Turkish Lira in freefall as state of emergency announced; More brokers take action

Turkish lira continues to collapse as President Erdogan declares state of emergency. Turkish brokers still offering unchanged trading conditions but more Western firms are taking risk management precautions.

This afternoon, Turkish President Recep Tayyip Erdogan declared a three month state of emergency across the nation for three months as a result of the failed military coup that took place on Friday last week.

The emergency allows President Erdogan an the cabinet to bypass parliament when introducing new laws and allows the government to restrict or suspend freedoms or rights.

As President Erdogan spoke today, saying “All viruses within the armed forces will be cleaned”, the effect on the currency markets has once again been vast.

The Turkish Lira began its rapid downward spiral on Friday as the coup was attempted, and remarkably Turkish FX brokers took absolutely no action to restrict trading, increase margin requirements or decrease leverage on Turkish Lira pairs, however Western brokerages began to set their platforms to close only on Turkish Lira pairs, and in some cases continue trading but with higher margin requirements or reduced leverage.

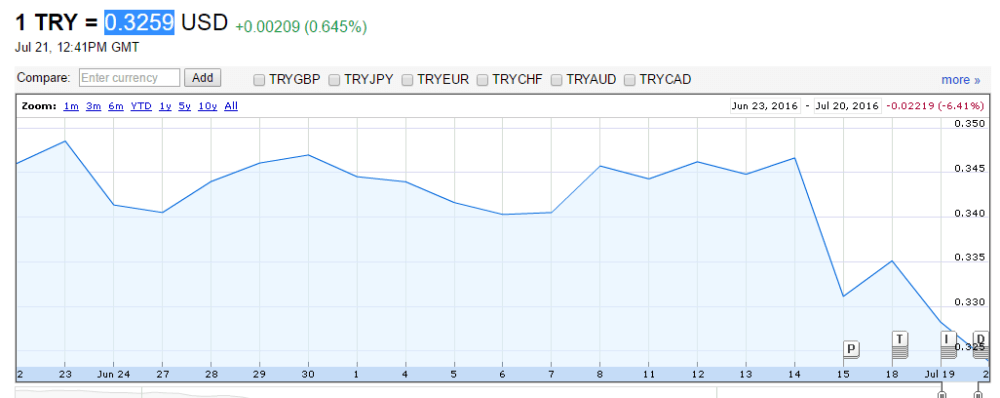

The Turkish Lira has once again begun to take a rapid downturn in value as the instability within the country continues, collapsing in value from its already low point to a new low of $0.3259 to 1 Lira.

Just an hour after the state of emergency was declared, Switzerland’s Dukascopy Bank SA has made a quick change to its trading conditions, stating that due a possible risk of significant price gaps and low liquidity on TRY instruments, which may cause negative equity on client accounts, Dukascopy Bank and Dukascopy Europe are implementing a maximum leverage of 1:10 for EUR/TRY and USD/TRY exposures as of 27 July 2016 at 10:00 GMT.

The company has asked that traders estimate their margin usage at the moment when the leverage reduction will be applied and adjust their exposure if needed.

For all Dukascopy accounts where there is no exposure in EUR/TRY and USD/TRY the lower maximum leverage will be applied today, 21 July 2016.

Turkey has a very well developed domestic FX industry, its brokers serving only Turkish clients and having their own technology firms as part of the brokerage, therefore by way of stringent regulation, brokers in Turkey are forced to be specialists in their own domestic market.

Strangely, only Western brokerages have actually taken action and even today it is entirely possible to trade all FX pairs including the Turkish Lira via all of Turkey’s brokerages.

FinanceFeeds tested Integral Menkul Degerler’s platform on Friday just after the attempted coup took place, and then again this afternoon after the state of emergency was declared, on which it is entirely possible to trade Lira against all pairs, without any restriction.

Destek Menkul Degerler, one of Turkey’s largest brokerages is still offering Turkish Lira trading with absolutely no restrictions in margin or leverage compared to normal trading terms, however the firm issued a warning on its website to investors on Friday, advising them to take their own precautions. The notice (in Turkish) is still present on the site.

The notice says

“Dear Investors. On July 15th, 2016, events in our country have occurred and impacted on the Turkish lira by causing high volatility. On July 18, 2016, the market price in Lira is very difficult to measure. Our investors are advised to adjust to the status of this development and take into account the margin collateral. Also purchase and sales quotations applied by the bank will be quite high. To our investors who make Turkish Lira denominated money transfers, we strongly advise to consider the situation. Our investors who want to transfer money to support FX accounts outside of work hours can use Garanti Bank, Yapi Kredi Bank, Akbank, İş Bank, Finance Bank, TEB and Agricultural Bank by submitting payments in dollars by wire transfer to our TL accounts.”

Whilst this is sage advice, it does not prevent traders from taking positions on a currency that is central to fiscal volatility against a stable major and exposing themselves to negative client balances, or the broker to potential inability to cover such balances should they go the wrong way.

GCM Forex has also taken no action, and has not issued any advisory notices to traders. Currently, on the broker’s website, it is possible to view USD/TRY values in real time and open and close positions as normal with 1:100 leverage.

FinanceFeeds called GCM Forex dealing desk in Istanbul this morning to inquire, and the firm was operating completely as normal.

Saxo Capital Markets Menkul Degerler (Saxo Bank’s Turkish operations) is also continuing to offer Turkish Lira trading. FinanceFeeds made contact with the company’s Istanbul office last week to establish the trading conditions for pairs which include the Turkish Lira.

“As far as we know, there is no restriction on trading Turkish Lira pairs, and trading is as normal. For extra peace of mind I will check with one of the traders now” said the Saxo Capital Markets representative. The representative made a very efficient check with the trading desk, and then confirmed that there are no restrictions on trading.

Western firms take risk management action

Interestingly, it is companies outside Turkey that took swift action to mitigate any exposure to client and company that may emerge from the situation in Turkey.

Geoff Last, Director of Institutional Liquidity Sales at Invast Global in Australia told FinanceFeeds on Friday as events began to unfold “Our Risk Management Team has reviewed our business in Turkish Lira in light of the developments in Turkey and we have implemented enhanced Risk controls as a temporary measure. This has entailed higher margin requirements and lower position limits for some clients.”

“Invast has many strong, long-standing relationships with brokers in Turkey and our thoughts are with our friends there. It is very encouraging to see that the situation appears to be stabilising. Interestingly we have seen very little impact on our turnover originating from Turkey. Volumes have been unaffected” – Geoff Last, Director of Institutional Liquidity Sales, Invast Global

On Friday, London-based ThinkMarkets (previously ThinkForex) was among the very first to react, setting its trading system to close-only on pairs involving the Turkish Lira and also began to look at restricting the margin and size.

FinanceFeeds contacted ThinkMarkets as the military coup began to take place late last week, at which point a spokesman for the company said “Due to the sudden slump in the Turkish lira the firm will limit transactions to prevent market volatility impacting client trades.”

“Our risk teams will be rigorously assessing the situation and we may look at limiting margin requirements on Turkish lira instruments as events unfold.”

“As a risk averse firm we have taken this measure quickly & swiftly to ensure that we safeguard the interests of our clients and mitigate our risk, hence our decision to limit any further exposure as uncertainty prevails in one of the most influential emerging market nations” continued the spokesman.

This morning, FxPro followed suit, setting Turkish Lira-based pairs to close only.

At CMC Markets in London, it is business as usual. “We are still pricing Turkish Lira, however the pricing team are keeping a close eye on it, and how it will be managed in terms of risk when trades are executed is something that the company will take into account” explained the firm’s dealing desk on Friday. A further call to the company today confirmed that the company is continuing to monitor the situation but has still left margin and leverage at standard levels.

In Britain, CFD and spread betting companies operate differently to those overseas insofar as the CFD is a type of OTC futures contract, therefore risk can be mitigated much easier, despite it being much harder to clear and price CFDs upon execution than spot FX transactions.

FXCM is also continuing to price Lira, however spreads are up to 18.7 on the USDTRY pair.

The key factor here is risk management. Indeed, many firms, including all companies in Turkey which have a solely Turkish customer base, are carrying on with normal terms, however the ability to internalize orders that could lead to negative balances is vital.