get going with this.”

In November 2013, Mr. Martin left Spotware Systems for X Open Hub, where he was Senior Sales Manager until March 2015, when he was appointed Sales Executive at ERP company Causeway Technologies. He now serves as VP Business Development at Dynamatrix in London.

Photograph courtesy of Spotware Systems.