VisualStation goes live in the FX market

Soren Laang looks at how to utilize a DMA execution model to best advantage, and emphasizes that specialists in the industry should concentrate on their key strengths

By Soren Lanng, Founder at ECO Group on the exclusive launch of VisualStation by TickCOM

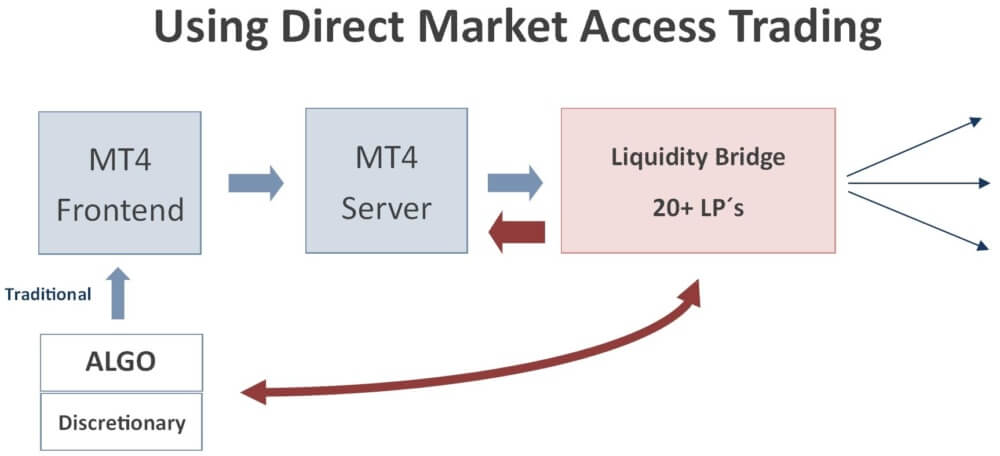

Transparency, latency, slippage and speed of execution has become an important factor for many FX traders – both discretionary and automated. A solution is to move to a Direct Market Access (DMA) solution sending in orders directly to the liquidity bridge, instead of through the broker server.

Using DMA can be the solution to existing problems of execution, especially for automated trading systems. Sending FX orders directly to the liquidity bridge is the closest a trader can get to the market – unless connecting directly to a single liquidity provider – however the aggregated liquidity bridge, aggregating liquidity from perhaps 15 liquidity providers, will provide better spreads and book than if using a single of these liquidity providers.

Using DMA requires the trader is having his own proprietary trading platform, which can keep track of open positions, including on hedged strategies, since the liquidity bridge do typically not offer the feature of positions size, and do not have sufficient information to do so. To make DMA operational, a backoffice application is needed in between the front end and the liquidity bridge, which can handle the order routing and house keeping such as keep track on open positions.

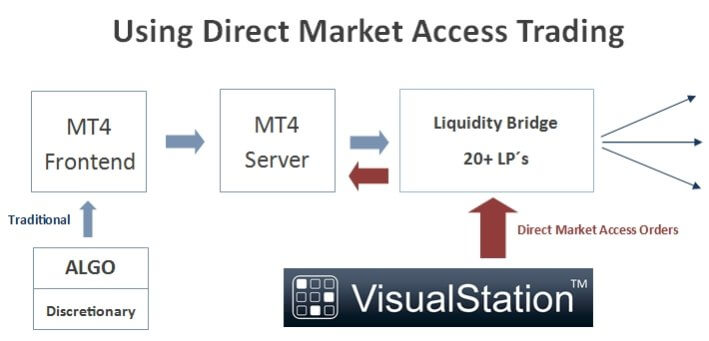

From our perspective, for example, we have institutional users who seek to avoid the MT4 server in their execution, a solution is to port their existing algorithms to VisualStation, which send the executions directly to the liquidity bridge.

In between, we have a back office which routs the orders to the bridge, and keep track on open positions of all the algorithms they have running, including hedged strategies.

As illustrated, the MT4 server is still in play. Before the order is sent to the LP, the bridge is checking for margin among other parameters, and when the order has been filled, it is pushed into the MT4 server.

It is possible to say that we extend the life of the MT4 server, and do MetaQuotes a favor. It is our experience, that brokers prefer to keep the MT4 server, but seek to be a complement to the MT4 front end.

The MT4 server would be nothing today without the bridge providers, and the extensions to the server such as risk management.

We cannot throw this away from one day to another, there is a momentum we cannot stop, such technologies takes many years to develop, and I think no company can span all. Even if we have a back office to route orders to the bridge providers, and a back office to keep track of positions, it doesn’t mean that we can offer a full solution.

This is outside our scope, and would imply we would have to start developing bridge aggregation, risk management and maintain these components. I think the best approach for a vendor is to focus at what it is good at, and we are good at front ends for financial trading.

Until today, brokers had two choices; to stay with the MT4 server and MT4 front end, or completely change platform to, for example cTrader.

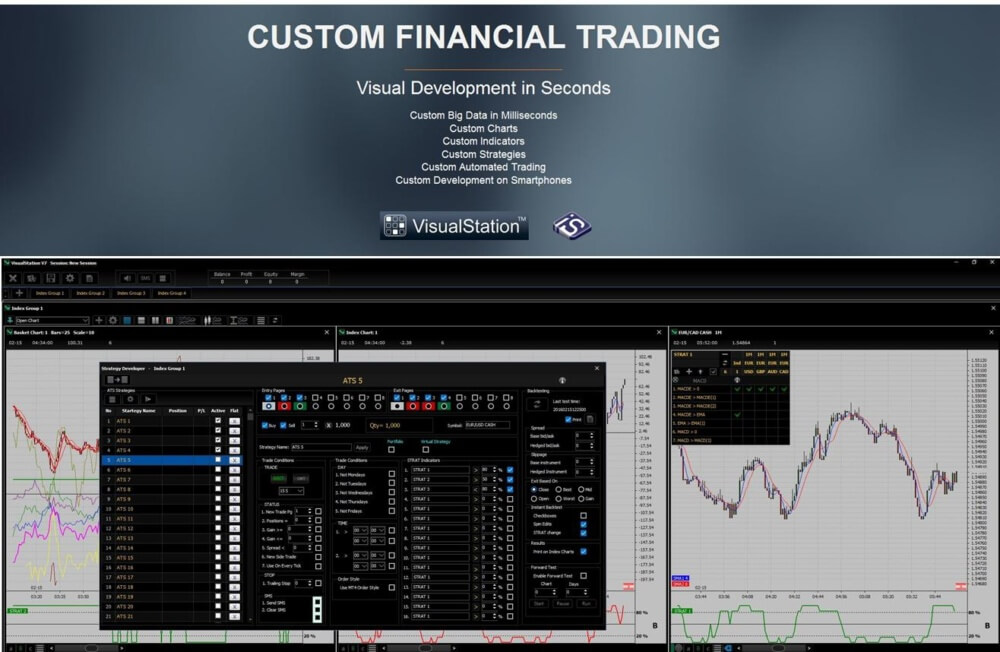

Our VisualStation is a trading and development platform, where programming has been replaced by visual development. Most sectors have already replaced programming, such as development of web sites and desktop applications, but not within financial trading.

The new VisualStation solution is the first platform of this kind, about every part of VisualStation is totally new and different from any other platform in the market, which makes the platform almost 100% differentiated in the market.

We made sure that VisualStation is focused to service 99.9% of the traders, the non-programmers. This segment has been left behind un-serviced the past decade, since about all platforms have been oriented at the programmers.

Traders know what they want, they are just not programmers. VisualStation is using in-platform cross market big data, and provide edit and backtesting of a strategy in less than 500ms. To make this possible, we use a native desktop application, without any kind of scripting language.

To make this possible we use a native desktop application, without any kind of scripting language. No platform using visual development is complete, it is not possible to natively provide support for any idea the trader might have, which is why we have added support for the users/programmers to extend the visual environment with custom Criteria Groups.

Therefore, when an MT4 EA contains the full strategy, our approach is a DLL which contain a set of criteria. Our DLL is without limitation, developed using MS Visual Studio or Embarcadero Delfi or C++ Builder.