World’s fourth biggest FX dealer, Standard Chartered, makes $1.5 billion loss whilst underlying profits dip 84% in 2015

Yet another prominent interbank FX dealer has announced a sizable loss for the year 2015, this time the institution being Standard Chartered, an international bank with a license to print Hong Kong dollar bills, global prominence and the enviable position of being the world’s fourth largest handler of interbank FX order flow. The bank, which […]

Yet another prominent interbank FX dealer has announced a sizable loss for the year 2015, this time the institution being Standard Chartered, an international bank with a license to print Hong Kong dollar bills, global prominence and the enviable position of being the world’s fourth largest handler of interbank FX order flow.

The bank, which had publicly declared its intention to focus on Asia, Africa and the Middle East during the course of last year has a highly diversified income stream, with five of its individual markets delivering an income of over $1 billion during last year.

As with other large interbank FX dealers Deutsche Bank, Credit Suisse and HSBC, 2015 was not a good year for Standard Chartered PLC (LON:STAN), which today announced an annual loss of $1.5 billion, and a decrease in underlying profits by a vast 84%.

The contrast between 2014 and 2015 is stark, with the firm having made a $4.2 billion profit in 2014, therefore amplifying this year’s loss, whilst the 84% downturn in underlying profit made last year’s $5.2 billion appear a distant memory.

Bill Winters, CEO of Standard Chartered made a commercial statement, admitting that last year’s performance was indeed poor.

“While 2015 performance was poor, the actions we took on capital throughout last year and in particular in December have positioned us strongly for the current macro environment. We have a balance sheet that is resilient and we are in the right markets. We have identified our risk issues, and we are dealing with them assertively. We are making good progress on executing our strategy, creating a bank that will generate improved financial performance over time following from our improved cost efficiency, tightened risk controls, and focus on our many core advantages” – Bill Winters, CEO, Standard Chartered.

Connecticut native Mr. Winters joined the company from JPMorgan in February last year, replacing former CEO Peter Sands, therefore he has not had a very easy initial year at the company.

During Mr. Winters’ tenure at JPMorgan, he assisted the firm in building its investment bank and worked on the integration of Bear Stearns which was acquired during the financial crisis at the end of the first decade of the Millennium, therefore his credentials as a forward-looking bank executive are indeed elevated.

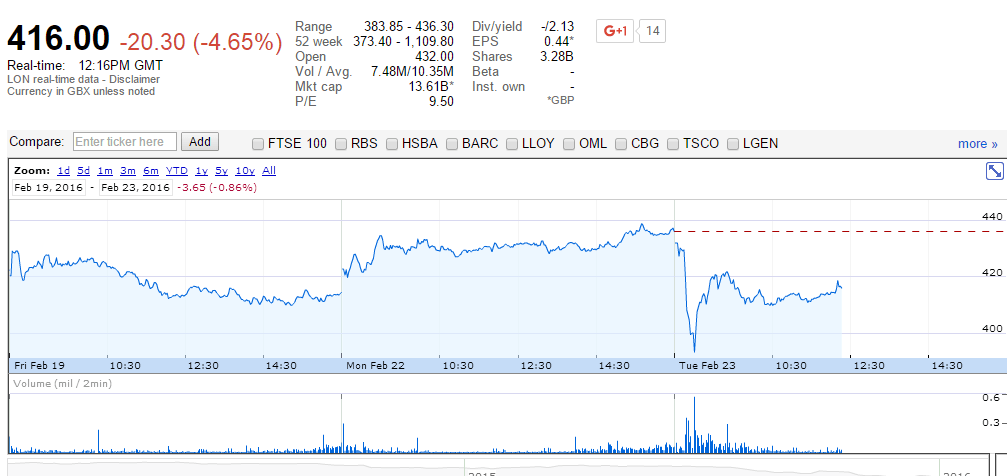

Standard Chartered’s dip in fortunes is aligned with that of its rivals during 2015, and the company, which is listed on the London Stock Exchange, has experienced a drop in investor confidence, resulting in shares being down 4.65% today.

Whilst HSBC has, for the moment, decided to shelve its (quite advanced) plans to move its operations to Hong Kong, could Standard Chartered be the institution which will lead the move eastward in order to spearhead the regeneration of its fortunes?

Chart courtesy of Google Finance