Australian Financial Complaints Authority receives more than 80,000 complaints in FY19/20

AFCA resolved 78% of cases, with a majority being settled in 60 days or less.

The Australian Financial Complaints Authority (AFCA) today published data about its operations for the period between July 1, 2019 and June 30, 2020.

Australians in dispute with their bank, insurer, super fund or financial firm lodged 80,546 complaints in the last 12 months. This is a 13.7% increase in monthly complaints compared to the last financial year (FY18/19). AFCA secured $258.6 million in compensation and refunds direct to consumers.

AFCA resolved 78% of cases, with a majority being settled in 60 days or less. Some 73% of complaints were settled by agreement or in favour of the complainant, with banks being the most complained about financial institution.

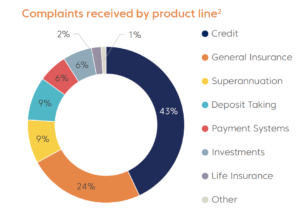

Let’s note that, across product lines, investments accounted for 6% of the complaints. Chief Executive Officer and Chief Ombudsman David Locke explains that most complaints have been about credit, insurance claims, and superannuation.

“Australian consumers have faced a number of significant challenges this year,” he said. “The pandemic has had a particular impact on Australian households, with 20% of COVID-19 related complaints being about financial hardship.”

“Australian consumers have faced a number of significant challenges this year,” he said. “The pandemic has had a particular impact on Australian households, with 20% of COVID-19 related complaints being about financial hardship.”

Since the virus was declared a pandemic in March, AFCA has received 4,773 complaints relating to COVID-19. Most of these complaints have been about general insurance claims (1,813) with more than 1,500 of these being travel insurance complaints.

The second most thorny issue for consumers was credit with 1,711 complaints, with almost a quarter of these being about a failure to respond to requests for assistance. There were also 791 COVID-19 complaints about superannuation, a majority of which related to early access of super.

Let’s recall that AFCA commenced its operations on November 1, 2018. AFCA has received 127,694 complaints since opening its doors, securing $371.1 million in compensation and refunds direct to consumers.

Credit has been the issue consumers have complained most about (43%) since November 1, 2018, followed by general insurance (23%), deposit taking (9%) and superannuation (9%). A majority of complaints have been about banks (35%), followed by general insurers (19%) and credit providers (13%).

Financial firms including AFS licensees that provide financial services to retail clients, credit licensees, most credit representatives, superannuation trustees and unlicensed product issuers are required by law to be members of AFCA.