FCA imposes requirements on One Stop Money Manager Limited

One Stop Money Manager is no longer able to conduct its regulated business because the FCA has imposed a number of requirements on the firm.

The UK Financial Conduct Authority (FCA) has earlier today provided information for customers of One Stop Money Manager Limited.

The firm is authorised and supervised by the FCA to issue e-money and provide payment services under the Electronic Money Regulations 2011. However, as of December 4, 2019 it is no longer able to conduct this regulated business because the FCA has imposed a number of requirements on the firm.

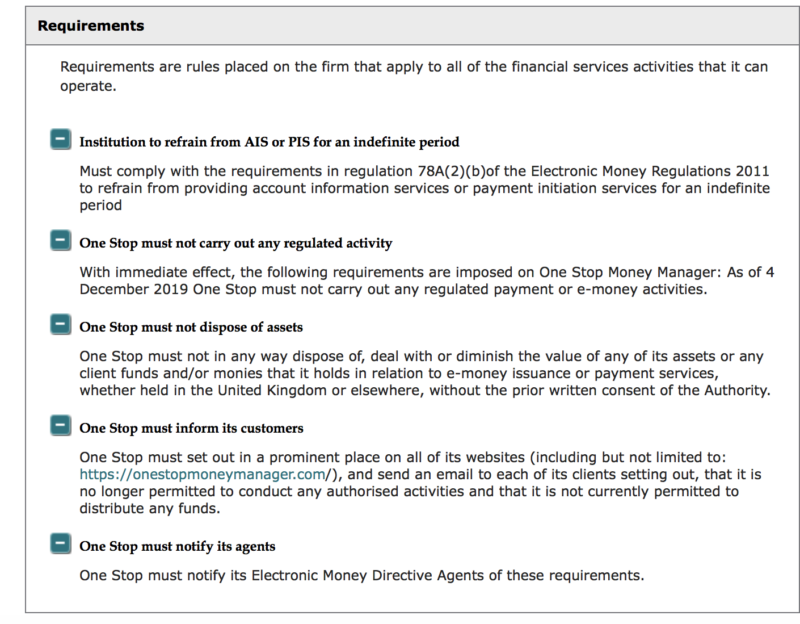

Requirements are rules placed on the firm that apply to all of the financial services activities that it can operate.

According to the FCA register, the requirements on One Stop include:

- Institution to refrain from AIS or PIS for an indefinite period

The firm must comply with the requirements in regulation 78A(2)(b)of the Electronic Money Regulations 2011 to refrain from providing account information services or payment initiation services for an indefinite period

- One Stop must not carry out any regulated activity

With immediate effect, the following requirements are imposed on One Stop Money Manager: As of 4 December 2019 One Stop must not carry out any regulated payment or e-money activities.

- One Stop must not dispose of assets

One Stop must not in any way dispose of, deal with or diminish the value of any of its assets or any client funds and/or monies that it holds in relation to e-money issuance or payment services, whether held in the United Kingdom or elsewhere, without the prior written consent of the Authority.

- One Stop must inform its customers

One Stop must set out in a prominent place on all of its websites (including but not limited to: https://onestopmoneymanager.com/), and send an email to each of its clients setting out, that it is no longer permitted to conduct any authorised activities and that it is not currently permitted to distribute any funds.

- One Stop must notify its agents

One Stop must notify its Electronic Money Directive Agents of these requirements.

This is to protect the interests of One Stop Money Manager Limited’s customers. Any customers with questions should contact the firm by email at [email protected] or via telephone on 01444 880606.