10 things you may be missing when selecting a liquidity partner – Guest Editorial

By Natallia Hunik, Global Head of Sales at Advanced Markets / Fortex I, along with my institutional FX team at Advanced Markets and Fortex, am dealing with FX brokers who may be in search of liquidity, technology solutions of all kinds, infrastructure enhancements or sometimes just a price feed that is stable and reliable on […]

By Natallia Hunik, Global Head of Sales at Advanced Markets / Fortex

I, along with my institutional FX team at Advanced Markets and Fortex, am dealing with FX brokers who may be in search of liquidity, technology solutions of all kinds, infrastructure enhancements or sometimes just a price feed that is stable and reliable on a daily basis.

We have seen it all from novice brokers that need everything explained from A to Z, medium-sized price-conscious brokers that are trying to bypass pre-qualifications and over-state their volume figures to get better deals to larger brokers asking us to fill out lengthy RFPs (Request for Proposal) while they work on selecting a new liquidity partner.

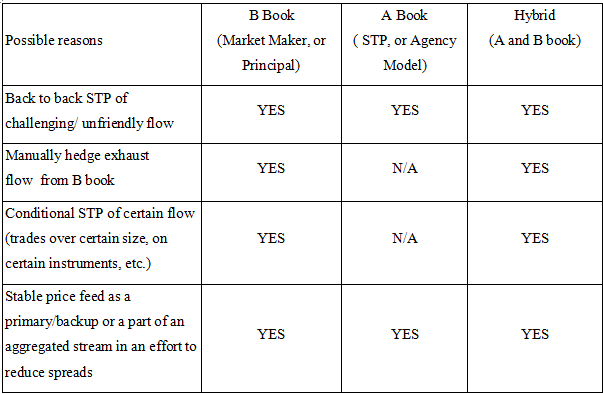

Let’s start by discussing the reasons why FX Brokers of all sizes need liquidity providers (note that I am discussing in reference to margin accounts with a liquidity provider). Regardless of the business model FX brokers choose to utilize, they need institutional liquidity for many reasons. The following matrix shows a number of possible reasons and which business models they would apply to:

What do they all have in common?

Everyone is trying to get the most value for their dollar (who could blame them?), and they place significant emphasis on the spreads and commission charges. As we are all supposed to learn from our experiences (or at least that’s what conventional wisdom says should happen), often times questions brokers ask during their liquidity partner research are signaling issues they have had with their previous providers. We also find that there are some very common themes regarding the issues they present.

Their flow was labeled toxic by the liquidity provider, they feel the slippage practices were unfair, they experienced issues with making withdrawals from their accounts, there were excessive rejects, there was an inability to handle large orders or flow from expert advisors, they received poor service or had to deal with incompetent technicians. All of these reasons will put brokers back in the market looking for new liquidity partners.

How are they different?

Depending on the size of the brokerage, their target market and business model brokerages will have different priorities. Smaller startup brokerages typically care about the stability of the price feed (most will start with cheap providers compromising on quality to keep initial costs down) and the ability to STP some of their EA flow back to back with a minimum cost per million and tight spread. The average transaction size for this type of client averages less than 10,000 currency units (1 mini lot).

For any real liquidity provider, handling such a client should not pose any issues but the problem will be whether the relationship is economically sustainable as the volume turnover may not be enticing enough for a Prime Broker.

Medium-sized, more established regulated brokerage companies already have their MT4 servers in place and typically have a successful dealing operation running. Liquidity solutions may be needed to STP some of their more challenging flow or larger trades that are too risky to take on their own books (e.g. money managers).

Therefore, apart from ubiquitous spread and commission, they are also looking for strong depth behind the quote, the ability to support many different order types, availability of the FIX API and reporting APIs and a comprehensive reporting system as many of them need to submit reports to regulators.

Apart from that, the managers of these companies will be looking to take advantage of economies of scale – have their trading commission scale downwards as the volume they send through to the liquidity provider increases.

Large established brokers are typically working on a credit facility and are facing Tier 1 PBs however, as Tier 1 prime brokers continue to pullout of the space following the SNB event and raising the remaining barriers to entry, sometimes to grossly unpalatable numbers, they need to switch the gears. The list of PB requirements is now quite lengthy. You can download a sample RFP here.

What all of those looking for liquidity may be missing?

When looking for a liquidity partner, please consider the following evaluation criteria which may help your business scale, grow and succeed.

In my opinion, these should be considered the essentials of any FX Prime Brokerage or Liquidity offering:

1. The presence of a Tier 1 PB behind the Prime of Prime provider. Look for public announcements from credible sources. Here is a good example.

2. The ability to deliver an executable price stream via proprietary software.

“Firms that deploy proprietary technology are able to deliver raw prices as there are no charges to the banks. This means that the clients can get raw pricing. If the software being used is one of the commercially available technologies used to deliver prices, it is likely that banks are being charged to be able to participate in aggregation. The same applies to an MT4 bridge – firms that have liquidity and technology bundled in, do not have any additional charges for the bridge” – Natallia Hunik.

3. A robust Backoffice technology for regulatory filings.

4. The tools for managing revenue streams.

5. A dealing platform with Depth of Market to manage your corporate/omnibus account.

6. Matching engine in NY4.

7. The ability to customize liquidity – to handle small tickets, block trading (fine tuning of top of the book and order types).

8. The ability to offer segregated accounts for additional protection.

9. FIX API and reporting API connectivity to integrate with backoffice and other systems

10. Finally, and this should go without saying, the first question to ask is about regulation. It is important to know that the broker, who will be acting as the counterparty to your trading activity, must adhere to some form of regulatory capital requirements, operational policies and procedures, an AML/KYC regimen and have a Disaster Recovery procedure in place at the very least.

Without oversight from a competent regulatory body, the PoP broker is essentially free to run their operation as they see fit, not how generally agreed standards would dictate. Inquire about the regulator that has authorized the Prime Broker to carry out FX activities. Be sure to verify their claims with that regulator’s registry to ensure the license type and the permissions they have been granted.

This editorial represents the viewpoint of, and was compiled by Natallia Hunik, Global Head of Sales at Advanced Markets / Fortex