Bitcoin report for 2017 – India, China, regional geopolitics and e-wallet security are considerations for the year ahead

“With just under 5 million Bitcoins left is no wonder why there is such a rush to obtain them. The estimate date to reach the limit of available Bitcoins is based on the block reward halving frequency every four years.” Victoria Garcia, London Stone Securities

By London Stone Securities

Bitcoin in 2017

As you might remember, in 2014 we published a report on Bitcoin which served as both an introduction to the cryptocurrency and also an analysis of price movements over the year. The article finished with the statement “The current price of one Bitcoin is £201.53 British Pound Sterling on 31st of December 2014”.

Now almost 3 years on, the price currently stands at roughly £615 per bitcoin. What has propelled the currency to these recent highs seen today, and what lies in store for 2017? Let’s find out.

Cash for the internet

First a refresher for those who are unfamiliar with Bitcoin, what it is and what are its uses. It has been described as cash for the Internet. Bitcoin was introduced to the world by a Satoshi Nakamoto in 2009. It is called a “cryptocurrency” which is defined as a digital currency in which encryption techniques are used to regulate the generation of units of currency and verify the transfer of funds, operating independently of a central bank.

Encryption basically just means taking something like text or data, then converting it into code which prevents unauthorized access. To decipher the contents you would need a “key” which unlocks the code and makes it readable.

Fiat Currency

Bitcoin defined as a currency works in a very similar fashion to any ordinary currency which fluctuates based on the demand. But Bitcoin is different to other currencies. Bitcoin is not classed as a “fiat” currency like all the regular forms of payment we are used to.

The term derives from the Latin fiat (“let it become”). Fiat currency is one that a government has declared to be legal tender, but it is not backed by a physical commodity. The value of fiat money is derived from the relationship between supply and demand rather than the value of the material that the money is made of.

Bitcoin is not a fiat currency as there is a fixed supply of 21 million coins. The main problem with fiat currency is the fact that unlimited amounts of money can be printed without a corresponding value behind it. Fiat currency is known as a centralized monetary system.

A central bank introduces new money into the economy by purchasing financial assets or lending money to financial institutions. Commercial banks then multiply this base money by credit creation through fractional reserve banking, which expands the total supply of broad money (cash plus demand deposits

Bitcoin is a decentralized system where no one or few parties hold power over money supply and therefore one can argue a more secure approach as there is no single obvious failure point.

Circulation

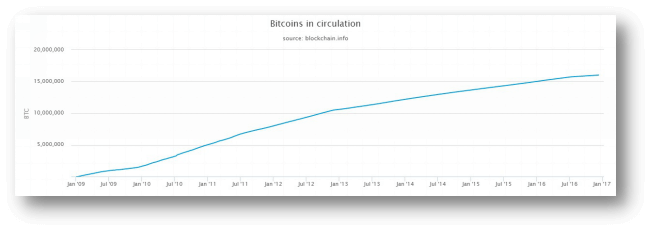

Currently 16 million Bitcoins have already been issued. The graph above highlights Bitcoin in circulation since its inception in 2009.

No more coins can ever be issued beyond the 21 million limit, giving all bitcoins in circulation some form of value at any given time, with the potential to appreciate. It will take until approximately until the year 2140 for all 21 million bitcoins are issued.

Bitcoin issuance is called “mining”. Mining is the creation of a new bitcoin. It involves you using your PC or a group of PCs with special software which uses computational power to solve math problems that then in turn unlock part of or all of a Bitcoin.

Power consumption, time and running costs all need to be considered when undertaking mining.

Exchanges and Cyber Wallets

So, what are the alternatives if somebody did not want to mine Bitcoins? the answer is to simply buy them on the secondary market using one of many exchanges. Secure exchanges that are trustworthy and have good user ratings will rank higher than their peers. Currently one of the highest rated exchanges in terms of security is Coinbase.

Bitcoins are stored in “cyber wallets” and similarly to cash Bitcoin works on a similar basis to cash if you lose a £5 pound note on the street chances are it’s gone for good, same if you lose a Bitcoin that say is stored on your hard drive or key drive.

There is no mechanism to recover stolen or lost Bitcoins at present. It is also technically an untraceable currency, feature that attracts its use for criminal activities such as drug dealing, tax evasion and financial fraud to name a few.

Now this fairly lengthy introduction is over let’s see what has happened recently in 2016 for Bitcoin and where it can go from here.

The present

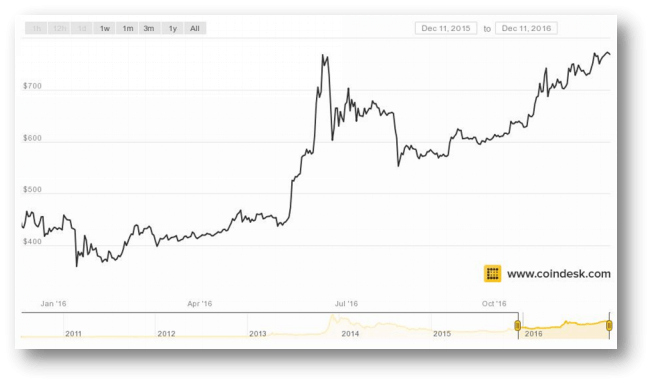

This is the 1 year graph for Bitcoin, as you can see from lows of around $360 dollars per bitcoin to recent highs we are currently experiencing over $700 near $800-dollar market.

2016 has been a year of significant volatility with the sell off the FTSE at the beginning part of the year to Brexit in June to the U.S elections that have just occurred back in November. Bitcoin’s price jumped 21 percent on the day of Brexit alone!

Note the huge jump in price during this period, this has been determined to be down to mass panic selling of the Chinese Yuan. A sudden burst of buying pressure in Bitcoin, driven by Chinese buyers, has spiked the virtual currency higher during this period.

The Chinese demand shows that there is a real possibility of using the Cryptocurrency as a method of capital controls against a plunging Yuan. Remember that is vast price increase represents only a small fraction of the $22 trillion of Chinese deposit money out there.

This further supports the assertion that Bitcoin is valuable just because people are willing to use it.

Predictions

Indian Influence

Since prime minister Narendra Modi pulled Rs500 and Rs1000 notes from circulation on 8 November in a bid to fight corruption and terrorism, the weekly volume of bitcoin trading in India has nearly doubled from prior levels. India sees over a billion people face government-imposed limits on ATM and bank withdrawals.

This has forced people to become adopters of the new technology not out of choice, but essentially out of desperation. This trend is likely to continue, in conjunction with the new gold tax in India, pushing investors and high profile traders to shift towards alternative safe haven assets such as silver or bitcoin.

India may want to try and prevent a mass exodus to Bitcoin by implementing their own system The Unique Identification Authority of India (UIDAI) which will work on a biometric basis. The clear trend in India is pushing for demonetization and this will have a beneficial effect on the price of Bitcoin.

Emerging Markets, China and U.S Policy

Donald Trump’s controversial spending policies in a bid to stimulate the U.S economy will increase the US national debt and cause high levels of inflation. This inflation will be the primary cause forcing the U.S. Federal Reserve to hike interest rates at a faster pace and potentially causing the U.S. dollar to skyrocket.

If this were to happen the debt laden Emerging Markets suddenly will look for alternative forms of currencies and payment systems that are not tied to central banks. Emerging Markets have been traditionally supported by high oil prices but recently the slump in the oil price has hurt them significantly.

The current Venezuelan humanitarian crisis due to their monetary collapse has led to mass starvation and poverty. In this instance, Bitcoin provides a solution by being able to bypass strict monetary controls in place, tariffs such as import taxes, and bureaucracy. Bitcoin is allowing people in Venezuela access to food and medical supplies that are saving lives.

The situation in China is very different, the Yuan is currently at a 6-year low, investors, speculators and ordinary citizens alike are aware that a big change is coming.

People are positioning themselves ahead of the curve and adopting Bitcoin in Record numbers. China seeks independence from the US Dollar and Bitcoin can offer a genuine alternative.

Price levels, demand and mining capabilities

If the banking system, as well other nations such as Russia and China, move to accept bitcoin as a partial alternative to the U.S. currency and the traditional banking and payment ecosystem, bitcoin’s price could easily triple over the next year from the current $700 level to $2,100 and beyond.

The block-chains decentralized system, an inability to dilute the finite supply of bitcoins, and low to no transaction costs are all highly attractive in these volatile uncertain times.

Hot money, large capital outflows from crisis states, money launderers, tax dodgers, drug kingpins and criminals alike are all attracted to the anonymity and flexibility Bitcoin offers.

Some recent statistics for Bitcoin

With just under 5 million Bitcoins left is no wonder why there is such a rush to obtain them. The estimate date to reach the limit of available Bitcoins is based on the block reward halving frequency every four years.

An explanation for this is as every Bitcoin is mined, it gets incrementally harder to mine the next one, and every four years on average there is a something called a “halving event”

The number of bitcoins rewarded for mining decreases with time: it is halved every 4 years. This event, the moment when the mining reward is divided by 2, is commonly called “Bitcoin halving”. So, based on calculations, in around 124 years there will be 0 Bitcoins left, at which point the lucky owner of 1 Bitcoin may be very rich indeed.

In today’s terms $770 dollars for one Bitcoin may seem quite high, but remember you do not need to buy whole Bitcoins at once, you are able to purchase fractions of Bitcoins. The smallest unit that a bitcoin can currently be broken into is called a Satoshi named after the creator and this equals to 0.00000001 Bitcoin.

Risks of Bitcoin

Bitcoin carries many risks, as a new technology with a relatively small but rapidly increasing market capitalisation (for a currency). Risks of liquidity, volatility, technological change and hacking are all still present.

Barriers to entry would be technological know-how and hardware, but the technology is open to practically anyone with access to a computer. It is possible to carry $1billion USD on a pen drive in Bitcoin format, there are not many more portable forms of wealth on the planet other than Bitcoin, but at the same time if that pen drive were to be lost, that would be an expensive misplacement!

If central banks where to view Bitcoin as a real threat, then there is the possibility for an alternative government sponsored system or regulation to be put in place to cripple the currency whilst in its early formative years.

In an event of an EMP (electro-magnetic pulse) attack this could wipe records and also pose a further risk to Bitcoin or any electronic equipment for that matter.

It is believed that Quantum Computers could break the encryption of Bitcoin which could theoretically render all Bitcoins worthless overnight. Quantum computing is currently one of the world’s most researched areas and could bring in an era of massive technological change which would mean Bitcoin would have to adapt or face becoming obsolete.

It is important to remember Bitcoin is not a stock or “equity” but a currency used to purchase real world items.

Final thoughts

It is clear that current world currency volatility can have a massive impact on Bitcoin, notably for example the run on the banks in Cyprus 2013 which pushed Bitcoin prices up to record highs of over $1000/Bitcoin.

In 2017 with the Euro in dire straits, with the very real possibility of the collapse of Venezuela, further countries adopting an isolationist stance which could lead entire collapse of the European Union, the volatility and uncertainty is set to continue and potentially grow in magnitude which will no doubt spike Bitcoin prices further as it will be viewed as a perceived digital safe haven.

Bearing this all-in mind, is $2000 dollars a reasonable target for Bitcoin in 2017? As with any other investment, only time will tell.