Australians file 73,272 complaints with AFCA in one year

The first year of operations of the Australian Financial Complaints Authority saw $185 million in compensation awarded to consumers.

It has been one year since the Australian Financial Complaints Authority (AFCA) opened its doors as the nation’s single external dispute resolution scheme for complaints about financial firms. Today, the body published some stats about its first 12 months.

Australians in dispute with their bank, insurance provider, super fund, or other financial firms have lodged 73,272 complaints with the financial sector’s new ombudsman between 1 November 2018 and 31 October 2019. This represents a 40 percent increase in complaints received compared to AFCA’s predecessor schemes, which in the 2017/18 financial year received a combined total of 52,232 complaints. They have been awarded $185 million in compensation during this period.

Of the complaints made, 56,420 have been resolved with the majority resolved in 60 days or less.

Research conducted in July this year showed that just three percent of Australians knew about AFCA. Yet, despite the need to raise awareness, Australians are making nearly 200 complaints a day.

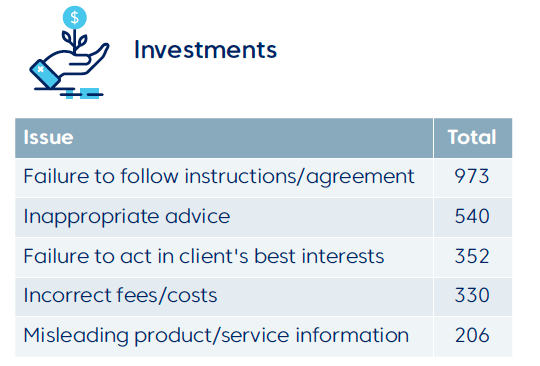

The top five issues for complaints about investments were: failure to follow instructions/agreement; inappropriate advice; failure to act in client’s best interests; incorrect fees/costs; and misleading product/service information.

AFCA Chief Executive Officer and Chief Ombudsman David Locke commented:

“Every day we continue to hear from people who are dissatisfied with the way their financial firm has handled their complaint. These matters have not been resolved internally by financial firms and so the individual then brings their complaint to AFCA”.

“Establishing AFCA as a new organisation and handling a 40 percent increase in complaints was never going to be easy and we are still improving the way we operate,” Mr Locke said.

Let’s recall that, in September this year, AFCA published a list of 29 financial firms that have failed to pay complaint-related charges, thus violating AFCA membership requirements. AFCA members are required by law to pay a membership levy, along with fees for every complaint received about them. The 29 members owe AFCA a total of $1.715 million in outstanding charges.

At the top of the list are three FX firms – AGM Markets Pty Ltd, Direct FX Trading Pty Ltd, and Berndale Capital Securities Pty Ltd. The debt of AGM Markets is $483,200, the debt of Direct FX is $397,570, and the debt of Berndale Capital is $364,230.