Brexit: No more regulatory passporting if Britain leaves the EU

UK-based FX companies and investment firms would lose their current passporting rights unless the UK retain EEA membership.

Just 10 days remain before the British public casts its vote in the very first ever public referendum on the nation’s membership of the European Union, the result of which not only has a potential impact on the volatility that may ensue with regard to the British Pound’s value against the Euro requiring FX companies to employ steadfast risk management measures, but there is a also a very important regulatory consideration to bear in mind.

In 2007, when the Markets in Financial Instruments Directive (MiFID) was originally implemented across 31 member states of the European Economic Area (EEA) and the 28 EU member states, the ability for companies in one regulatory jurisdiction within the European Union to ‘passport’ their licenses to other states was adopted.

Under this particular system, brokerages in London with a license from the Financial Conduct Authority (FCA) are able to provide service to any customer, white label partner, and introducing broker, as well as provide or receive prime brokerage services and liquidity from companies or individuals in any of the 28 European Union Member states.

Currently, the major regions that this applies to in the electronic trading industry are Britain and Cyprus.

In Britain, FCA regulated spread betting giants such as CMC Markets and IG Group have significant client bases in other European countries, notably France and Germany, and are able to comply with regulations on the basis that all clients in mainland Europe are covered by the MiFID passporting facility meaning that such companies are able to market their services without applying for regulatory licenses in each separate country.

The same applies to Cyprus, the world’s largest and most prominent region for retail FX brokerages, which has attracted over 180 brokerages (out of the 1,231 live MetaTrader 4 brokers in global existence today) largely due to low taxation, a very well stuctured business environment, access to skilled and knowledgable human resources and, very importantly, the CySec license being passportable under MiFID, thus being equally as valuable as an FCA license as Cyprus based brokers can offer their services with full regulatory coverage across the entirety of Europe, including Britain.

If the British public vote to leave the European Union on June 23, however, this would be very likely to change.

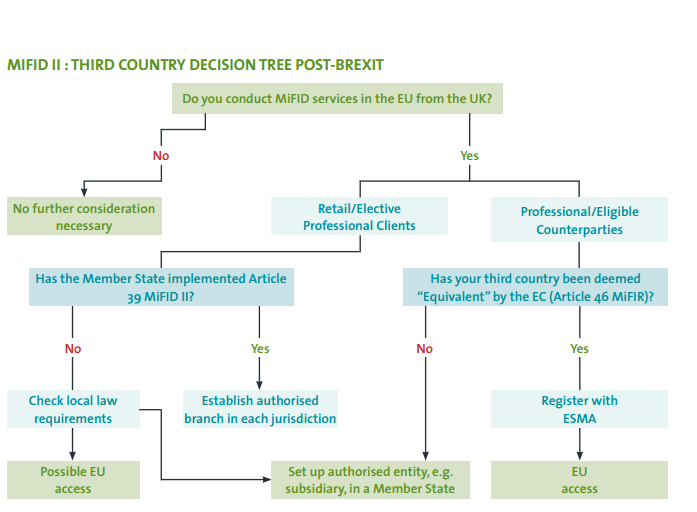

Unless it retained membership of the EEA (which is quite unlikely), the UK in the event of an exit from the European Union would become a “third party” for the purposes of much EU legislation.

This would mean that, in order to continue to do business with EU entities, the UK would need to maintain a regulatory environment at least “equivalent” to that of the EU despite not benefitting from the advantages of being a member. Obtaining an equivalence decision could be time-consuming and may become political.

In certain cases (e.g. UCITS), there is no equivalence regime and in others (e.g. MiFID II) the regime is uncertain, or has never been used.

Companies that currently rely on on the EU “passporting” regime will probably need to set up a separately authorised subsidiary in Europe, and transfer some staff there, in order to continue to do business with EU customers.

Bearing in mind that the FX industry in Cyprus is so well developed, and a vast amount of skilled employees based there are either originally from the UK, or are native-level English language speakers, it could become an even more attractive region for FX firms, albeit this time secondary (or tertiary) branches of large British electronic trading firms wishing to maintain the ability to passport their licenses.

For example, it would be quite sensible for the British CFD and spread betting giants to open subsidiaries in Cyprus in order to support the large German and French client bases that account for a considerable portion of their business, and continue to service the British clients from their London head offices.

The treatment of firms headquartered in Britain following the event of an exit from the EU potentially depends on any finalized exit deal agreed between the UK and the EU.

If the U were to leave the EU but not retain membership of the European Economic Area (EEA), as appears likely given what the pro-Brexit voters consider to be the political shortcomings of the EEA model, the UK would become a third country for MiFID purposes.

This would mean that UK-based FX companies and investment firms would lose their current passporting rights. If the UK did retain EEA membership, the passporting regime for financial services and investment firms would be preserved, although the UK would no longer have any ability to directly influence future EU legislation despite being subject to it in many areas.

Capital Requirement Directive – New licenses would be required in multiple jurisdictions

If the UK did not retain EEA membership following a Brexit, therefore not maintaining full access to the internal market, the position of UK financial services firms under the Capital Requirements Direcgive (CRD) would be far from straightforward, as under MiFID, the automatic EU passport for FX firms to offer their services transcontinentally would be lost. British companies would therefore require new licences in multiple EU jurisdictions.

Bearing in mind that many Cyprus based FX firms do not consider mainland Europe or Britain their main target audience, many doing business in Asia, Russia, the Middle East and Africa, and many of the larger Cyprus-based companies such as FxPro and FXTM already have offices in London with FCA licenses, the event of a possible Brexit is most likely not to affect their business. On the contrary, British fims, as previously mentioned, may set up offices in Limassol in order to maintain passporting abilities.

In Britain, however, the potential loss by London’s highly developed FX sector of the MiFID passporting facility could lead to many restructures of corporate operations.

If, however, there is no Brexit, then it is a case of business as normal.