Australian Financial Ombudsman closes record volume of disputes in Q2 2018

Shortly before the Ombudsman’s transition to new dispute resolution body AFCA, it publishes the last set of quarterly statistics.

Australia’s Financial Ombudsman Service (FOS) which will soon transition to new external dispute resolution body AFCA, has managed to close a record number of disputes in the second quarter of 2018. This is indicated by the latest quarterly statistics recently published by the FOS.

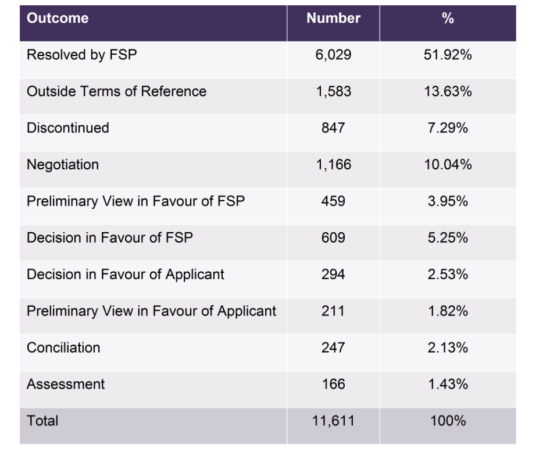

Even as the FOS moves towards AFCA commencing, it is still resolving FOS disputes. The Ombudsman received 11,790 disputes in the quarter from April to June 2018 – 17% more than in the same quarter last year – and it closed 11,611 disputes, which is the highest number closed in a quarter in the past five years.

Most disputes received this quarter were credit disputes (40%), followed by general insurance disputes (30%). Investments disputes were 508, accounting for 4.3% of the total.

Of the closed disputes, more than two-thirds (64%) were resolved through an agreement between the financial services provider and the consumer. Compared with last quarter (59%), this is a 5% increase. The FOS closed 14% of disputes because they were outside FOS’s jurisdiction and 7% due to applicants deciding not to pursue their dispute(s).

The Ombudsman closed more than 6% of disputes at the Preliminary View stage and 8% at the Decision stage.

Let’s also note that AFCA has recently released an updated guidance for financial firms on how to let their customers know about AFCA. From September 21, 2018, AFCA members must ensure that IDR final response letters and ‘delay letters’ include references to both the relevant predecessor external dispute resolution (EDR) scheme (which will be able to receive complaints only up until 31 October 2018) and AFCA (which will be able to receive complaints on and after 1 November 2018).

Between November 1, 2018 and February 1, 2019, such letters may continue to include references to both the predecessor EDR scheme and AFCA, provided it is clear that only AFCA can receive complaints after November 1, 2018.

On or after February 1, 2019, such letters must include references to AFCA but not the predecessor EDR schemes.

Below is a recommended referring copy: