Breaking news IG Group, CMC Markets and Plus500 share prices crash due to FCA ruling on CFD products and leverage cap

The ruling today by the Financial Conduct Authority has had a decimating effect on the share prices of IG Group (down 22%), Plus500 (down 38%), and CMC Markets (down 23%) as CFDs – the core business of most British electronic trading firms – are subject to leverage caps and further restrictions. All this effect on top quality firms, yet the British authorities turn a blind eye to binary options fraud whilst other countries take action

This morning, FinanceFeeds reported that the Financial Conduct Authority in Britain has imposed restrictions on the method by which contracts for difference (CFDs) are

the regulator’s view being that Contracts for differences, such as spread bets and rolling spot foreign exchange products, are complex financial instruments offered by electronic trading firms and that following an increase in the number of firms in the CFD market, the FCA has concerns that more retail customers are opening and trading CFD products that they do not adequately understand.

The FCA’s analysis of a representative sample of client accounts for CFD firms found that 82% of clients lost money on these products.

In Britain, CFDs and spread betting are very popular indeed, whereby some of the highest quality electronic trading firms in the world, some of which are publicly listed, provide these products via proprietary platforms to a discerning British audience of loyal customers.

The FCA is therefore proposing a package of measures intended to enhance consumer protection by limiting the risks of CFD products and ensuring that customers are better informed. The new measures include:

- Introducing standardised risk warnings and mandatory disclosure of profit-loss ratios on client accounts by all providers to better illustrate the risks and historical performance of these products.

- Setting lower leverage limits for inexperienced retail clients who do not have 12 months or more experience of active trading in CFDs, with a maximum of 25:1.

- Capping leverage at a maximum level of 50:1 for all retail clients and introducing lower leverage caps across different assets according to their risks. Some levels of leverage currently offered to retail customers exceed 200:1.

- Preventing providers from using any form of trading or account opening bonuses or benefits to promote CFD products.

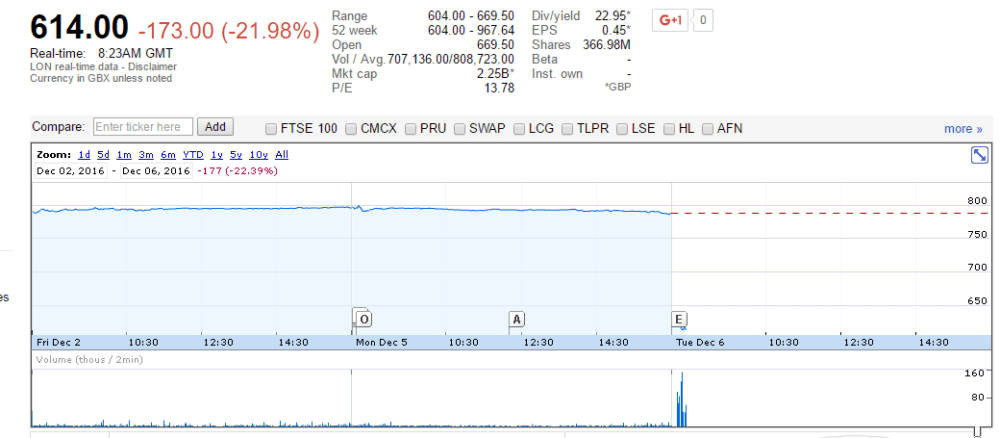

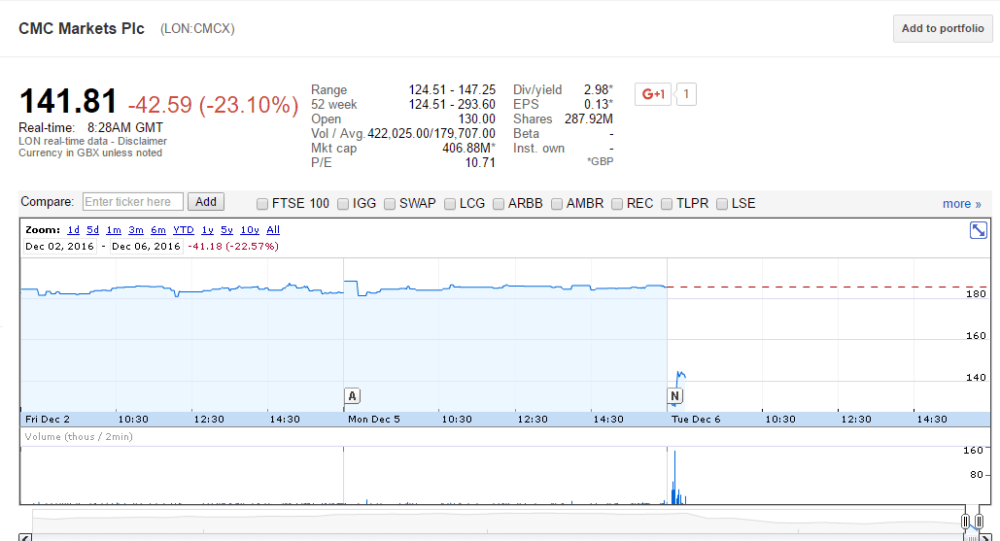

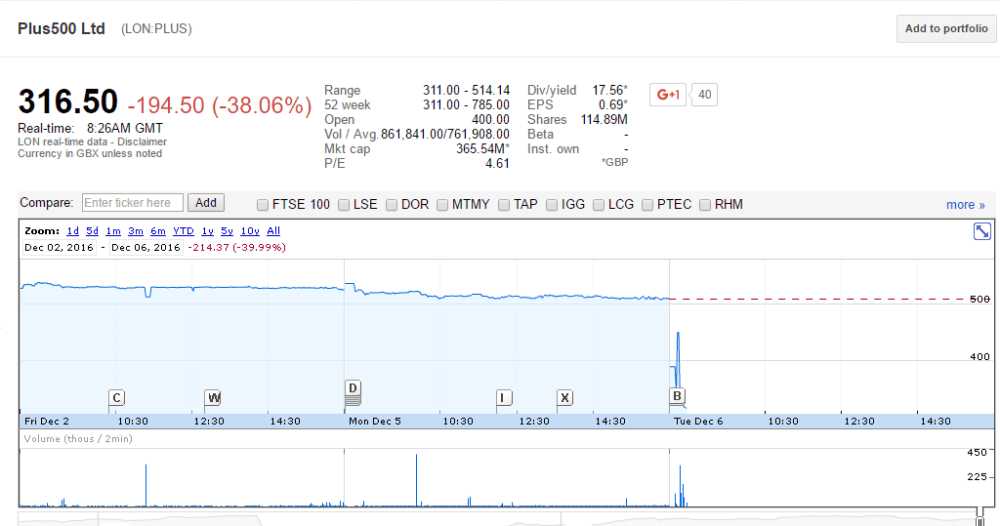

This has caused a tremendous reduction in the share prices of three of Britain’s largest and most widely respected electronic trading firms, all of whom’s core business is retail market CFD trading via sophisticated proprietary platforms.

IG Group, Britain’s second largest electronic trading and investments firm after Hargreaves Lansdown, which has a market capitalization of £2.25 billion, has experienced a tremendous 21.9% drop in share prices today down to 614p per share.

Also affected is Plus500, the evergreen example of efficiency with no sales staff, very light operating costs and a digital marketing solution that is the envy of the entire retail business.

Plus500 took an astonishing 38% hit on its share prices this morning, taking its value down to £365 million. Just two years ago, this was a $1 billion company.

CMC Markets whose market capitalization is £406 million and has recently developed its next generation proprietary trading platform at a cost of $100 million, has experienced a 23% decline in share price this morning.

This, therefore is a dark day for the established and highly respected public firms in the world’s largest and most sophisticated financial center – London.

Whilst regulatory prowess and consumer protection is vital in today’s electronic trading industry, not just for the protection of customer interests but also for the longevity and prestige of the companies in top quality jurisdictions, and whilst FinanceFeeds fully supports good quality regulation and will always stand with the top level companies and their leaders in this industry, it is very important to point out that the FCA has taken this step, decimating the values of quality stock, yet continues to turn a blind eye to the fraudulent OTC binary options brands and their associated entities that continue to run amok in Britain whilst other nations across the world ban them outright and arrest the perpetrators.

Britain’s firms are those among the most reputable worldwide, and the longevity of their client bases in their own domestic market is testimony to this, as is their public and commercial profile, therefore the FCA would be better served rounding up the binary options fraudsters before moving in on the upper levels of the retail trading industry.

Whilst the general sentiment among industry leaders in Britain does concur that this is just an adjustment and that prices will rebound, there is a degree of agreement with the FCA’s ruling.

One particular institutional FX industry executive told FinanceFeeds this morning “This is purely an adjustment, and overall it is good for the industry. Find me a futures exchange where you can put 1% down as initial margin – it’s unheard of.”

“If you trade DAX or FTSE on exchange it’s probably more like 4%/5%, which is 20/25:1. The reason for crazy leverage is because of the b-bookers as an STP model can’t run on crazy leverage, therefore I concur that this is a good move” he continued.

As always, there are two ways to look at what constitutes regulatory prowess.