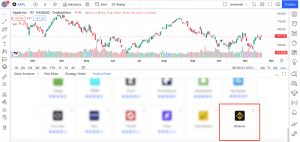

TradingView enables direct access to trade Binance Futures

Binance Futures is now integrated with professional charting and trading platform, TradingView, enabling users to perform technical and fundamental analysis, as well as trade through charts without leaving the site.

The world’s largest crypto exchange announced the integration in a blog post on Thursday, highlighting that it allows users manage their trades efficiently and learn new strategies with an active community.

TradingView users, who are also Binance customers, are now able to trade USDⓈ-Margined futures perpetual and delivery contracts directly within TradingView’s browser and desktop apps. They can access additional features by simply connecting to the platform using their Binance accounts.

“With this integration, users with a Binance Futures account will be able to log in and trade almost 200 crypto perpetual futures pairs on Binance Futures’ exchange directly from the TradingView charts and utilise numerous unique advantages — the exchange leads the market in derivatives trading volume and liquidity, offers 24/7 Customer Support in various languages and provides an array of amazing benefits through the Binance VIP program,” the release further states.

According to the web-based charting provider, registered users can simply scroll down to see the list of available broker partners. Then, they can search to find Binance icon, type in their exchange credentials, and start experiencing new opportunities, the company explains.

The alliance could boost interest in Binance’s offering after it was forced to wind down its futures and derivatives product in many countries amid a growing crackdown by regulators. The influential exchange has come under increasing regulatory scrutiny in Europe and Asia amid concerns about compliance and protection for investors.

Crypto derivatives surged in popularity among retail investors during the global pandemic, prompting regulators to put Binance and other platforms under increased scrutiny even though most cryptocurrency trading is unregulated.

Both futures and options are a way for investors to bet on the trends of a cryptocurrency price without having to actually hold the underlying coin, which skirts regulatory and custodian issues. However, futures are, in general, riskier than options as the only financial liability for the latter is the premium paid at the purchase time. On the other hand, futures contracts involve maximum liability.