“Don’t nationalize the internet!” – Corbyn’s plans would destroy our industry worldwide

Several of London’s senior leaders have voiced their concerns over the potential nationalization of the internet. We look at how it would wreck our industry if this happened under a Corbyn government.

One of the many dangerous policies intended for implementation by the socialist Labour Party should they be elected to government in the UK tomorrow is the nationalization of many large infrastructural companies, including internet service providers.

Globally, socialist countries do not have free access to internet, and removal of freedom of business and press, censorship, control and monitoring are part of the ethos of a left wing leadership.

Jeremy Corbyn’s Labour Party is no exception, and has its sights set on forcing privately owned utilities, infrastructure and internet companies to turn themselves over to the government.

There are many dangers associated with this terrifying prospect, many around the potential control that the government could have over everyone’s business and personal life as is the case in hard left regions like Venezuela, China, Vietnam, North Korea, parts of Eastern Europe and the Middle East, but of course the inefficiency at which governments operate services would likely wreak havoc on private business, and of course the electronic trading industry which relies on it.

Our industry relies on high quality internet infrastructure, hosting and data transmission for regulatory reporting, trade execution, the transmission of price feeds to and from traders and banks, and market analytics, as well as connectivity between trading platforms and liquidity providers, and risk management.

The entire basis of the financial services sector, especially in electronic trading, is reliant on many components of internet and hosting firms, all privately owned, and all global.

Today, members of the Institute of Directors in Pall Mall, London, have voiced their disdain for such a proposal.

In a survey of over 1,000 of its members, the Institute of Directors found that Labour’s broader plans to nationalise swaths of the economy would result in less reliable, costlier and underfunded utilities and infrastructure.

That’s for sure.

Jeremy Corbyn’s Labour party has promised to radically transform the economy. It would unleash £400bn of investment spending over 10 years, nationalise rail, mail, water and parts of the broadband network, and increase day-to-day spending by around £80bn a year.

This is a sugar coated arsenic pill disguising the real reason – to achieve complete government control and bring down private enterprise.

The Institute of Directors’ members were supportive of higher public spending to improve infrastructure, the poll showed, with 28 per cent saying it should grow significantly and 49 per cent calling for a more modest expansion.

“By and large, directors agree that the economy needs a shot in the arm, particularly with many firms facing the prospect of Brexit upheaval,” said IoD policy director Edwin Morgan.

“Companies have been calling out for infrastructure improvements across the country for a long time, and they will be pleased that this is one area where all the parties appear to agree on the need to raise our game.”

Yet he said that although “Business leaders are as frustrated as anyone by slow broadband and cancelled trains”, taking “whole sectors under state control would consume huge amounts of government time and effort while offering no guarantee of improvements”.

A Labour party spokesperson said: “Labour is proud of our popular policies to put key sectors like energy, water, railways and communications into the hands of the people.”

Only it wouldn’t be in the hands of the people, would it?

Rather like the confusingly named “peoples’ republics” around the world which are operated using a communist model, no person has any control over their every day life, instead being automatons who are afraid of an overbearing and all-controlling government.

From our point of view we must look at the potential effect on the entire world’s markets should this awful nightmare come to fruition.

Just a year ago, Stéphane Tyc, co-founder of McKay Brothers, a European high-speed trading network operator, said “You need connectivity from where the news comes from the CME futures markets in Chicago, and New Jersey, where the US stock exchanges are based.”

“For foreign exchange markets in Europe the news is in London,” said Mr Tyc, noting that the EBS and Thomson Reuters matching engines are based around the City.

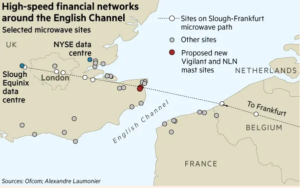

That demand has been highlighted in recent weeks by Interxion’s planned €35m expansion and a failed attempt by US high-frequency traders to build 300-metre masts by the English Channel.

Undersea cables emerge from the north Atlantic in the UK before heading towards Slough, near London’s Heathrow airport. There sits a cluster of data centres owned by US group Equinix.

Intercontinental Exchange owns a data centre at Basildon in south-east England that houses the Paris, Amsterdam, Lisbon and Brussels exchange servers, as well as what was the Liffe derivatives bourse, and the FTSE 100 futures

These airless warehouses are the modern equivalent of the City’s famed coffee houses and open outcry pits of a bygone age. Trading is monitored by automated software on IT servers in remote data centres. These bunkers have enough fuel to withstand an outage for several days and the sort of security that James Bond would call a challenge.

Among the names there include the matching engines of Bats Europe, the largest pan-European stock exchange, plus access points for a host of US exchanges such as the CBOE. Alongside them are housed data providers such as Bloomberg, Thomson Reuters, Dow Jones and Interactive Data, along with dark pools and smaller equity and derivatives markets.

The other side of the city is equally connected. Intercontinental Exchange owns a data centre at Basildon that houses Euronext’s Paris, Amsterdam, Lisbon and Brussels exchange servers, as well as what was the Liffe derivatives bourse, and the FTSE 100 futures.

Those futures exchanges have strong connections to Frankfurt, and Deutsche Börse’s Eurex futures exchange. Its Bund, Bobl and Schatz futures are pegged to the prices of German government bonds and the German exchange also has the closely watched DJ Stoxx and Dax equity indices.

Connecting the cities are microwave networks, similar to those in the US between Chicago and New York. They also connect sites in central London, such as the Interxion site and the London Stock Exchange’s data centre.

These microwave networks can be profitable for the few high-frequency traders that have the capacity to make the investment. “It also makes the market more efficient. It ensures that somebody who is buying an instrument in Frankfurt is getting pretty much the same price as someone who’s buying a similar instrument in London,” said Don Wilson, chief executive of DRW, a Chicago proprietary trader. One of DRW’s subsidiaries was blocked from building the masts in Kent.

Imagine what would happen to the accessibility to market under an inefficient and censored internet system run by people who despise the capital markets industry, and whose Shadow Chancellor John McDonnell publicly stated he will impose capital controls and “foment the overthrow of capitalism in London.”

One uncertainty is that Euronext’s five-year contract to put its matching engines in Basildon expires in April 2019. A one-year window to provide notice that it is leaving began on April 1 2017, but the exchange said at the time that the location of its infrastructure was not directly related to its markets structure. This means that at any time, it could pull out – especially if the government starts destroying the infrastructure that it relies on.

This may well be news, and the survey relevant. However at this pivotal time, it is important that we do not allow this menace to enter Number 10 Downing Street and foist this awful potential reality onto our industry.