AliPay Vs WeChat Pay vs UnionPay – Important research

Very detailed and in depth research with regard to how to select the right payment solutions provider for your brokerage when establishing in China, compiled by Leverate’s Adinah Brown

Venturing into the Asian market is not easy, a critical factor in the equation to get right is the selection of your third party payment service provider.

In China the leading players in the QR code-based mobile payment market are Tencent’s WeChat Pay, Alibaba’s Alipay and less dominant though still a significant player is China UnionPay (CUP).

While all are largely similar in their mobile payment offerings, there are distinct differences that could have significant bearing in how you choose to set up your brokerage in this expansive region.

The main differences between them largely stem from where each of these companies originated from, that continue to characterize their offerings.

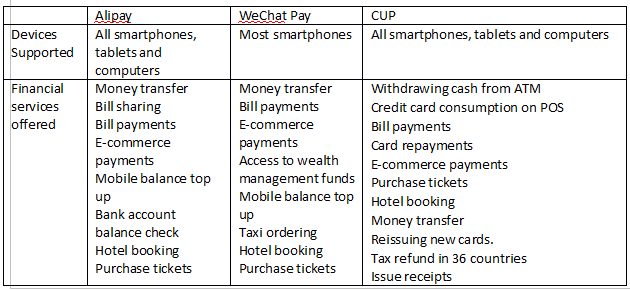

WeChat Pay is an outgrowth of the WeChat social communication mobile app. Users who have put the details of their bank account information have since been able to navigate their daily life, from paying bills to transferring money to purchasing groceries, exclusively through the continued use of their mobile phone.

WeChat Pay’s hallmark service was the ‘red envelope’, where users were able to send gifts of money to friends within their social WeChat groups.

In contrast, Alipay was developed as an extension of services to facilitate payments made on Alibaba, its online shopping site.

Yet, Alipay has since evolved to become more of an escrow payment service, where consumers can confirm their receipt of goods or services they have purchased before money is released to the seller. Likewise, it has also extended its service to facilitate payment transactions for products beyond the Alibaba website to offline payments such as utilities bills.

Union Pay is China’s state-run credit and debit card network, who in May 2017 ventured into the QR payment system. While this was a highly ambitious move considering that the space is already dominated by Alipay and WeChat Pay, who combined have a 90% market share, CUP identified QR mobile payment as a change in consumer behavior that they couldn’t afford to ignore.

To their advantage, they already have a massive consumer base that is already using their cards, who to participate, simply have to download the app from one of their many partnering commercial banks.

While this market dominance has certainly set the challenge for China Union Pay to convince consumers to switch over to their payment service, the credit card company has set to work by pushing its offering to its enormous user base.

To date, China Union Pay has issued more than 5.4 billion cards which resulted in over 38 billion transactions within 2016.

The scale of this usage, according to The Nilson Report, makes CUP the third most used credit/debit card brand in the world, behind only VISA and Mastercard. The competitive advantage of China Union Pay and its raft of 165 participating banks means that they have an already existing direct line to consumers, making it easier for them to mobilize their payment services.

Difference in Services

Transaction Fees

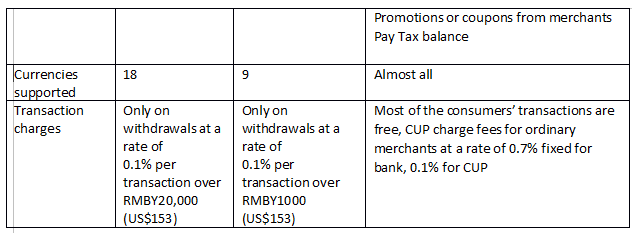

WeChat users can freely transfer money to other users within the WeChat ecosystem and can only incur a fee when they withdraw more than RMBY1000 ($153) from their WeChat balance, at which point they are charged a 0.1% transaction fee.

Furthermore, money in the WeChat balance can be used to buy any in-house WeChat financing products. To maximize the value of WeChat Pay and avoid any transaction fees, users can spend online or in the offline store.

According to IDC analyst Michael Yeo, “the intention of the transaction fees is to encourage users to keep their withdrawals to a minimum and keep more money circulating through the WeChat Wallet ecosystem, thereby increasing the opportunity for people to keep spending within the system”.

“The intention of the transaction fees is to encourage users to keep their withdrawals to a minimum and keep more money circulating through the WeChat Wallet ecosystem, thereby increasing the opportunity for people to keep spending within the system” – Michael Yeo, IDC

Likewise, on AliPay all internal transactions are free. For external transactions, once a user passes a threshold of withdrawing more than RMBY20,000 (US$2,897), a transaction fee of 0.1% kicks in. Merchants are also charged a fee of 0.55% on the flip side to every purchase. To avoid building up towards this transaction fee, users can purchase financial products within AliPay and then transfer their money from there into a bank account. In this case, to avoid transaction fees users need to keep their external money transfers to a minimum.

The QR code payment system in CUP has a fee structure that far more closely resembles the fees associated with their plastic cards. Fees are only charged to banks, merchants, POS machine holders and online merchants. Generally, consumers don’t pick up the cost of facilitating transactions.

Impact Outside of China

While WeChat, the social communication tool has tentacles that stretch beyond the Great Wall of China, WeChat Pay does not. This is due to regulations imposed by the People’s Bank of China which heavily restricts all forms of foreign currency outflow.

Doing their best to circumvent these restrictions, WeChat Pay, like other mobile payment service providers, have established external partners to reach out to markets overseas. In South Africa, WeChat Pay has been able to introduce its international payments solution where users can now send and receive money using the WeChat Wallet as well as be able to withdraw cash from an ATM machine. They have also partnered with global payments technology company, Adyen, to help businesses worldwide access new customers in foreign countries.

As a non-bank financial service provider, Alipay was able to avoid the ire of the People’s Bank of China for a considerable time, and was able to extend its services into Asia, Europe and the USA. However, by the end of 2016, Alipay was forced to close all foreign financial accounts, yet not without already making a considerable impact in Southeast Asia.

The tech landscape of Southeast Asia very much resembles that of China’s five to ten years ago when infrastructure was still in a stage of construction. Southeast Asia continues to be the first stop of many Chinese businesses, who looking to expand their services, will often try to bring their internet and payment providers along with them. So, while AliPay’s promotion of mobile payment solutions has been working to accelerate and further expand the infrastructure there, it may end up having to share the profits of this hard work, with its rival, WeChat Pay.

Being beholden to the restriction imposed on its partnering banks by the People’s Bank of China, does not leave much room for CUP to expand its foreign accounts. However, where they have focused their efforts is that of Chinese account holders who are travelling abroad, predominantly to America.

In 2015, the US was the travel destination of more than 2.5 million Chinese travelers, who combined spent more than $40 billion during the duration of their stay. By developing partnerships in the USA, CUP has been able to successfully tap into this market and thereby increase their overseas market share.

The transactions which take place in US dollar are closed on the RMB exchange rate, not on the day of purchase, but on the bill day. In any other country, be it Thailand, Canada or France, the amount is converted from the local currency to USD and only then to RMB.