MTGOX’s bankruptcy trustee updates on US seized funds release

The US government has agreed to release 50% of the funds seized from an MtGox affiliate in May and June 2013.

Nobuaki Kobayashi, the bankruptcy trustee of ill-fated Japanese Bitcoin exchange MtGox, has today posted a set of updates on the progress marked in the case, including documents distributed at the eighth creditors meeting, as well as a Notice of Hearing before United States Bankruptcy Judge.

The Notice provides us with information regarding the release of funds seized from MtGox’s affiliate Mutum Sigillum LLC in 2013. The US Government, acting through either the U.S. Secret Service or the US Homeland Security Investigations arm of the Department of Homeland Security, then seized a total of about $5.14 million, with Mutum accused of being engaged in an “unlicensed money transmitting business”.

Following negotiations, in February 2017, MtGox’s bankruptcy trustee and the US Government agreed the terms of the Settlement Agreement, which releases one-half of the Seized Funds to the Foreign Representative (Mr Kobayashi). This means that the US Government agrees to release a total of $2.57 million. In exchange, the Foreign Representative, on behalf of MtGox, agrees to withdraw its claims as to the remaining Seized Funds, and agrees to forfeit all rights, title, and interest in that portion of the Seized Funds to the Government.

The bankruptcy trustee has filed a motion for an order approving the Settlement Agreement with the U.S. Government; Transfer of Seized Funds; Repatriation of Released Funds to Japan for distribution in the Japan Bankruptcy Proceedings.

The hearing for this motion has been scheduled for April 24, 2017.

Mr Kobayashi has also published a report, which treats matters such as a potential distribution of funds, the investigation into the disappearance of bitcoins from MtGox, as well as claims approval/rejection.

The balance in the account that the trustee has secured as of March 7, 2017, is JPY 1,030,895,045, that is, a drop of about JPY 23,500,000 from the time of the 7th creditors’ meeting. The amount of BTC managed by the bankruptcy estate as of March 5, 2017, is 202,185.36428254BTC.

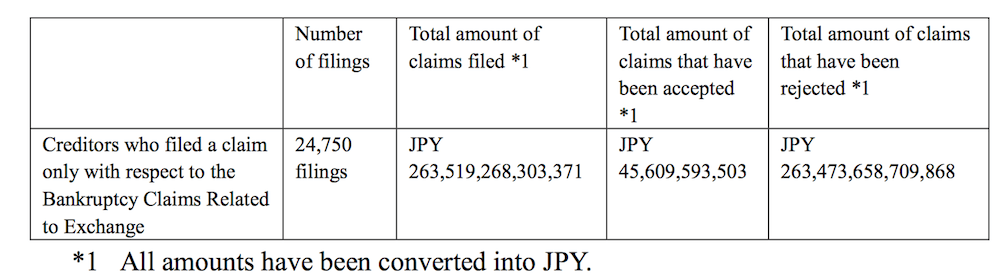

As per data from May 25, 2016:

- The trustee has received 24,750 claims for compensation with regards to MtGox’s bankruptcy.

- Total amount of claims filed is JPY 263.52 trillion.

- Total amount of claims accepted is JPY 45.6 billion.

- Total amount of claims rejected is JPY 263.47 trillion.

As per the latest information, out of the claims that the trustee had rejected, he has retracted his objection against 19 claims, the total amount of which was JPY 34,884,662 at the time of the previous meeting. He has also accepted 81 claims, the total amount of which is JPY 126,630,380 after the previous meeting up to present.

The bankruptcy trustee says he is willing to proceed with the distribution process as soon as possible. However, the detailed schedule will be affected by each creditor’s response to the acceptance or rejection of his or her claim. Hence, at present, the possibility of carrying out a distribution and its timing and method are not yet determined.