What’s going on at Lucid Markets anyway?

FinanceFeeds looks at what’s going on at Lucid Markets, after the name of the entity was mentioned in CFTC’s Order against FXCM.

About two weeks have passed since the US National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC) have published their decisions regarding FXCM Inc (NASDAQ:FXCM), with the company now set to leave the US market, abandon its NFA and CFTC memberships and bid goodbye to its US retail FX clients. Three of FXCM’s principals, including Drew Niv and William Ahdout, have been banned from NFA and CFTC membership too.

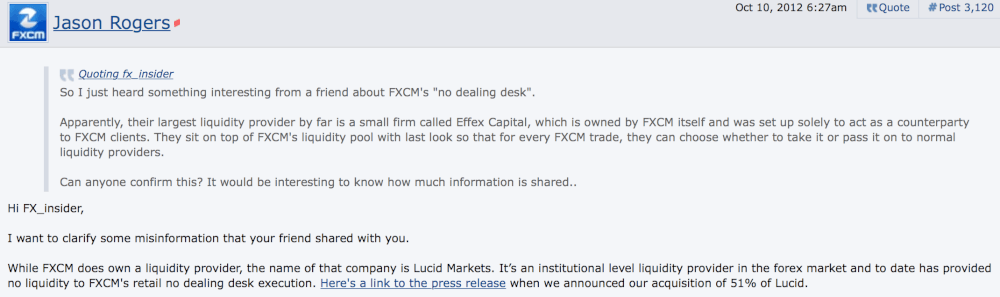

The CFTC and NFA complaints and the orders stemming from them were quite detailed as to the violations FXCM and its principals have allegedly committed. A particularly interesting point in the CFTC Order concerns an exchange of posts between a representative of FXCM and an anonymous user on Forex Factory. Whereas a user with the designation “fx_insider”exposes the relations between FXCM Inc and Effex Capital, FXCM’s representative claims that FXCM owns a liquidity provider and that is Lucid Markets, not Effex Capital.

FinanceFeeds took that as an occasion to explore the fortunes of Lucid Markets.

- The business in brief

When FXCM references to “Lucid”, it refers to NFA registered Lucid Markets Trading Limited and its UK-based subsidiary, Lucid Markets LLP.

Lucid Markets LLP is an electronic market maker and trader in the institutional foreign exchange spot and futures markets, headquartered in the UK. The Partnership (Lucid Markets LLP) was incorporated on June 19, 2012 and commenced trading October 1, 2012. The partnership acquired all of its assets and liabilities through a transfer from Lucid Markets Trading Limited (LMT). The consideration for the transfer was the controlling membership of the partnership.

As per the latest report we have (for the full year to December 31, 2015) from Lucid Markets LLP, LMT is 50.1% owned by FXCM UK Merger Limited, which in turn is 100% owned by FXCM Newco, LLC. FXCM Inc is the ultimate controlling undertaking.

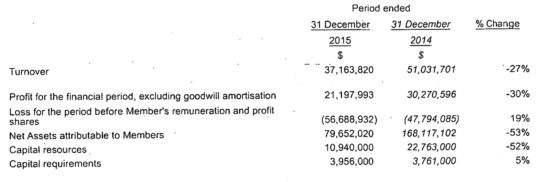

- Turnover

The first reports concerning results of Lucid Markets LLP are for the three months to December 31, 2012, that is, the first three months after the company’s name was registered in the UK. All of the reports since then state, regardless of the amount of turnover, that “All turnover arose in the United Kingdom”.

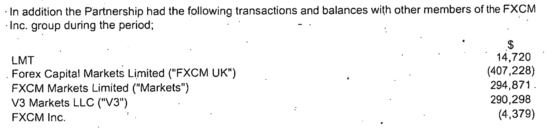

- Transactions with other members of FXCM Group

In 2014 and 2015, Lucid Markets LLP declared it had transactions and balances with other members of the FXCM Inc. group, including LMT, Lucid Markets US, FXCM Markets, FXCM UK, V3 Markets, and FXCM Inc.

Here is how the reports explains the transactions:

LMT is the immediate parent of the partnership. Transactions between the Partnership and LMT relate to day to day activities of the business and the transfer of costs.

LM US is a 100% owned subsidiary of the Partnership. Transactions between the entities relate to the transfer of costs of sales expenses incurred by the Partnership on behalf of LM US.

FXCM Markets is an other FXCM Group entity. The relationship between the Partnership and Markets pertains to that of Markets acting as a broker, whereby the Partnership generates revenues from the transactions.

V3 is an other FXCM Group entity, where certain costs are shared with the Partnership and those costs are recharged between the entities.

FXCM UK is another FXCM Group entity. Certain costs are shared with the Partnership and those costs are recharged between the entities.

FXCM Inc is the Group parent of the Partnership. Certain costs are shared with the Partnership and those costs are recharged between the entities.

- Lucid and V3

Back in March 2014, FXCM and Lucid Markets Trading announced the acquisition of certain assets from HFT firm Infinium. As a result, V3 Markets was set up in Chicago.

In 2014 and 2015, Lucid Markets had transactions with V3 Markets, as the filings with the UK Companies House show.

In the reports, V3 is labeled as “an other FXCM Group entity, where certain costs are shared with the Partnership and those costs are recharged between the entities”. More precisely, V3 Markets gained a floor trader firm registration with the NFA in June 2014. A fairly recent update on NFA’s website – from earlier this year, shows that V3 Markets is no longer registered as a floor trader firm with the NFA, effective January 6, 2017.

- Up for sale?

A Lucid Markets LLP report approved in April 2015, shows that at that point the company was obviously unaware of any plans by FXCM to sell it. The report offers a brief description of the SNB events and the deal between FXCM and Leucadia. Next, Lucid Markets’ states:

“The Company’s (Lucid Markets LLP – Ed.) operations were not impacted by the events above. In addition, none of the transactions mentioned above will affect the operations of the business, including any disposal of interest in Lucid by FXCM”.

A year later, however, following FXCM’s announcement about plans to dispose of non-core assets like FastMatch, V3 Markets and Lucid, a report (approved in April 2016) states that: “During 2015, FXCM Group commenced the process of disposing of its interest in certain retail and institutional businesses. The Partnership (Lucid Markets LLP – Ed.) is one of these businesses and is actively being marketed for sale in 2016.”

Unlike V3 Markets, which has bid goodbye to its NFA floor trader firm registration and is now without a current status, Lucid Markets LLP and Lucid Markets Trading Limited have retained their registrations as Securities & futures firm and Exempt Commodity Pool Operator, respectively.

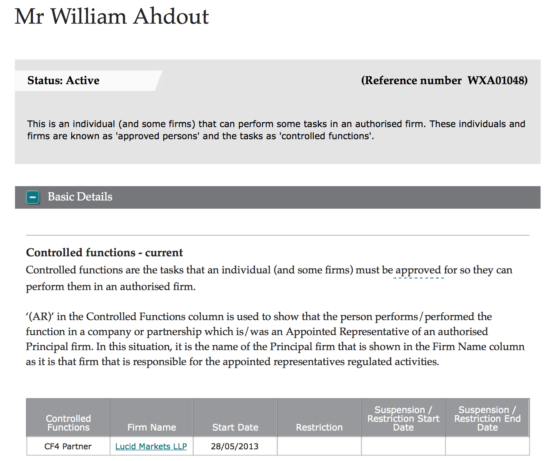

- William Ahdout

Mr Ahdout still has a status “active”, according to the UK FCA register. He is one of the partners at Lucid Markets LLP, effective May 28, 2013. The date is not random – that is the day Lucid Markets got its regulated status in the UK by the Financial Conduct Authority.

Mr Ahdout, however, is no longer registered as V3 Markets’ Principal – the move became effective on the day V3 Markets ceased being registered as a floor trader firm, that is, January 6, 2017, a month before the US regulators slammed FXCM Inc, along with Mrs Niv and Ahdout.

- More information

It is expected to be included in FXCM’s financial report for 2016 and in Lucid Markets LLP’s Full Accounts report with the UK regulators. The latter is due by September 30, 2017.