Westpac registers 62% Y/Y drop in net profit in H1 2020

The interim results include a substantial increase in impairment charges linked to coronavirus impact, costs associated with AUSTRAC proceedings, and the impact of estimated customer refunds, payments, associated costs and litigation.

Westpac Banking Corp (ASX:WBC) today posted its financial results for the first half of 2020, with profits hit by increased impairment charges.

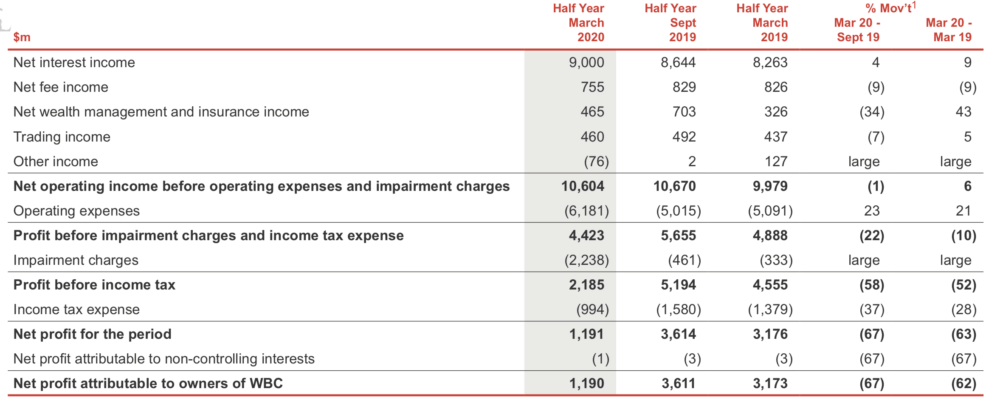

Net profit attributable to owners of Westpac for First Half 2020 amounted to $1,190 million, a decrease of $1,983 million or 62% compared to the first half of 2019. First Half 2020 included a significant increase in impairment charges due to the expected economic impact of the COVID-19 pandemic, costs associated with AUSTRAC proceedings including a provision for a potential penalty, and the impact of estimated customer refunds, payments, associated costs and litigation, which together reduced net profit before tax by $3,008 million.

As FinanceFeeds has reported, Westpac had forecast impairment charges of $2,238 million (pre-tax) in the first half of 2020. The impairment charge includes approximately $0.6 billion from individually assessed provisions and net write-offs together with approximately $1.6 billion of additional impairment charges predominantly related to COVID-19 impacts.

In addition, Westpac has also provisioned $900 million for a potential penalty relating to the AUSTRAC civil proceedings brought against it in November 2019.

Net interest income increased $737 million compared to First Half 2019 from a 2% increase in average interest-earning assets (mostly higher liquid assets) and an increase in net interest margin of 12 basis points to 2.21%.

In aggregate, non-interest income decreased $112 million compared to First Half 2019 mainly due to:

- a decrease in net fee income from lower product volumes and exit of the Advice business;

- a decrease in the valuation of Pendal; and

- lower asset sales; partially offset by

- a reduced charge for estimated customer refunds, payments, associated costs and litigation.

Operating expenses increased $1,090 million or 21% compared to First Half 2019. The rise was mainly due to:

- costs associated with AUSTRAC proceedings including a provision for a potential penalty; and

- an increase in amortisation and impairment of the Group’s software; partially offset by

- provisions for Wealth restructuring in the prior period.

Asset quality was sound, Westpac says, with stressed exposures as a percentage of total committed exposures at 1.32%, up 22 basis points compared to First Half 2019. Given that COVID-19’s economic impact only escalated in March 2020, these metrics do not fully reflect the more challenging position beginning to emerge across the economy and its impact on customers, the bank explains.

The effective tax rate of 45.5% was higher than the First Half 2019 effective tax rate of 30.3% as the costs associated with AUSTRAC proceedings including a provision for a potential penalty were substantially non deductible.

Westpac Group CEO, Mr Peter King, said: “This is the most difficult result Westpac has seen in many years. It is significantly impacted by higher impairment charges due to COVID-19, as well as notable items including the AUSTRAC provision.

“In light of the changed economic outlook we have increased Westpac’s provisions for expected credit losses to $5.8 billion, which includes approximately $1.6 billion of additional impairment charges predominantly related to COVID-19 impacts,” Mr King said.