FXCM UK reports termination of Drew Niv’s director appointment

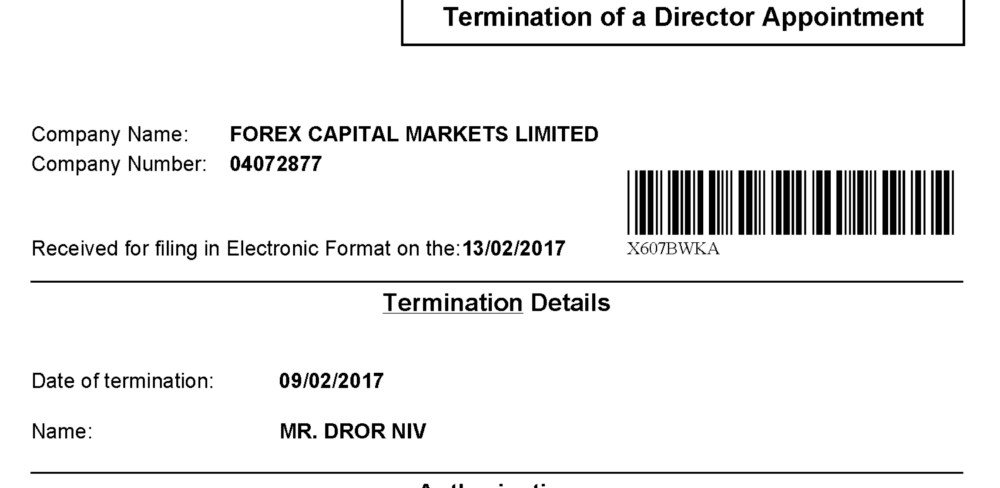

The UK Companies House service shows Forex Capital Markets Limited terminated Dror Niv’s appointment on February 9, 2017.

FinanceFeeds has been exploring the consequences from the exit of FXCM (NASDAQ:FXCM) from the US retail FX market, with many questions yet to be answered regarding what’s going on in the overseas companies that are part of the larger “FXCM family”.

On February 6, 2017, along with the exit of the broker from the US, the regulators also imposed a ban on Drew Niv, FXCM’s CEO, from the US Forex industry. Today, Forex Capital Markets Limited, authorised and regulated in the United Kingdom by the Financial Conduct Authority, registration number 217689, has submitted a report regarding Mr Niv.

The filing with the UK Companies House is brief – it says that Dror Niv’s appointment as a director had been terminated effective February 9, 2017.

The report, besides its formality, is important as it shows that FXCM overseas companies are indeed affected by what happened at FXCM US. The situation is developing, regardless of the apparent lack of action on behalf of regulators like the FCA in the UK.

Meanwhile, several hours ago FXCM posted a press release insisting that in the face of the disposal of its US retail FX business, it will be profitable. It stressed that it expected significant cost savings from the move. But the question is not FXCM’s profitability but rather its capability to recover from the blow to its reputation and the possible further actions by regulators.

FastMatch has already sought to distance itself from the US broker, noting that “FXCM is a passive minority owner of FastMatch. FastMatch operates as a completely independent entity of FXCM with no operational dependencies between two firms”. FastMatch has also replaced former directors Drew Niv and William Ahdout by Brian Friedman, President, and Jimmy Hallac, Managing Director, of Leucadia National Corp. (NYSE:LUK).