Australians report more than $13.7m in losses due to investment fraud in Q1 2020

The number of reports concerning investment scams was 1,407 during the first three months of 2020, according to the latest data from Scamwatch.

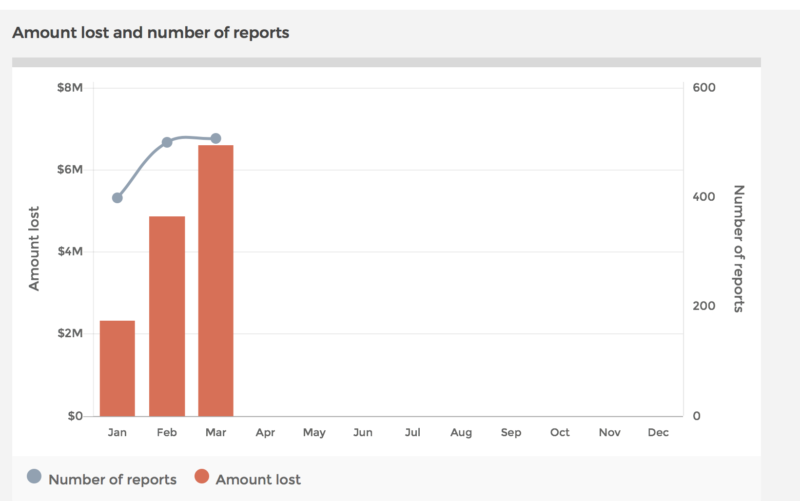

Australians reported $13,784,024 in losses due to investment scams in the first quarter of 2020, according to the latest data from Scamwatch, the body operated by the Australian Competition and Consumer Commission (ACCC).

In the first quarter of 2020, the month with the biggest losses was March – Australians reported nearly $6.6 million lost due to fraudulent investment schemes last month.

The number of reports concerning such scams was 1,407 during the first three months of 2020. People from 45 to 54 years of age were most active in reporting investment fraud. The biggest losses were reported by those over 65 years of age.

Investment scams accounted for the biggest losses across all scam types targeting Australians in the first three months of 2020. They were followed by dating & romance scams and threats to life.

Let’s recall that Australians reported more than $61.6 million in losses due to fraudulent investment schemes in 2019. This marks a steep rise from a year earlier, when Australians reported $38.8 million in such losses.

The month with the biggest losses in 2019 was July, followed by August and December. The number of reports for the entire 2019 was 4,986, with those from 25 to 34 years of age being most active in complaining about investment fraud.