Dukascopy enhances tech analysis capabilities of JForex Trader mobile app

Take Profit and Stop Loss indicator has been added to Positions list screen and editing of chart indicator parameters has been improved.

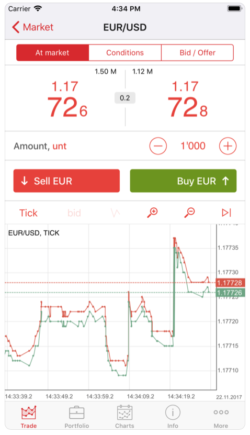

Swiss Forex bank & marketplace Dukascopy has just released a new version of its JForex Trader mobile application, with the latest set of updates focusing on technical analysis features.

Version (5.6) of the JForex Trader application for iOS devices introduces Take Profit and Stop Loss indicator to the Positions list screen. In addition, a “Show TP/SL details” switch has been made available on the Positions list screen. The switch offers graphic representation of Open Price, Current Price, Stop Loss and Take Profit price.

The editing of chart indicator parameters has been improved, and instrument selection screen has been enhanced. The color theme choice can be made in the app settings. Public JForex strategies have been added.

The editing of chart indicator parameters has been improved, and instrument selection screen has been enhanced. The color theme choice can be made in the app settings. Public JForex strategies have been added.

The previous version of the solution, released on November 2017, also included improvements concerning charting. For instance, a monthly time frame was added, whereas traders got to enable/disable custom indicators and edit custom indicator parameters.

Dukascopy’s JForex Trader aims to replicate all the main features of the Dukascopy platforms, such as live, secure and persistent connection with server, access to ECN liquidity, instant order execution, as well as a decent range of trading orders to choose from. The set of FX tools available to users of the app includes, among others, FX market news, economic calendars, access to Dukascopy TV, and Movers & Shakers.

Another of Dukascopy’s mobile applications that has recently seen some updates is social networking app Dukascopy Connect 911. In November last year, users of the solution got the ability to send video messages to others or send a video response for Dukascopy 911 questions. Improvements in stability and camera application accompanied these video features. Also, in the end of January 2018, the app re-emerged with new design and offering easier access to various features from the 911 section.