FCA sees complaints rise to 6.02m in H2 2019

Average redress for upheld complaints about investments increased, from £894 to £952.

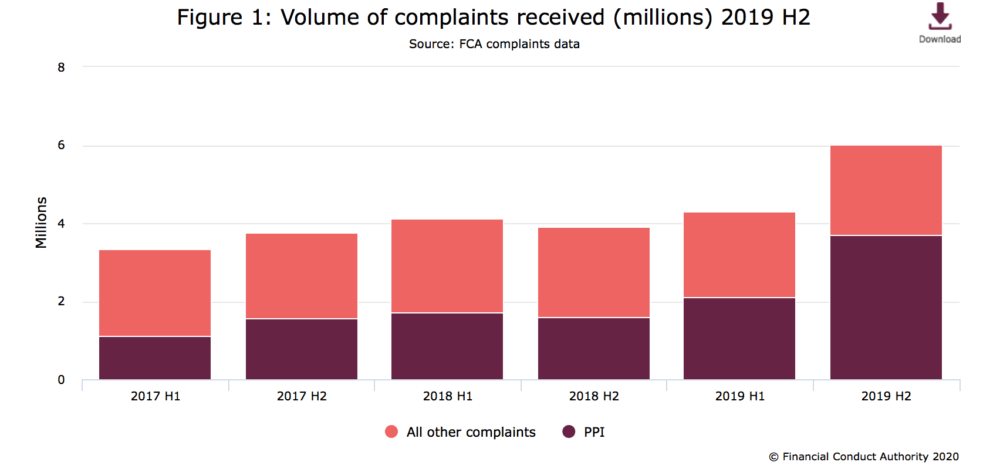

The UK Financial Conduct Authority (FCA) today published the complaints figures for regulated firms for the second half of 2019. The data revealed an increase in complaints from 4.29 million in the first half of 2019 to 6.02 million in the second half of 2019.

The increase in complaints was mainly due to a 75% increase in the volume of PPI complaints received, from 2.12 million to 3.71 million. PPI complaints accounted for 62% of all complaints received during this period, continuing to be the most complained about product. This was the highest level of PPI complaints reported to the FCA by firms.

As well as PPI complaints increasing during the second half of 2019, there was a 6% increase in all other complaint volumes compared with the first half of 2019, from 2.18 million to 2.31 million.

Excluding PPI complaints, the most complained about products were current accounts (10% of all complaints), credit cards (6%) and other general insurance products (5%).

Over the same period, complaints about home finance products decreased from 8.7 to 8.4 complaints per 1,000 balances outstanding, while investment products increased from 2.1 to 2.3.

Overall, excluding PPI, the average redress per complaint upheld decreased from £200 in the first half of 2019 to £184 in the second half of 2019. Average redress per upheld complaint about banking and credit cards decreased by 12% between the first half of 2019 and the second half from £204 to £181. Average redress for upheld complaints about investments increased, from £894 to £952.

Upheld complaints about decumulation and pensions received an average of £673. This is lower than in the first half of 2019 where an average of £730 was paid per complaint, and the second half of 2018 when £870 was paid per complaint.

There was a decrease in the percentage of complaints upheld across all product groups in the second half of 2019 when compared with the first half of 2019.

Investment products continued to have the lowest uphold rate compared to other product groups, at 48%. While decumulation and pension products have the highest at 61%.