USD and EUR Dynamics Amidst Global Turbulence Looking to the 1.05 Level

Looking at the landscape of the foreign exchange market right now, understanding the dynamics at play becomes paramount, particularly as the USD asserts its dominance amidst a backdrop of global turbulence.

Central to this comprehension are the foundational principles guiding central banks, encompassing forward guidance, monetary policy decisions, interest rate adjustments, quantitative easing (QE), quantitative tightening (QT), and a host of other variables.

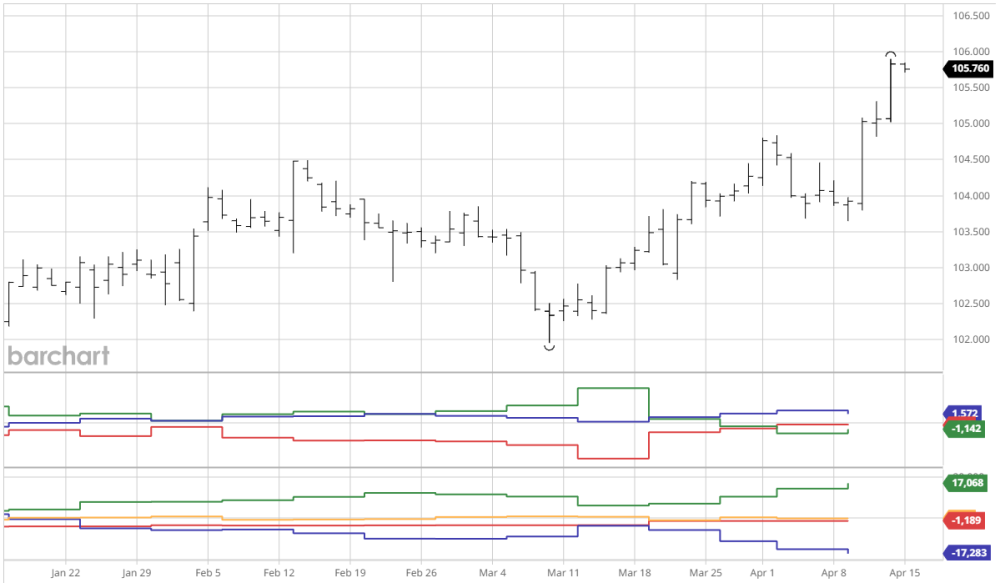

USD Index

Multiple factors converge to fortify the USD’s position this year. Elevated inflationary pressures, soaring unemployment figures, and a steady stream of capital inflows into the greenback collectively reinforce its resilience. Concurrently, retail investors actively offloading the dollar inject additional liquidity into the market, augmenting its allure and stability.

USD Inflow of Longs Since Jan 24

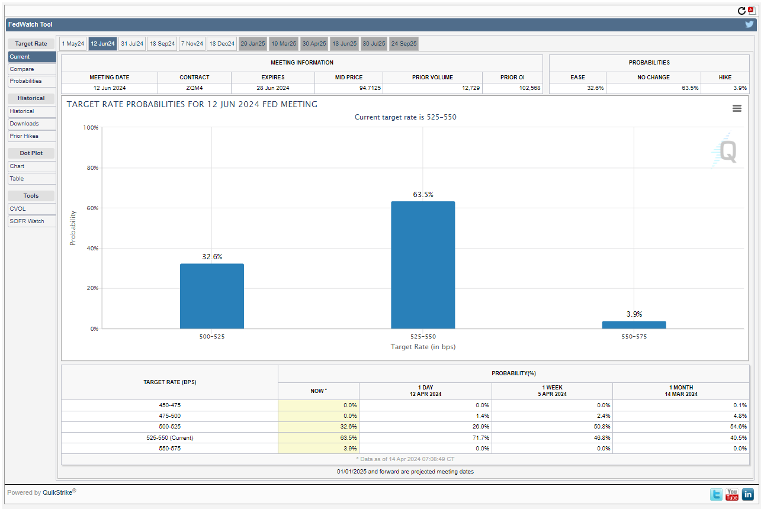

Conversely, the EUR presents a starkly contrasting narrative. Initial anticipation of an interest rate reduction by the Federal Open Market Committee (FOMC) in March has been tempered by subsequent market signals. Shifting rhetoric from FED officials, veering from a neutral stance towards a more hawkish outlook, suggests a cautious approach towards further interest rate cuts. This caution is warranted given the persistent challenges of high inflation and unemployment rates, which, if mishandled, could precipitate destabilizing inflationary spirals.

FED Watch Tool

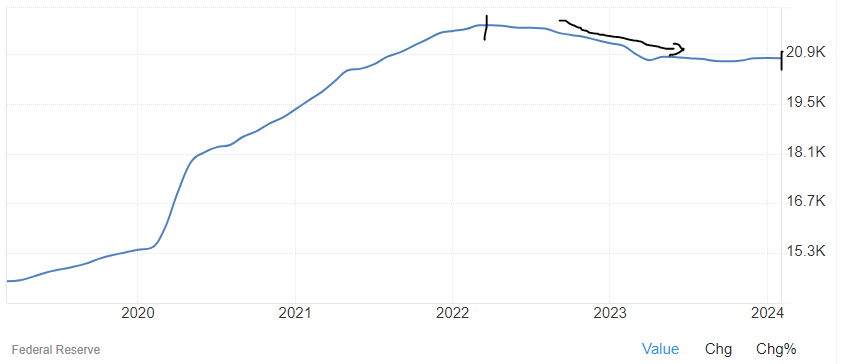

Moreover, the curtailment of M2 money supply circulation contributes to the USD’s appreciation, underscoring its intrinsic value amidst economic headwinds. Despite formidable hurdles such as burgeoning interest rates and inflation, the real estate sector exhibits remarkable resilience, defying conventional expectations.

USA Money Supply

A pivotal moment for the EUR unfolded with a statement from a European Central Bank (ECB) member signalling a potential divergence from the Federal Reserve’s monetary policy trajectory. This revelation prompted investors to redirect capital away from the EUR, triggering capital outflows and subsequent inflows into alternative assets such as USD and gold.

As history echoes through the corridors of financial markets, prevailing trends hint at a probable further descent in the EURUSD pair in the upcoming week. The prevailing sentiment suggests a predisposition towards breaching the psychologically significant 1.05 threshold, propelled by the intricate interplay of economic forces and market dynamics.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.