Updated TradeStation mobile app supports rolling options

The latest version of the solution enables users to roll options.

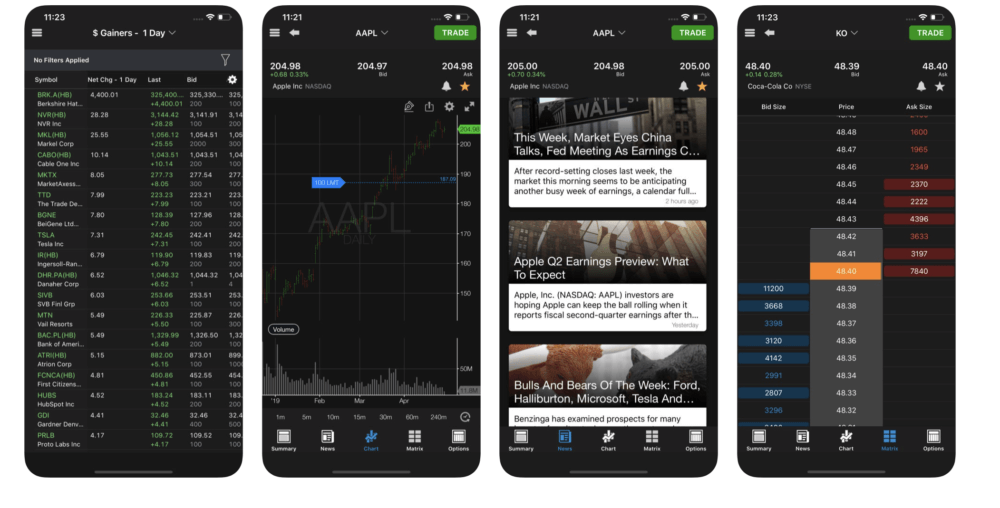

Online trading services provider TradeStation keeps updating its mobile solutions, with the latest version of the TradeStation Mobile app for iOS-based gadgets and Android-based solutions supporting rolling options.

In addition, the app for iOS-driven devices now gives options traders access to all available strike prices from the Options chain. The users of Android-based mobile gadgets may reverse positions if they see fit, as the newest version of the app enables them to do so.

The latest release of the app adds to list of enhancements to options trading introduced in previous versions of the solution. In December 2018, traders got the ability to see their full Risk/Reward & Breakeven price points on the order summary page before they send their order to the market. This is set to help traders make more educated trading decisions before executing options orders.

Version 4.9.1 of the app, which was released earlier in December, enables saving of symbols and quote lists in the cloud. This way, the data becomes accessible from any mobile device.

In one of the preceding updates to the app, an all-new balances experience became available, as the balances screen highlights important information and streams realtime account info directly to one’s device without the need to pull-to-refresh. Also, the app enabled traders to fund their account directly from the balances screen.

TradeStation’s mobile app aims to make it easier to keep an eye on the markets, one’s money finance and investment objectives. The app allows its users to get streaming quotes in real time, analyze and trade options spreads on the go. Traders are also able to monitor market depth and trade from the Matrix, get get mobile alerts on price and volume swings. The solution offers a variety of tools for analyzing charts.