Euro collapses against dollar as politicians consider the end of the EU to be near

As a huge column of migrants from the Balkan states make their way en masse toward Western Europe, on foot, battling the inclement weather, fears that the European Union may finally become a thing of the past very shortly are at the front of the minds of politicians across the continent. Add this surge of […]

As a huge column of migrants from the Balkan states make their way en masse toward Western Europe, on foot, battling the inclement weather, fears that the European Union may finally become a thing of the past very shortly are at the front of the minds of politicians across the continent.

Add this surge of migrants who are leaving their homelands with absolutely nothing except the clothes they wear to the continual torrent of ‘refugees’ from countries including Syria which are now being settled on a semi-permanent basis in Western Europe, and the financial, social and demographic burden has gone from the mildly unsustainable to the completely unsustainable.

Western Europe’s countries already host battered economies and the days when they produced are long gone. France has a debt-to-GDP ratio of 250% compared to just 5% in Mexico (an independent sovereign nation with a vast telecommunications and manufacturing sector) and 1% in China which lets face it, is the new economic superpower.

“The trouble with socialism is that in the end you run out of someone else’s money” – Margaret Thatcher

Italy, Spain, Portugal and Greece are in dire straits with floundering economies and a youth unemployment situation in which over 50% of the population under the age of 30 are out of work, yet the poor and potentially dangerous are flocking into the Western states of the European Union, bringing with them very little likelihood of enhancing the economy, instead several hundred thousand caps in hand, into which the social security will be expected to empty its coffers in return for security risks and potentially adverse social effects.

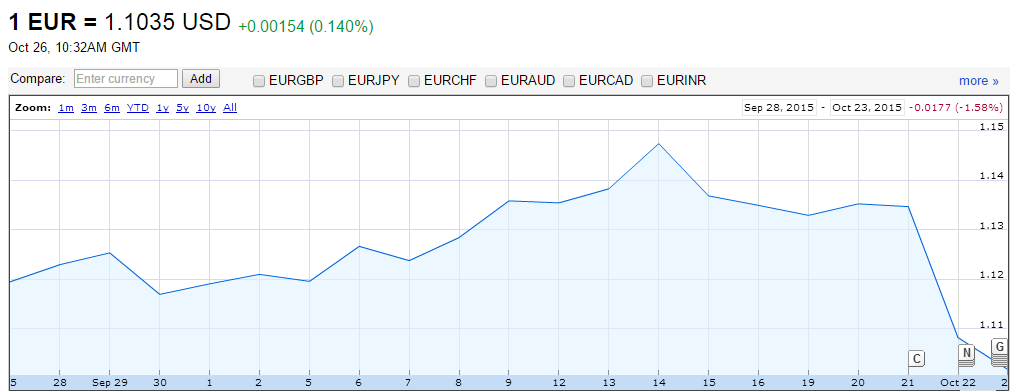

Euro plunges to 1.10 against the Dollar

The Euro collapsed last night against the US Dollar as politicians take a pessimistic view. Slovenia’s Prime Minister publicly stated that the EU will certainly break up if leaders cannot agree on how to deal with the migrant crisis.

Hungary, one of the first nations to receive Syrian migrants, closed its borders last week to the south of the country, after experiencing riots in the streets and violent clashes between citizens and migrants, forcing vast and unprecedented numbers of migrants into Slovenia.

Prime Minister Miro Cerar sent out a dramatic call to fellow central and eastern leaders in Brussels for emergency talks.

He said

“If we don’t find a solution today, if we don’t do everything we can today, then it is the end of the European Union as such. If we don’t deliver concrete action, I believe Europe will start falling apart.”

“Since October 17, more than 62,000 migrants have arrived in Slovenia, with some 14,000 still passing through the country on today alone.”

Weary from the year’s events which have seen Greece elect a staunch socialist prime minister in order to ensure that no austerity is put in place and the vast debt that it owes the European Central Bank and International Monetary Fund is never repaid, the collapse and repeated bailouts of several banks across the continent, and the lack of industrial and commercial prowess that blights Europe, Britain has been very astute in safeguarding itself against the potential economic disaster that looms should the European Union dissolve.

David Cameron’s eagerness to do an initial £30 billion worth of business with China – by far the most economically and industrially sophisticated nation on earth – is a clever move and may well shield Britain should the country become independent from the EU. With China as a trade partner, Britain’s economy and modernity of its financial markets system can only improve.

Should the lack of confidence in the future of the European Union prevail, it could push the Euro down to below parity with the Dollar, which may well be the beginning of the end for the single currency.

Chart courtesy of Google Finance – Image courtesy of Daily Mail