UTIP Platform as a new generation of trading software

UTIP Technologies Ltd. has recently introduced a new web trading terminal called WebTrader New to the general public. But the company isn’t a newcomer to the broker’s software market. This article describes new features the UTIP offers to the Forex community in 2023.

WebTrader New is a web terminal with multiple tools for trading and analysis. It stands out among peer platforms with its user-friendly and sophisticated interface, along with intuitive design.

Interface Features of WebTrader New

General UX. Our developers pay special attention to the user who is accustomed to the classic interface.That’s why the terminal’s design retains the basic layout of similar applications. However, the platform allows traders to take a new look at the trading process.

Homepage. WebTrader New is now accessed without entering your login or password. In this way, it is possible to launch the terminal’s homepage with no authorization required. This feature is great for analyzing the market and viewing changes on the chart.

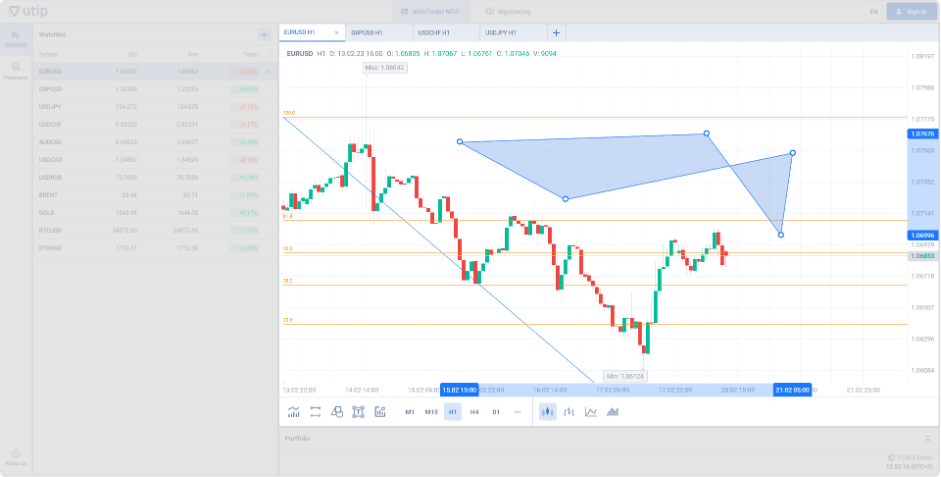

Chart and Settings Panel. The chart settings panel is perfectly developed. Changing the chart display, modifying the period or adding technical elements can be carried out directly from the panel, without opening unnecessary attachments or configuration windows. Indicators, drawing tools and comments may be edited right on the chart.

The chart is known for its smooth performance. One can see it while working with indicators and technical analysis, especially when multiple chart tabs are active at once.

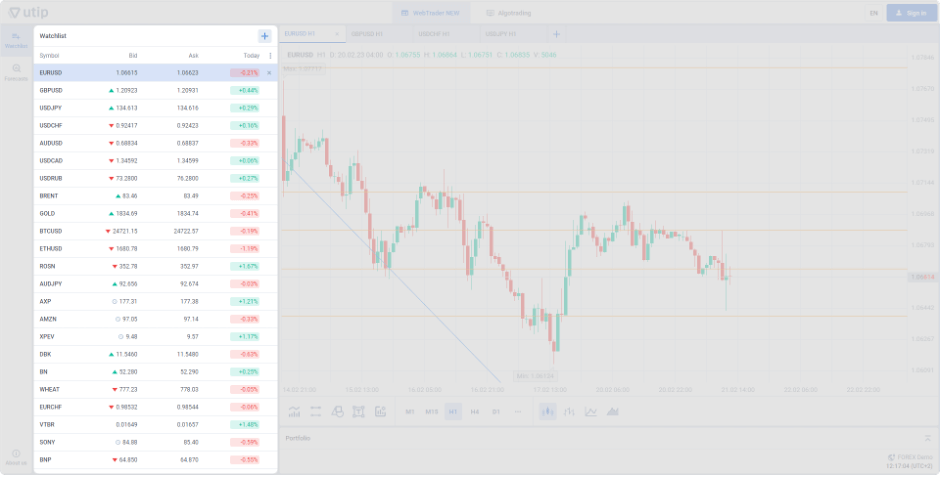

Symbols. A list of selected symbols is displayed on the left side of the terminal, reflecting price movements on each symbol over a certain period of time. It is easy to customize the list, since not only the order of symbols is changed, but also its data.

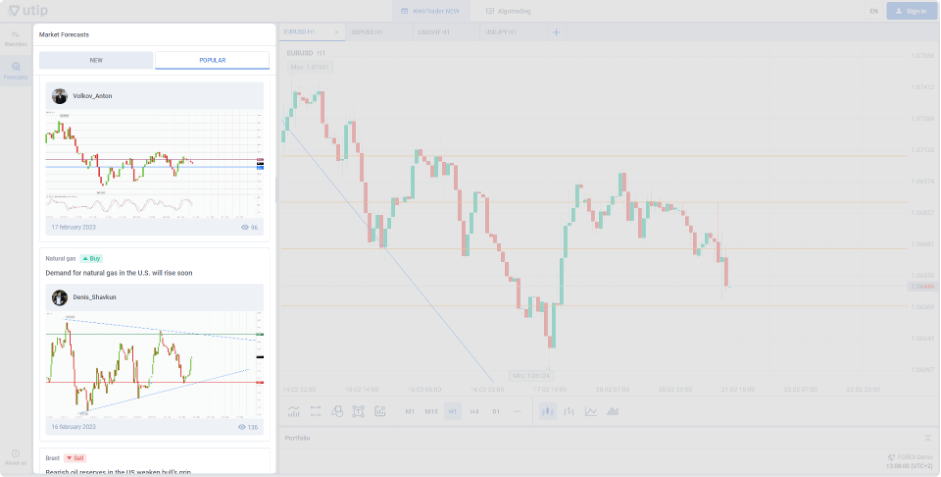

Market Forecasts. The “Market Forecasts” section is regularly updated with content from financial analysts. This section is presented in the MarketCheese service. The “Market forecasts” have been already introduced in the mobile terminal, and now it is added to the web-version as well.

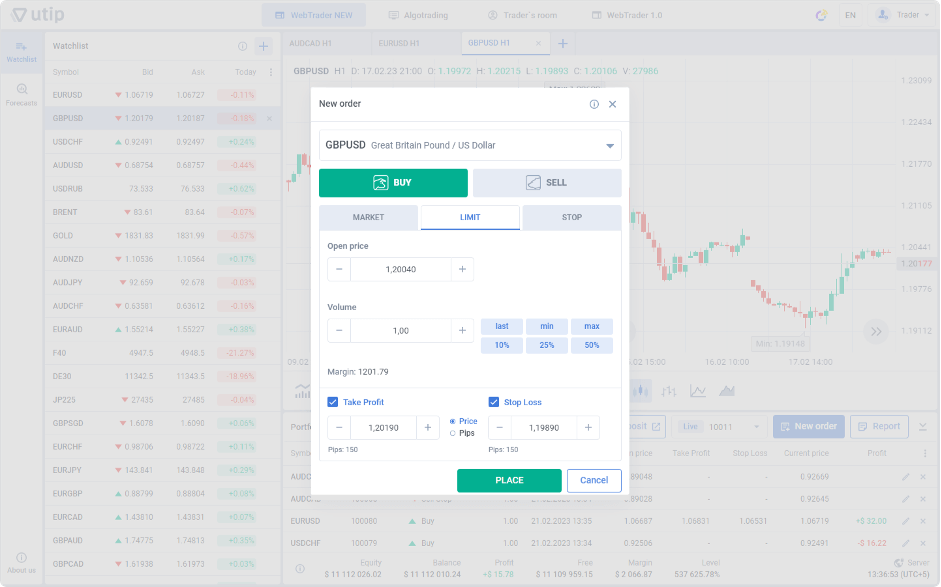

Trade window. It allows the user to buy, sell, place pending orders, and switch modes in one click. In the trading window, there are particular presets, so it is easy to specify the necessary volume, without calculating a potential balance of free funds. This solution facilitates further operation for traders.

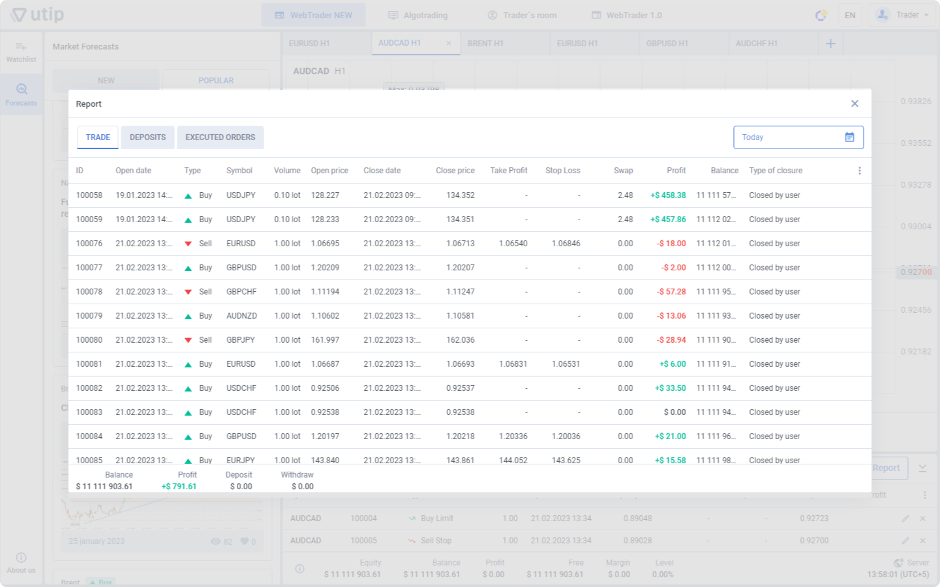

Reports. In order to evaluate your trading progress, the terminal generates a detailed report of all transactions made on your account in a matter of seconds. In fact, the report provides data on closed trades, performed deposits, as well as executed orders. It can be configured to display the parameters of transactions made and the period required.

There’s a lot to say about the intuitiveness of the WebTrader New interface, although the uptime and prompt execution of orders should be a key feature of quality. In this respect, the WebTrader New proves to be a great tool. No errors have been recorded while using the terminal, either for opening positions, or for placing pending orders.

To test the WebTrader New terminal, follow the UTIP Technologies website.