Beeks Financial Cloud marks increase in revenues and gross profits in FY19

Gross profit increased 22.5% to £3.65 million, however Beeks registered a decrease in gross margins from 53.4% to 49.6%.

Cloud computing and connectivity provider for financial markets Beeks Financial Cloud Group PLC (LON:BKS) has earlier today posted its financial results for the year to end-June 2019, with revenues and gross profits staging a rise from the preceding year.

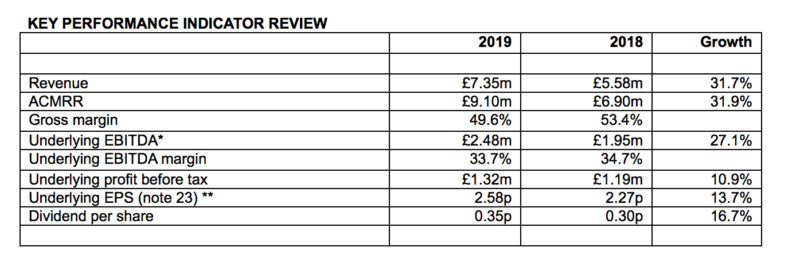

The company noted that FY19 was a good year in terms of revenue growth. Group revenues increased by 31.7% from the prior year to £7.35 million, on the back of continued organic growth. The CNS acquisition contributed £0.1 million revenue in the final two months of the year. Annualised Committed Monthly Recurring Revenues (ACMRR) increased by 31.9% to £9.1 million (2018: £6.9m) with CNS accounting for £0.8 million of this increase.

The company says it continues to have a healthy level of customer concentration with no single customer accounting for more than 6% of ACMRR. The number of institutional customers increased to 220 from 192 as at June 30, 2018 and the top 10 customers accounted for 32% of recognised revenue in the year (2018: 29%).

Gross profit increased 22.5% year on year to £3.65 million, however Beeks saw a decrease in gross margins from 53.4% to 49.6% as anticipated.

Part of this reduction was within direct costs due to the investment made this year into Beeks’ two new data centres in London InterXion and Singapore. The company explains that these data centres are revenue generating but not yet at breakeven levels which is typically achieved 12 months from go-live. Gross margin has also been impacted by an increase of depreciation to £0.89 million (FY18: £0.58m) as the Group has continued to invest in capacity to support its increased revenues and customer growth. In relation to sales growth, fixed asset investment and therefore depreciation has increased at a higher rate, partly due to the timing of sales order to revenue recognition and the longer sales cycle we have seen in the Tier 1 space.

In terms of outlook, Gordon McArthur, Beeks’ Chief Executive Officer, says the company has entered the new financial year in a strong position and enjoyed a good level of trading in the first two months of the year.

“Our core business with mid-tier organisations continues to grow and we are now layering on more strategic engagements with larger organisations”, Gordon McArthur said.