TradeStation updates symbol search tool in mobile app for Android devices

The tool now incorporates volume in the search results, which will help users quickly identify the most active stocks directly from their search.

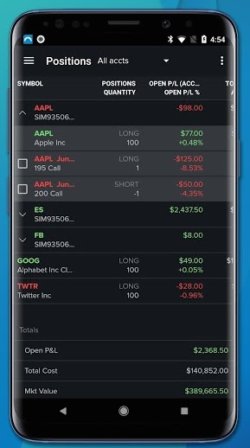

Online trading services provider TradeStation continues to bolster the capabilities of its mobile applications, with the latest solution to undergo a set of enhancements being the TradeStation app for Android-based mobile gadgets.

The latest version (4.1.1) of the solution offers a newly updated symbol search tool. It now incorporates volume in the search results, which will help users quickly identify the most active stocks directly from their search. It is also more predictive and will make navigation easier when traders are looking for a certain company ticker.

The most recent version of the solution has five popular chart studies added to it – VWAP, Momentum, Price Channels, Time Series Forecast, and Moving Average Weighted. These were added to the TradeStation Mobile app for iOS devices earlier this month. Now, they become available on the app for Android devices too.

The most recent version of the solution has five popular chart studies added to it – VWAP, Momentum, Price Channels, Time Series Forecast, and Moving Average Weighted. These were added to the TradeStation Mobile app for iOS devices earlier this month. Now, they become available on the app for Android devices too.

The regular updates that TradeStation’s mobile applications enjoy can be easily explained by the type of clientele the broker is targeting. In a recent FinanceFeeds’ interview, John Bartleman, President of TradeStation, said that in order to expand to a retail audience, web was important. That is why the broker added Matrix, trading news and its Trader Concierge to actively push data to customers.

Another of the new tech solutions that TradeStation is working on is the “SandBot”. It is on the list of projects on which TradeStation Sandbox, a fintech accelerator and think-tank program. This is an AI-based chatbot that helps traders find new trading opportunities while keeping them connected to the markets. It allows traders to get the price of a stock, ETF, or futures contract by entering a few key strokes. In addition, SandBot is able to investigate an idea that interests a given trader. The bot produces suggestions and traders get to decide which combination of symbols responds best to their goals.