GBP could become THE number 1 major currency – just watch the liquidity!

How did the GBP flash crash really happen? Why will the GBP be the currency to lead the entire range of majors very soon? Why does credit and liquidity mean more than European trade agreements? We investigate

The British Pound has for very many years been the strongest currency in the world, and still remains so, yet it has played second fiddle to the US Dollar as far as the benchmark currency for FX trading is concerned, even despite the Tier 1 banks – the uppermost level of the liquidity providers from which FX markets are actually created and order flow is handled for the entire world being based in London.

Yes indeed, the US dollar is a global standard for trade in all sectors of industry, across all international settlements and for creating comparisons and performance statistics. Effectively the US dollar is the measure by which to calculate absolutely everything, everywhere, yet the British pound remains the highest valued currency.

Dissenters have amassed ever since the United Kingdom’s electorate took to the polling booths and took the step that will future proof the British economy entirely by voting to leave the European Union.

The British pound dived in value to a 31 year low immediately – but still remained higher in value than any other currency.

It is too easy to consider the difference in currency values on face value and to look at the superficial soundbites that dominate mainstream market analyses that assess vanilla currency values without looking at what is actually behind these movements.

Taking a close look beneath the surface reveals a totally different set of circumstances and shows why the Pound is heading for a massive long term rise, and will be the best of the lot by far.

Confidence in British business is high – stock in FTSE 100 listed companies has not reached such lofty heights since 1986, this being an indication of the confidence that investors (some of which are majority shareholders) have in British business once the nation is freed from the unproductive burden of sponsoring the European Union to the tune of several billion per year, and being exposed to European Central Bank debt created by its policy of handing out free money to bankrupt countries over and over again and selling its debt back to the taxpayer numerous times.

This does not happen in highly productive Britain, whose FinTech and financial sectors dominate the world. London’s financial sector employs just 0.0009% of Europe’s workforce, yet is responsible for 19% of all tax receipts. Now that is the sign of efficiency.

So, if house prices are high and confidence in British firms’ future performance and ability to negotiate free trade agreements globally with critical regions in Asia, North America and Australia – all buoyant modern economies with highly developed financial markets sectors unlike Europe which is steeped in socialism, debt and dependency, and international venture capital investors are plowing money into the prowess of the British business minds, why is the pound low?

It is purely down to negotiating liquidity agreements. An independent Britain means new negotiations need to be made, thus a downturn in the value of the pound is inevitable due to liquidity shortages. Not lack of confidence, or the negative thought that the United Kingdom needs Brussels, but simply liquidity shortages.

When Theresa May’s government has completed the execution of Article 50 and Britain becomes completely independent, and the liquidity agreements with the banks across the world have been set in place, we can watch the Pound rocket in value.

Brussels hampers trade agreements, and dictates which EU member state can do business with which region overseas, usually looking after its own interests and restricting access to the important markets of the Far East and North America.

Risk aversion by banks offering liquidity and the issue of counterparty credit risk have also played a significant part in this, and will continue to do so.

The difficulty is that London’s banks measure the capitalization of firms that they extend credit to in US dollars and Euros only, not in British pounds.

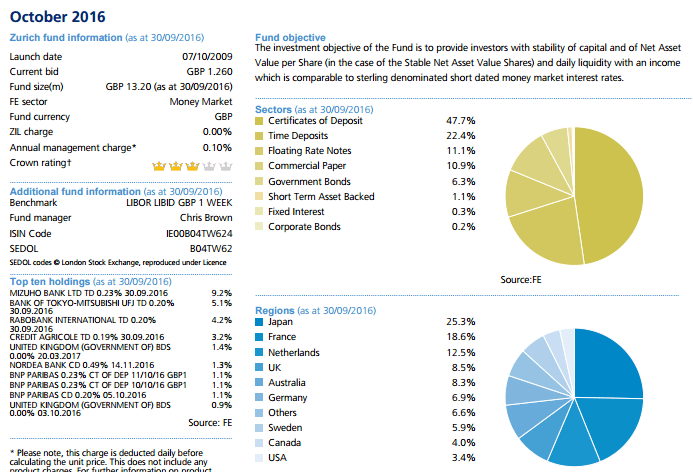

The Bank for International Settlements which is owned by central banks and whose primary function is to foster international monetary and financial cooperation as well as serving as an actual bank for central banks only uses three currencies as a reference point for global liquidity, and the British pound is not one of them, therefore the methods of measuring pound liquidity are not transparent at all.

The term “global liquidity” is used by the Bank for International Settlements to mean the ease of financing in global financial markets.

Credit is among the key indicators of global liquidity and the focus of the global liquidity indicators constructed by the BIS (Domanski et al (2011). Global liquidity in general and credit in particular influence the build-up of financial system vulnerabilities in the form of asset price inflation, leverage, or maturity or funding mismatches.

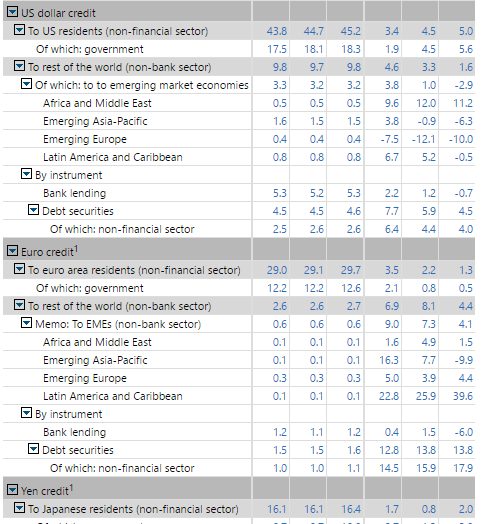

The BIS constructs three indicators of global liquidity: banks’ international claims, banks’ total claims on the private non-financial sector, and total credit by currency of denomination. These indicators draw on national data and BIS international banking and financial statistics, but incorporate assumptions and estimations by BIS

statisticians, however these are conducted in Yen, Euro and US Dollar, with the Pound nowhere to be seen.

The Pound Flash Crash

When the British Pound took a tumble in value as a result of the ‘Flash Crash’ in early October, once again the European Commission as well as the pro-EU brigade in British media began to once again assume that Britain’s top quality sovereign currency was floundering because Britain dared to leave the European Union.

Fortunately the astute business leaders of the Square Mile know that this is not the case, and had examined possible reasons closely.

Immediate finger-pointing centred on the likelihood of a “fat-finger” trade, where someone typed the wrong number in an order, which is not unheard of.Another theory is that it was a glitch in an algorithm used to automate trades — along the lines of the 2010 US stock market “flash crash” or the 2014 spike in US Treasuries.

If it was a fat finger, then the market convention is that the counterparties will agree to wipe it out and it will be scrubbed from the records within hours. The fact that has not happened yet makes a fat finger less likely, but watch this space.

One day after its occurrence, some pundits considered that it could have been timed to take advantage of low liquidity however there is no proof that it was deliberate, but if someone wanted to try moving the market sharply, then the time that it occurred would have suited such an action perfectly with Wall Street finishing its working day, the Asia Pacific region well into the early hours of the mornin and Australia already into its next working day with Singapore’s morning having commenced. Singapore is Asia’s largest center for institutional and interbank FX.

Other theories consider that it was connected to options expiries because Friday is the day forex options tend to expire and this can cause extreme trading moves if the writers of those options — banks — suddenly need to hedge themselves against a big drop in a currency.

Based on data from the DTCC trade depository, the biggest group of expiring sterling-dollar options was at the $1.25 level, with a notional $1.23bn outstanding. In other words, the sudden slide in the pound below $1.25 triggered a scramble by writers of options to sell the pound and protect themselves from losses.

If, as some other analysts may believe, it was due to stop-loss orders below $1.26 then that would be a very over-reaching market explaination which covers many sharp moves with no obvious cause

Investors leave orders with their banks to reduce or close out their positions at pre-agreed levels — to mitigate the risk of a sharp move when they are, say, asleep. The risk is that a build-up of orders at the same level exacerbates a price move when they are all triggered simultaneously.

Wouldn’t it be an interesting thing to do now, to place a very long pound trade and then look back in one year’s time and reminisce about a circumstance that is never likely to happen again.