“These new data feeds represent a paradigm shift in market data accessibility. By providing unprecedented insights during out-of-trading hours, we empower traders with a continuous ATS source, fostering informed decision-making. Our partnership with dxFeed further solidifies our commitment to delivering innovative solutions to the financial industry.”

Search Query: #dxfeed

Catering to a diverse clientele, including traditional and crypto markets, dxFeed serves brokerages, prop traders, exchanges, individual traders, quants, portfolio managers, and academic institutions.

Market data provider dxFeed has embarked on an important expansion initiative by collaborating with Exocharts, a provider of Order Flow and Market Profile charting in the futures contracts and cryptocurrency markets.

This offering is poised to be a game-changer for online retail brokerages, money managers, and individual users. It also delivers critical pricing data to the DeFi (Decentralized Finance) space, and ensuring that vital information flows continuously.

“Cboe gives the most favorable conditions for obtaining Australian data. That’s why providing access to the Cboe Australia Market Data is a significant milestone for us, and we believe it will provide our clients with valuable insights and opportunities.”

Market data provider dxFeed has partnered with API3 to integrate its data into the latter’s managed decentralized API (dAPI) service.

“To completely fulfill customers’ demand, our quant team has already started developing the dxFeed machine learning experimental engine based on extended research of clients’ needs.”

dxFeed has launched a Trust Center aimed at centralizing the resources addressing compliance and security for clients’ self-service exploration and delivery.

“More and more traders are using Market Depth while conducting volume analysis. Its primary function is to help traders identify potential support and resistance levels.”

“Already in the first half of 2022, we’ll be happy to introduce to the market a new product designed for day traders.”

ForexLive users now have access to the latest market activity across various sectors, an overview of global market performance and by instrument, symbol search, and real-time charts.

The new platform provides immediate, real-time price information and unifies 40+ global exchanges and offers a managed, scalable solution

dxFeed, a leading market data provider, delivers data from NYSE, NASDAQ, and OPRA Exchanges to Options AI trading platform.

dxFeed, a leading provider of market data for the global financial industry, and ATAS, a professional, trading and analytical platform, launched dxFeed ATAS for volume market profile, order flow, and advanced technical analysis on data from CME Group, CBOT, NYMEX, COMEX, Eurex (including DAX, EURO STOXX Futures)

“This integration makes it much easier for brokers to offer their execution services on tradingview.com. It’s great for our brokers to be able to access the massive network of traders that TradingView has.”

Technology provider Devexperts has appointed Mario Volpe as its newest vice president of business development, effective immediately.

Devexperts, a leading global software provider for the capital markets industry, has partnered with TEB Investment (TEB Yatırım), a subsidiary stock brokerage of Türk Ekonomi Bankası A.Ş, to deliver TEB YATIRIM TRADER

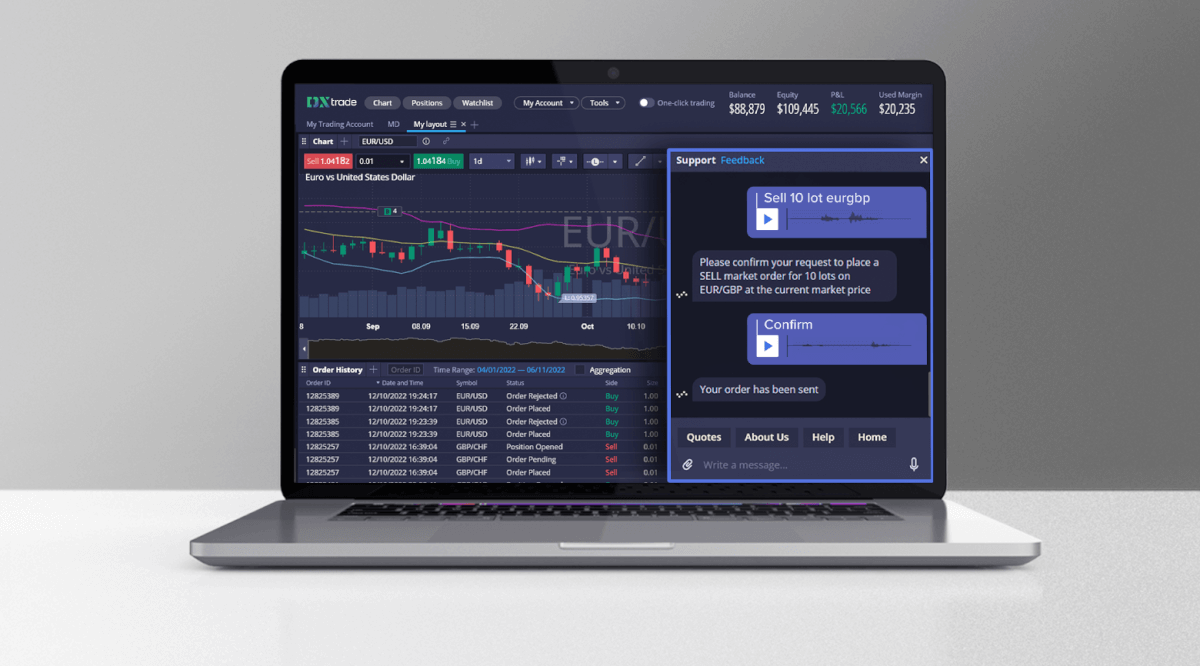

“Other live chat solutions simply aren’t able to provide a native experience on a web platform—they’re plagued by UI issues. Meanwhile, DXtrade brokers and traders enjoy a superior experience even when sharing a screen. That’s why our combo has no true market peers”.

DXtrade brokers received access to 30+ major banks and Tier 2 liquidity providers with Your Bourse.