Amount recovered in binary options fraud case reaches $9.3m

The majority of the recovered funds come from the accounts of binary options marketers rather than binary options brokers.

Kenneth Dante Murena, the court-appointed Permanent Receiver in an enforcement action brought by the United States Commodity Futures Trading Commission (CFTC) against a number of binary options companies and their marketing affiliates, has submitted his fourth report. The document, related to Mr Murena’s activities for the time period of April 1, 2018 through June 30, 2018, was submitted on August 10, 2018, at the Florida Middle District Court.

The case targets Jason B. Scharf, doing business as Citrades.com and AutoTradingBinary.com, his companies CIT Investments LLC, a Nevada limited liability corporation; Brevspand EOOD, a Bulgarian business entity; CIT Investments Ltd., a Marshall Islands business entity; CIT Investments Ltd., an Anguillan business entity; and A & J Media Partners, Inc., a California corporation. The case also names their affiliate marketers Zilmil and its owner Michael Shah among the defendants.

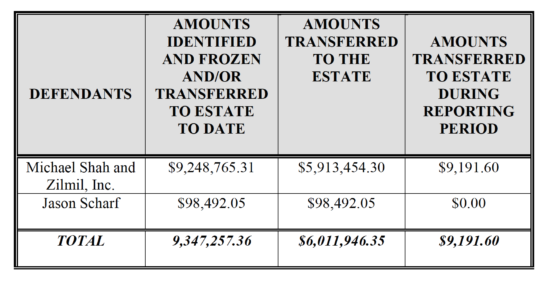

Specifically, during this Reporting Period, the Receiver recovered an additional $9,191.60, and received written confirmation of the existence of more than $1.4 million in accounts at three banks in India, Therefore, to date, the Receiver has frozen and/or recovered more than $9.3 million of the defendants’ funds, of which more than $6 million was transferred to the Receiver’s fiduciary accounts and approximately $3.3 million remains frozen at various financial institutions.

After payment of the Court-approved administrative expenses of the Estate for the first and second reporting periods, the total amount in the Receiver’s fiduciary accounts for all Defendants, including interest earned, was $5,674,984.33 as of the end of the Reporting Period.

The Receiver notes that CIT Investments LLC, Brevspand EOOD, and CIT Investments Ltd. have not responded to the CFTC’s Complaint, retained counsel and made an appearance in the enforcement action, or provided any accounting, information or records to the Receiver. Scharf and A&J Media Partners, Inc. still have not provided the required accountings or agreed to meet with or be interviewed by the Receiver, indicating that they intend to assert their Fifth Amendment privilege in response to virtually any formal or informal questions from the Receiver.

Regarding the Zilmil Defendants, that is, the marketing affiliates of the binary options brokers, they have not provided and continue to decline to provide the detailed accounting required under the Court’s Orders, invoking their Fifth Amendment right against self-incrimination.

Let’s recall that in July this year, the Commodity Futures Trading Commission (CFTC) filed a Motion for a Summary Judgement against Shah and Zilmil, with the Florida Middle District Court. The document requests that the Court orders the defendants to pay disgorgement in the amount of $18.67 million, as well as a civil monetary penalty of $56 million.

The CFTC Complaint alleges that Michael Shah, acting through his company Zilmil, Inc., is the mastermind of an internet scam involving binary options. Between July 2012 and the present, Shah and Zilmil made more than $18.6 million in proceeds from their fraudulent scheme.

Using fraudulent misrepresentations, the defendants induced people to deposit money with illegal binary options trading websites that purported to offer customers the ability to trade so-called binary options contracts online. The defendants acted as marketers for the following binary options websites: LBinary, Global Trader 365, Vault Options, TraderXP, Trade Rush, Banc de Binary, Citrades, OptionMint, OptionRally, RBOptions, Bloombex Options, Redwood Options, BeeOptions, Amber Options, OptionsXO, and SpotFN. None of these websites or their operators are or ever have been registered to offer binary options contracts to the public.

The marketers convinced customers to deposit money with the binary options websites by offering miracle software “trading systems” with names like 2014 Millionaire, Binary Genetic, and Millionaire Money Machine. For each person who deposited money with one of these trading websites, the marketers received a commission of as much as $450.

The case is captioned Commodity Futures Trading Commission v. Scharf et al (3:17-cv-00774).