Australian Financial Complaints Authority receives 29,873 complaints in first five months of operations

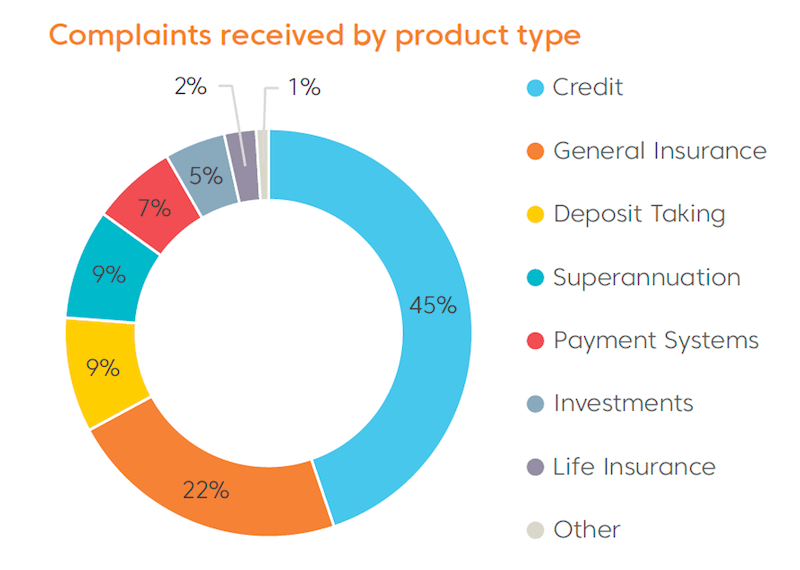

Credit and general insurance products triggered most complaints, whereas investments accounted for 5% of all complaints during the five months to March 31, 2019.

The recently launched Australian Financial Complaints Authority (AFCA) has been publishing regular updates about its work. The body has just posted data about complaints handled during the first five months of its operations, that is, the period from November 1, 2018 to March 31, 2019.

The external dispute resolution scheme received 29,873 complaints during the five-month period, up from the 23,681 complaints received in the first four months of its operations. Credit and general insurance topped the list of products that triggered most complaints. Investments accounted for 5% of all complaints received during the five-month period.

The top five issues for complaints concerning investments include:

- Failure to follow instructions/agreement – 287;

- Inappropriate advice – 182;

- Failure to act in client’s best interests – 119;

- Incorrect fees/costs – 108;

- Service quality – 92.

Let’s stress that membership in AFCA is compulsory for all AFS licensees, Australian credit licensees, superannuation trustees and other financial firms that provide services to retail clients. Earlier this year, the Australian Securities and Investments Commission (ASIC) has demonstrated that firms’ membership in the new dispute resolution scheme is crucial. The regulator cancelled the Australian financial services (AFS) licences of two financial services providers due to their failure to become members of AFCA scheme.

The businesses whose licenses got taken away are both NSW-based. Sydney Business Accounting’s licence cancellation took effect on February 14, 2019, and A G Calleia & Co’s licence was cancelled on February 15, 2019.