Value of London’s FinTech startups is greater than the entire national economy of France!

Just four years is all it has taken for a few hundred FinTech geniuses to outperform the entire national economy of Britain’s neighboring country. Here are the statistics and why FinTech is the way the electronic trading business should go

France may well be Britain’s neighbour by proximity, but in terms of business, it is far removed.

The national net worth of France, a nation with over 66.9 million people is 14 trillion Euros, however although the population numbers in France are not dissimilar to that of the United Kingdom at almost 80 million, the economic situation could not be more disparate.

Yes, Britain has vast, publicly listed football clubs whose corporate wealth dwarfs most national economies globally, and huge multinational IT outsourcing and professional services companies with massive market capitalization figures, just two examples of the scale of the country’s massive multi-sector economy, however whilst France has a small economy steeped in socialism and government ownership, Britain’s highly diversified, technology-centric global powerhouse is tremendous.

The reason for using France as a yardstick here is to simply demonstrate just how vast and successful London’s FinTech sector is.

In just a five year period since FinTechs became a major focus around London’s Shoreditch area, FinTech startups in London have outperformed the entire national economy of the entire country of France, with start ups which have been established over the past four years now totaling over £50 billion in value across all sectors of financial services.

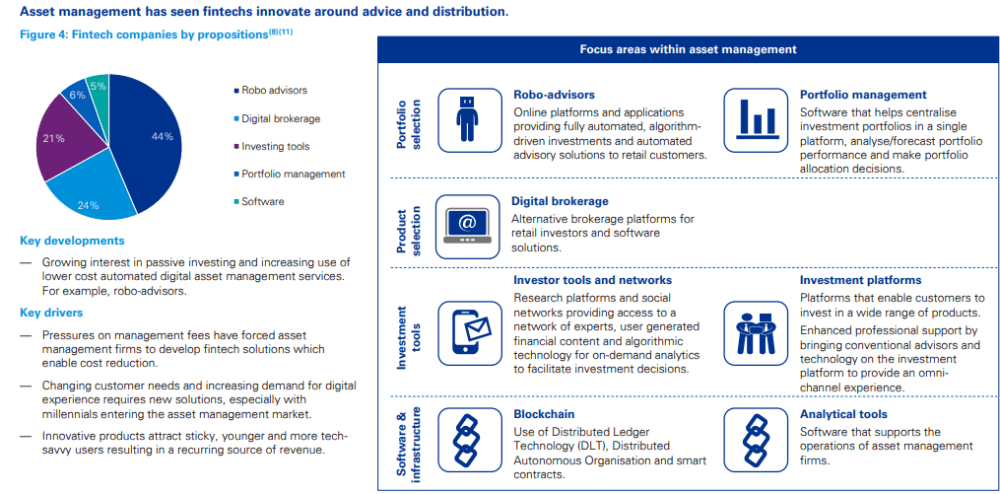

Fintechs have disrupted the financial services sector by providing new services and product propositions, with better customer engagement and better quality services and a disruptive force to this extent attracting such vast investment is no mean feat.

This means that just one square mile of land hosts startups which came from absolutely nothing to massive fruition very quickly have outpaced the entire national economy of a whole nation which has been established for 2000 years.

In Britain, the entire infrastructure, capital base and talent availability is absolutely given to FinTech development, with the government placing an emphasis on it. Just one example is how universities across the UK have specific hubs dedicated to giving FinTech entrepreneurs space and networking opportunities even during their educational years.

Financial institutions have to keep pace with new technologies and business models, in order to compete with their new rivals and they do recognise the potential risks. In a survey of 168 respondents within large financial institutions around the world conducted by professional services consultancy KPMG, 57% identified fintechs as ‘the greatest’ source of disruption, ahead of regulatory pressure and other factors such as cyber security.

Meanwhile, financial institutions also view fintechs as sources of innovation. Over 51% of the respondents to the aforementioned KPMG survey in 2017 ranked fintechs as the top source of innovation, with 21% ranking it as the second most important source.

That has grown tremendously since KPMG conducted the report, and the amount of capital investment flowing into FinTechs in London is one of the factors that have created what was a fledgling sector just four years ago and placed it higher in terms of net value than the entire nation which lies next door to the UK.

Today, statistics from London based consultancy Innovate Finance revealed investment in the first half of 2019 was up 45 per cent compared to the same period last year, and nearly doubled the inflows recorded in the second half of 2018.

The number of deals declined 30 per cent, indicating a move towards larger and later-stage rounds as the sector moves towards maturity.

The UK scored 2019’s largest fintech funding round in the world so far when Softbank invested $800m in supply chain finance lender Greensill. The Japanese mega-investor’s other UK fintech bet, a $440m round for savings challenger bank Oaknorth, was the third-largest globally.

Fintech is the highest-performing part of the UK’s tech industry, which contributes more than £130bn to the economy every year. London startups dominated the UK’s intake in the first six months, representing 90 per cent of all investment flowing into the fintech sector.

Challenger banks such as Monzo and Starling Bank had stellar rounds in the period, raising $147m and $98m respectively. Starling also added another £100m to its coffers after winning a business banking grant from the RBS Remedies Fund. Payments firms were similarly popular with investors, as Checkout.com, Worldremit and Gocardless raised a combined $481m in funding.

Specifically referring to activity among British FinTech firms, Innovate Finance CEO Charlotte Crosswell said: “It is hugely encouraging to see evidence of resilience and growth despite the uncertainty and challenging times ahead.”

Separately, 2019 is forecast to be a record year for UK investment across all sectors, breaking a milestone previously set in 2017. Data from Beauhurst showed a 20 per cent increase in the total amount of investment received by the UK’s startups and scaleups in the six months to the end of June, while the number of deals rose four per cent.

The artificial intelligence sector experienced a record first half of the year and a 15 per cent increase in deals compared to the end of 2018. Meanwhile adtech reported a 14 per cent increase in deal numbers, its first rise in three years.

If the brokerage industry considers itself to be tech-led, and it should be as electronic trading certainly is technology-dependent in every aspect of operation, the revenues generated by some of the larger MT4 firms could easily be channeled into the FinTech development arena and attract the attention of a vast global audience along with investments from some of the most stable and well organized VCs in the world.