Effex Capital, implicated in FXCM US problems, files lawsuit against NFA

Effex Capital, whose relation to FXCM played a vital role in the regulatory arguments for pushing the broker out of the US, today launched a legal action against the National Futures Association.

There has been an interesting turn of events regarding the legal battles surrounding FXCM’s exit from the US market. Many of our readers recall that the broker’s business relations with Effex Capital served as one of the main arguments used by US regulators to highlight the misleading business practices of FXCM back in February.

As the volume of legal action against FXCM continues to grow following the February events, it turns out that Effex Capital is fighting back at the National Futures Association (NFA).

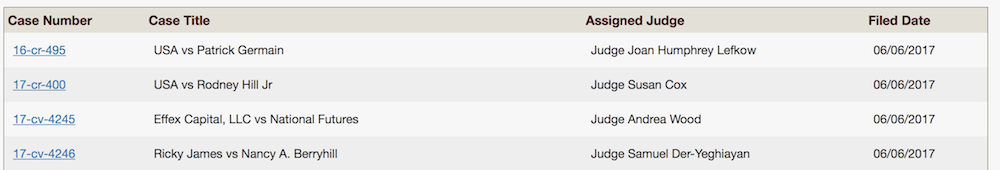

The list of most recently filed cases at the Northern District Court of Illinois shows a case captioned Effex Capital, LLC et al v. National Futures Association et al (#1:17-cv-04245). The nature of the case, filed on June 6, 2017, is “assault libel & slander”.

Photo credit: Northern District Court of Illinois.

Information at this point is scarce as it takes 24 hours for the full data to be uploaded on PACER. However, Law360 reports that Effex Capital accuses the NFA of publishing false claims about the company and not giving it the opportunity to defend itself and rebuff these claims.

Effex says that the false claims were made by the NFA in this year’s February complaint and settlement with FXCM.

Effex accuses NFA of a regulatory overreach and says that the body falsely accused Effex Capital LLC and its CEO John Dittami, who are not NFA members, of co-operating with an NFA member to the detriment of Effex customers. The NFA claims are also said to have revealed Effex Capital’s trade secrets.

According to NFA’s February complaint, Effex’s CEO John Dittami was employed by FXCM beginning in 2009 as head of one of FXCM’s trading and market-making divisions. In or around March 2010, Effex was established as a seemingly independent company organized and operated by Mr Dittami. FXCM, however, supported and controlled Effex.

In return for the order flow that FXCM directed to Effex, Effex paid rebates to FXCM that reached up to 70% of Effex’s profits from FXCM’s order flow.

Effex Capital and Mr Dittami are among the defendants in a class action on behalf of FXCM’s customers who traded on the broker “No Dealing Desk” platform during the 2010-2016 period. The customers allege they suffered harm as a result of FXCM’s relationship with Effex Capital as a liquidity provider. The class action alleges (inter alia) breach of contract and breach of fiduciary duty by US and other related claims against Global Brokerage Inc (NASDAQ:GLBR), FXCM Holdings, Dror Niv, William Ahdout, and Effex and its principal.