Viewpoint on BoE’s SNB event study: London’s non-bank prime of prime sector comments

London’s non-bank prime of prime sector picks up on human traders adding value in the face of study that shows 75% of rapid appreciation of the CHF was created by bank algos

The Swiss National Bank’s sudden decision to remove the 1.20 peg on the EURCHF currency pair in January 2015 without prior warning represents one of the most memorable events that the OTC derivatives business has ever encountered.

That day, the markets were sent into an unprecedented day of volatility, creating absolute havoc for many companies, substantial losses and exposure to negative client balances for many, and in some cases, signaled the end for some brokerages which became insolvent as the sudden exposure to their liquidity providers was too much to cover.

Although dialog on this matter has surprisingly subsided, research into market behavior at the time continues among policymakers and central banks, an example being a recent report from the Bank of England which involves a detailed study of the use of algorithms by banks on the day of the Swiss Bank’s decision to remove the peg on the two pairs.

Despite many institutions and brokerages considering the move by the Swiss National Bank to have been completely without warning, the Bank of England sees things very differently, this month having been the very first entity in the world to have looked at Switzerland’s central currency issuer’s long term perspective.

The Swiss National Bank (SNB) began intervening in FX markets to cap the value of the Swiss franc against the euro on 6 September 2011. In a press release of the same date, the SNB said “the massive overvaluation of the Swiss franc poses an acute threat to the Swiss economy and carries the risk of a deflationary development”.

The Bank of England points out that at that time, which was over three years before the peg was removed, the Swiss National Bank had stated “it will no longer tolerate a EUR/CHF exchange rate below the minimum rate of CHF 1.20 … and is prepared to buy foreign currency in unlimited quantities.”

Following the introduction of this policy, the franc generally traded a little below its cap. The Bank of England’s opinion is that the Swiss National Bank pushed against it for a period in mid-2012, before appreciation pressures again intensified towards the end of 2014 due to weakness in the euro-area economy.

According to the Bank of England, in response to this, the SNB cut its interest rate on sight deposits to minus 0.25%. However, commitment to the exchange rate policy appeared to remain firm. On 18 December 2014 the SNB Governor stated that the central bank was “committed to purchasing unlimited quantities of foreign currency to enforce the minimum exchange rate with the utmost determination.”

Thus, a keen eye could possibly have seen the event coming, if the Bank of England’s position on this is to be taken at face value.

The Bank of England’s study which was released this week investigated the market reaction to the SNB announcement on 15 January 2015. In particular, the Bank of England illustrated graphically some of the key features of human and algorithmic trading around the announcement as a prelude to the more formal analysis in the rest of the paper. We first focus on the seconds around the announcement, then the minutes, and finally the hours.

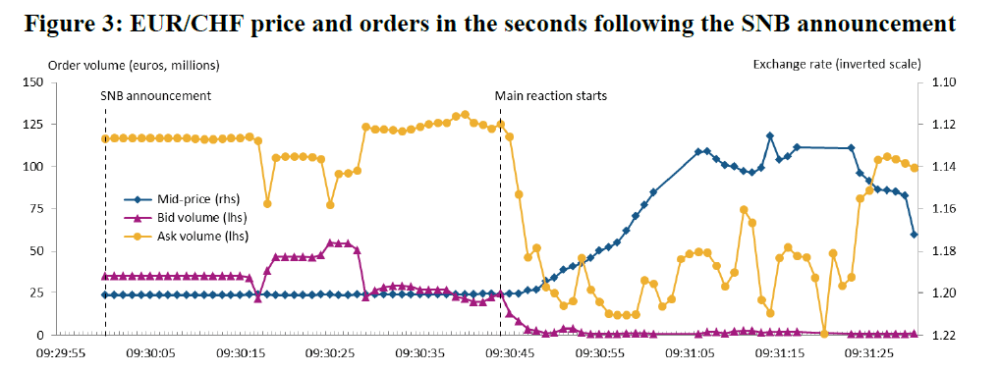

Figure 3 plots the volume of GTC orders to buy (‘bid’) or sell (‘ask’) euros for Swiss francs as well as the mid-price, which is the mid-point between the best bid and ask prices, during the 90 seconds following the announcement. Not shown, for reasons of sensitivity, is a sharp fall in outstanding orders to sell francs in the seconds approaching 9:30. While our data from EBS does not include the identities of the institutions submitting the orders, we presume this was driven by the SNB in preparation for its 9:30 announcement. The chart does show that it was not until about 44 seconds after the announcement that the market reacted significantly.

At this time, the mid-price started to reflect a very rapid appreciation of the franc, as both sides of the order book collapsed in size.14 Indeed, for a few seconds during the minute of 9.31, there were no orders to buy euros in exchange for Swiss francs at any price. We take the delayed response to the announcement as further evidence that it was not anticipated.

Source: Bank of EnglandLondon’s PB sector picks up on differences between how banks used algos, and how manual traders responded

The Bank of England then called into the equation the method by which interbank FX orders were traded, manually or via algorithmic automated trading methodology (bank AIs).

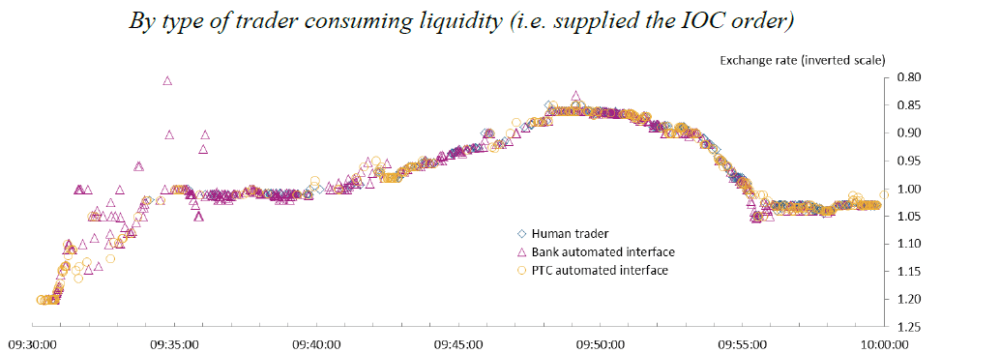

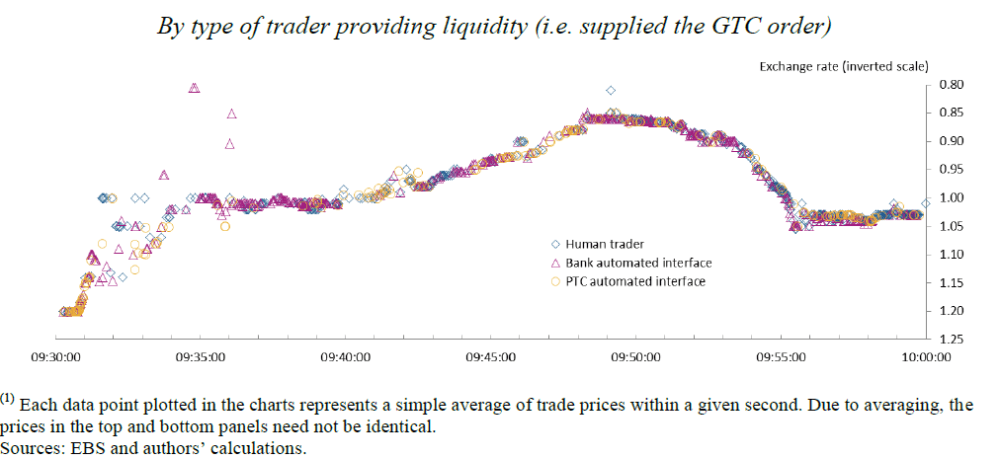

This particular study is extremely interesting because it shows the prices at which different types of trader exchanged euros for Swiss francs in the 30 minutes following the SNB announcement depending on whether their trades were consuming liquidity (top panel) or providing it (bottom panel).

Trades that consume liquidity result from IOC orders, while those that provide it result from GTC orders. The top panel shows that bank AIs consumed liquidity at extreme prices (prices significantly different to those of immediately preceding trades) on a number of occasions, notably between 9.31 and 9.36.

Thus, over 75% of the cumulative appreciation of the franc in the 20 minutes to 9.50 was attributable to bank AIs, which accounted for 61% of the volume of liquidity-consuming trades. Indeed, we show below that bank AIs accounted for an even larger share of the realised variance of the EUR/CHF rate at this time.

The lower panel shows that bank AIs also provided liquidity for some of the extreme-price trades. That bank AIs both consumed and provided liquidity at extreme prices may reflect the diverse set of traders from whom these trades may originate. This includes not only the different banks but also their various clients. In addition, a roughly equal number of extreme-price trades were accommodated by human traders.

Indeed, human traders accounted for a significantly higher share of liquidity-providing trades (50%) than they did for liquidity-consuming trades (19%) during the 20 minutes to 9.50 when the Swiss franc appreciated sharply.

The consensus among those in the institutional non bank FX liquidity provision sector in London that FinanceFeeds has gleaned comment from since the release of this study is that the Bank of England’s study alludes to the notion that whilst such a large percentage in the appreciation of the franc during that short window was attributable to bank algorithms, manual traders added value.

The Bank of England study provides an overview of the reaction of both the EUR/CHF and USD/CHF markets to the SNB announcement over the whole trading day of 15 January 2015.

This particular part of the study demonstrated that the Swiss franc appreciated extremely sharply against both ‘base’ currencies in the first 20 minutes following the announcement, but that sizeable portions of these gains were reversed in the subsequent hour.

After that the two spot rates were much more stable, with the Swiss franc worth about 10% more than at the start of the day. Ergo, according to this research, algorithmic traders were net purchasers of Swiss francs over the day, particular bank AIs against the euro and PTC AIs against the US dollar, while human traders were net purchasers of the base currencies. PTC algorithm are prime broker customer electronic trading interfaces.

See it coming: Own your own infrastructure

Thus, computers traded ‘with the wind’, buying the franc as it appreciated, while humans ‘leaned against the wind’. Note, however, that human traders did not make net purchases of the base currencies in the key 20-minute period immediately after the announcement. Finally, the third row shows that human traders were consistently net suppliers of liquidity over the day, while PTC AI trades consumed it.

The transaction data set records the time stamp to the nearest millisecond of each trade that occurred, along with the actual transaction price, the amount transacted, and the direction of the trade. Importantly for this study, the nature of the party providing liquidity (submitting the good-till-cancelled (GTC) order) and consuming liquidity (submitting the immediate-or-cancel (“IOC”) order) is categorised by EBS as human, bank AI or PTC AI hence the ability here to disseminate the data.

Interesting indeed, and should infrastructure be looked at as closely in the retail market as it is by the central banks and large interbank dealers which have vast, in house R&D teams and support entities which share their load between external solutions architects provided by companies including Fujitsu-Siemens or Accenture, they would also be in a position to collate data of this type and anticipate disruptive market events such as that created by the Swiss National Bank.

Looking at this as an example, it could be fair to suggest that those who are not in control of their own destiny and whose IP is on someone else’s platform are somewhat vulnerable as they are reliant on their provider to navigate this, which results in not only outsourcing of platform and customer database, but also of responsibility.