Be careful! Impostors are impersonating FX dispute resolution services, and they do not mean well!

Unscrupulous FX brokers from unregulated regions are now displaying false membership of false regulators on their sites, as well as stealing photographs so that they can make up false officials to dupe clients. Is your broker’s name on the false list? Here is a full, detailed insight

The dubious and deceitful practice of ‘cloning’ has been a bugbear for retail FX traders for quite some time, this being a practice used by unregulated entities with malintent on their main agenda which involves the emulation of a genuine and often reputable company’s corporate identity, website and branding, in the hope that retail investors will subconsciously associate it with the genuine firm and deposit funds, only to find that the funds are then never to be seen again.

Whilst major regulatory authorities around the world have over the past few years published information relating to clones of genuine FX companies, very little public awareness exists and absolutely no censuring or stemming of the problem has taken place.

In short, they are getting away with it.

This practice has taken a very unpleasant turn recently, and is actually becoming more prevalent, the perpetrators moving away from simply cloning broker websites and actually resorting to far more detailed methods.

Customers of unregulated companies which have stolen money from customers on the pretense of investing in binary options – a gigantic and high profile fraudulent activity that the City of London Police has termed Britain’s largest ever internet fraud – as well as customers of non-entity retail FX bucket shops with no connectivity to the live market, have absolutely no recourse.

There is no regulator or national government on their side, and there is no method of the law enforcement agencies seeking any form of recourse because the firms are often layered in such a way that everything is based in one offshore jurisdiction, the customers in another and the owners in another (often Israel).

Therefore, individuals which have fallen foul of this may resort to independent dispute resolution services as a last ditch attempt to resolve without massive search , investigation or legal fees that would likely lead nowhere.

The trouble that is now manifesting itself is that the types of unpleasant human material that are experienced in ripping unsuspecting customers off via the binary options ruses and via non-genuine FX firms know exactly what type of person their ‘customer’ is – gullible and easily separated from their money.

This has resulted in several entities purporting to be helpful, and positioning the once-duped, twice-shy victims of binary options firms as exactly that – victims, whilst setting about orchestrating a very similar scheme, that being to assure them that if they part with yet more money, these arbitrators will get their funds back for them.

Here is an example:

Supposed lawyers, with very little credibility, have sprung up, offering the chance to retrieve funds.

One such claim, made recently, by a lawyer with an anonymous-style email address which did not contain a proper company name was “I believe if you have invested more than 100,000USD on binary trading options and you are having issues withdrawing your funds/bonuses, then its time to reach out to [email protected]. He helped me recover 95% of my funds when it starts to seem like all hope was lost in getting my funds back. There is really no point to keep loosing funds to these unregulated brokers.”

Hogwash of the highest order.

This is implausible in the extreme for various reasons, and – just look at the name of the firm.

It appears that not only an English grammar lesson is required, but a means of preventing such blatant attempts to dupe the easily led even more should be brought about.

This is just one example, there are several more, and FinanceFeeds has been documenting them carefully for further research purposes, and for the greater good of the FX industry, its customers and genuine dispute resolution services.

In this regard, once again, the genuine regulators, including FCA and CySec, areas where cloning and this kind of bogus ‘victim assistance’ is prevalent, are impotent.

Today, a further example of an attempt to throw investors off course in the quest for unjustifiable credibility made itself clear.

Speaking with Peter Tatarnikov, Director of the Financial Commission, FinanceFeeds looked with interest upon how Mr Tatarnikov unearthed a very unpleasant sleeping giant.

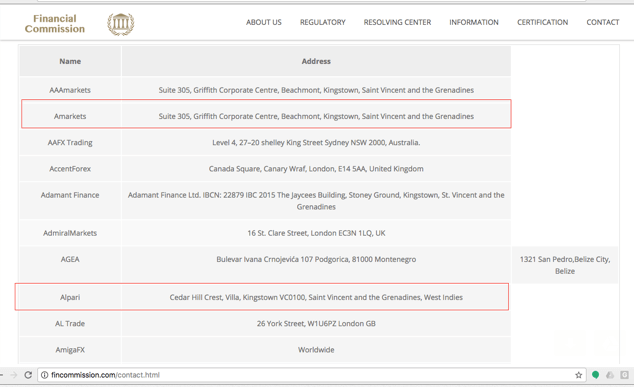

Mr. Tatarnikov noticed that a firm in the name of MiraMarkets.com, which has absolutely no credibility or presence as a mainstay in the electronic trading sector, has made a substantial attempt to emulate a dispute resolution service, making false claims that several brokerages that are actually well known to the FX industry and the investing public are ‘registered’ with it.

If ever there was a list which can be considered bunkum and balderdash, this is it.

Mr. Tatarnikov explained that MiraMarkets has been “attracting deposits saying that they are regulated by the financial authority, when they are not.”

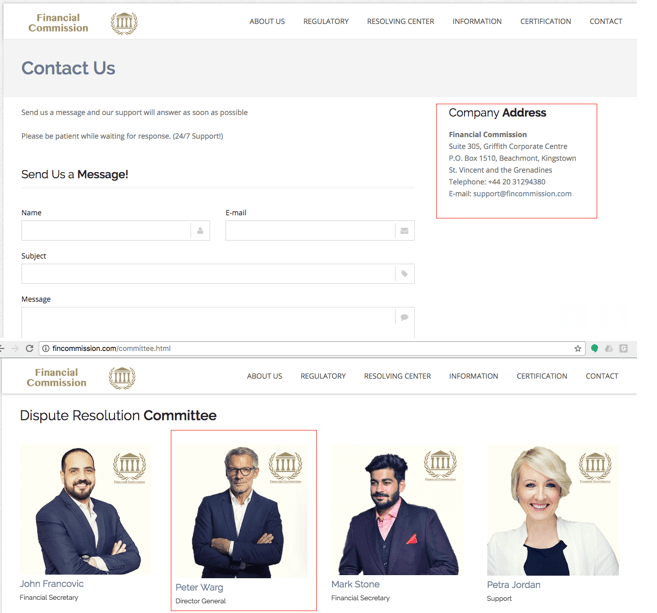

This false dispute resolution service is calling itself FinCom, which is very similar to Finacom, which is the genuine firm represented by Mr Tatarnikov.

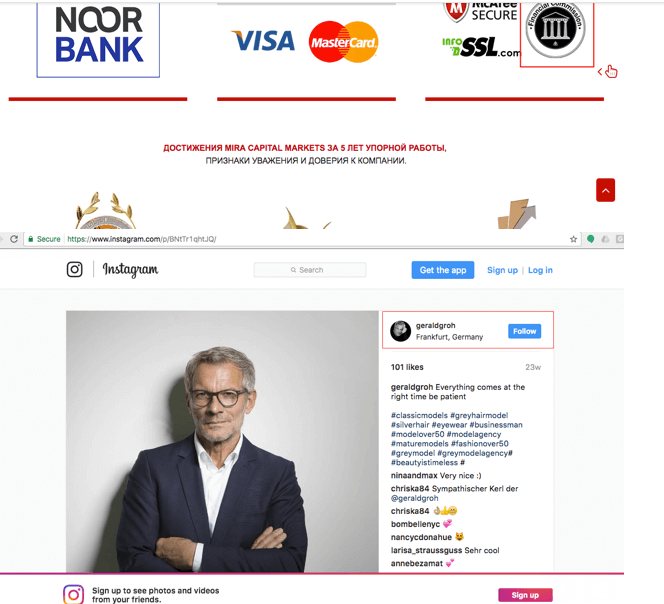

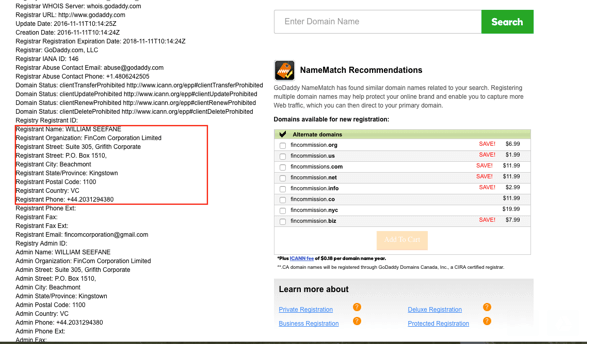

Mr. Tatarnikov explained today to FinanceFeeds that the bogus arbitrator is using a false website domain which is www.fincommission.com, and has placed on the website a stolen photo of Gerald Groh for their fake Director General (Peter Warg).

Looking closely at the Companies House register in the UK, it is clear that William Seefane, who is the contact person used for Fincom, is the front man for 9 other entities in the UK. Using a common ‘front man’ is a very well worn practice by fraudsters, as it disguises the real people behind the firm and leads the auditors on a wild goose chase.

FinCom terms itself an official licensing authority and regulator, which it is not, and lists members as pretty much all of the companies in the industry, which is a false statement.

Mr. Tatarnikov this morning stated “Financial Commission Warns of Pseudo-Clone Website and Mira Markets – The Financial Commission, which is a recognized dispute resolution organization, operated by FinaCom PLC, today is aware of Mira Capital Markets, which is impersonating membership through a nearly-cloned (pseudo-clone) website that is mimicking many aspects of Financial Commission.”

“Financial Commission has become aware of two websites: Mira Capital Markets (miramarkets.com) – which is using data and linking to a website that is a pseudo-clone of Financial Commission (fincommission.com), to make it seem to the public that it is a member when it is in fact not a member of https://FinancialCommission.org.” he said.

“MiraMarkets is apparently using the information from the pseudo-clone website to masquerade to the public while appearing as a member while it attempts to lure investors” said Mr Tatarnikov.

“Moreover, the pseudo-clone website lists a few dozen brokerages on a purported member section, many of whom have contacted us thinking that the site has any legitimacy or connection to us only to be informed that it is in fact a pseudo-clone website that is impersonating Financial Commission” he said.

“The great lengths that companies may go to help perpetrate a fraud can be difficult for even the most cautious investors to detect. Be sure that the .org suffix is at the end of the URL when searching for our website, or clicking on related links when attempting to visit FinancialCommission.org.” stated Mr Tatarnikov today.

A good look with a keen eye through the following documentation will reveal the intricate nature of this ruse, including the plagiarism of the Financial Commission’s logo and fonts, along with its design, which then houses false directors.

The companies listed as members, whilst all major firms, are listed with offshore addresses, and the domain registration leads to the same figures as mentioned above.

Brokers which use this method as a means of extracting funds from unsuspecting customers have thus far got away with doing so, however with the Advertising Standards Agency in Britain finally having stepped up their prowess, we live in hope that this will eventually be relegated to the history books.

Meanwhile – caveat emptor!