British government set to use blockchain technology, proving Bitcoin VC investors absolutely right

Bitcoin has experienced a full turnaround recently, attracting venture capital investments from experienced mainstream companies which have in some cases set records, exemplified by 21 Inc’s $120 million round of funding earlier this year. Such gargantuan investments were unheard of when the Bitcoin fraternity was intent on proving virtual currency’s worth as an alternative to […]

Bitcoin has experienced a full turnaround recently, attracting venture capital investments from experienced mainstream companies which have in some cases set records, exemplified by 21 Inc’s $120 million round of funding earlier this year.

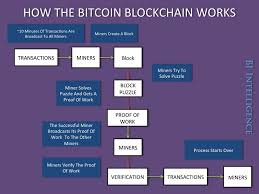

Such gargantuan investments were unheard of when the Bitcoin fraternity was intent on proving virtual currency’s worth as an alternative to sovereign tender, however once the financial technology moguls began to understand the value of the technology which operates behind Bitcoin, in particular blockchain and secure e-wallet systems, governments worldwide and mainstream commercial investors began to pledge their support.

In New York in June this year, Coinsetter CEO Jaron Lukasiewicz explained to Andrew Saks-McLeod that:

A comprehensive understanding of how Blockchain technology can be applied to other commercial applications is essential, as well as who is using it. Mr. Lukasiewicz explained that there has been a substantial growth in the use of Blockchain technology for the purposes of payments and remittance usage among large entities, therefore it has been slowly eating into the market share which Western Union and MoneyGram had previously dominated, at sometimes similar rates

At that time, it had become apparent that some corporations had ben attempting to rival Transferwise which is taking Bitcoin into direct competition with deliverable FX.

Today, the British government has taken this step, The British government has on several occasions expressed its interest in technological innovation, with chancellor of the exchequer George Osborne having pledged to assist London’s rise toward being a global financial technology center.

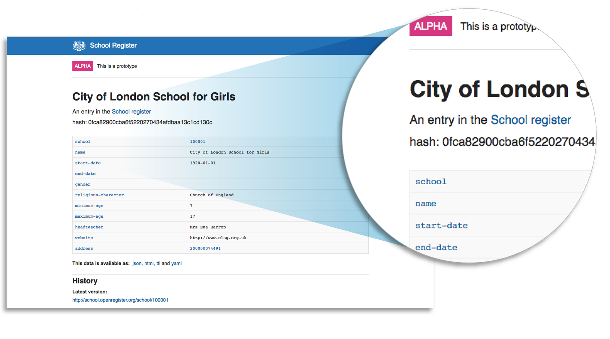

Britain’s Government Digital Service has begun to utilize Blockchain technology in certain prototype platforms for providing online information.

The civil servants and developers behind this consider that keeping on top of an authoritative, canonical register is an aduous task and that this often involves purchasing products which are either off-the-shelf and therefore inflexible and not fit for purpose, or making a proprietary system which is expensive and time consuming, or other than that, having to maintain diary records to do manual uploads to the main government site.

The British government’s digital service should modernize this procedure. Indeed, in this particular school register, a hash code is visible as a method of ensuring data remains untouched by those who mean harm.

Paul Downey, a prominent British hacker, has been listed on the Government Digital Service website as having stated

“Technically we are aware of how protocols such as the blockchain demonstrate how proofs could be distributed, and certificate transparency demonstrates how to use distributed copies to highlight where a canonical source of truth has been tampered with, but these are only two of a number of different models for increasing the trust in integrity of record we’ve started to explore.”

For the official report from the British government’s digital service, click here.