U.S. SEC alerts public to Binary Options fraud as product gets massive adoption

A few years back, from within the Forex industry a new disruptive product was born, offering a way to trade securities with a binary proposition. In time, as OTC binary options became popular and brokers invested millions to introduce the product to the general public, even recurring to sponsorships in sports, regulatory authorities showed concerns […]

A few years back, from within the Forex industry a new disruptive product was born, offering a way to trade securities with a binary proposition. In time, as OTC binary options became popular and brokers invested millions to introduce the product to the general public, even recurring to sponsorships in sports, regulatory authorities showed concerns as it could be considered gambling instead of trading.

Not only many countries have prohibited or restricted binary options, but there has been a massive fraudulent play by a part of these brokers, putting the sub-sector under fire, with regular complaints, lawsuits, fines and revoked licenses.

Regardless, widely accepted brokers have been also adopting the binary option trend. Today, Dukascopy has announced the expansion of the maximum duration of Up/Down options from 60 minutes to 24 hours, among other enhancements. RoboOption, part of the Roboforex group, announced weekend trading to clients for Long Term and One Touch options.

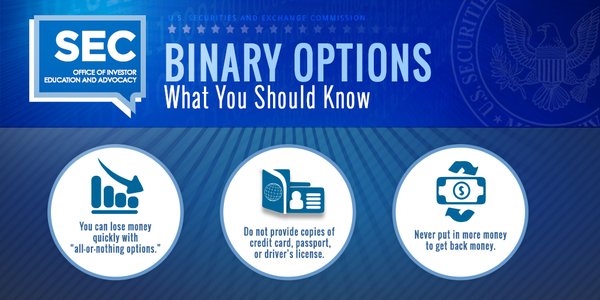

The U.S. Securities Exchange Commission, however, has sent an alert to the public to be aware of the product, since most binary options trading platforms don’t comply with applicable U.S. regulatory requirements. The country only allows such trading to be conducted through dedicated NFA-regulated exchanges, those being NADEX and Cantor Exchange.

In the most recent publication, the SEC revealed that it has received numerous complaints of binary options-related fraud practices, such as Refusal to credit customer accounts or reimburse funds to customers, Identity theft and manipulation of software to generate losing trades.

To avoid being the next victim, the SEC recommended the public to beware of overstated investment returns for Binary Options: “Additionally, some binary options Internet-based trading platforms may overstate the average return on investment by advertising a higher average return on investment than a customer should expect, given the payout structure”, said the statement, concluding that the expected return on investment is often negative, resulting in a net loss to the customer.

In addition, background checks of the Firm or Financial Professional is a must: “”Before investing, check out the background, including registration or license status, of any firm or financial professional you are considering dealing with through the SEC’s Investment Adviser Public Disclosure (IAPD) database, available on Investor.gov, and the National Futures Association Background Affiliation Status Information Center’s BASIC Search. If you cannot verify that they are registered, don’t trade with them, don’t give them any money, and don’t share your personal information with them.”

In March, the government of Israel banned Binary Options trading as it deemed gambling, which is prohibited in the country. Canada found the same verdict and warned about financial and personal risks.