Forex Capital Markets LLC finally ceases to be Australian Financial Services Representative

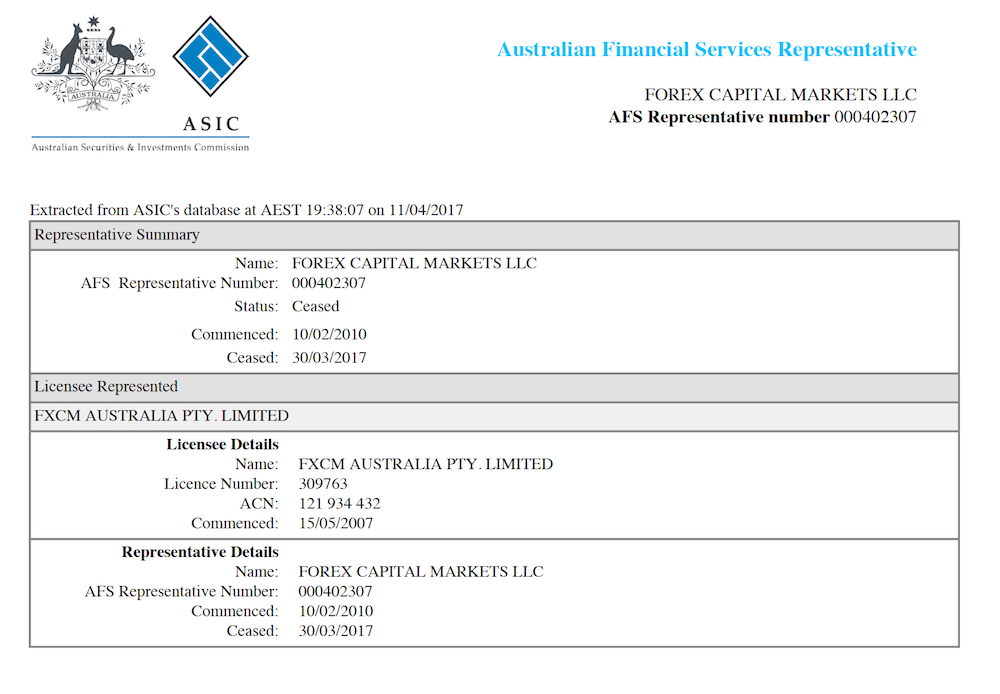

The ASIC Connect system shows that Forex Capital Markets LLC finally stopped being a representative of FXCM Australia.

The time lag in actions of regulators in response to measures taken against a company in another jurisdiction can be substantial. This was exemplified once again by the Australian Securities & Investments Commission (ASIC), whose ASIC Connect system did not reflect changes with regards to Forex Capital Markets LLC two months after US regulators published findings into the business practices of the brokerage for the last several years – findings that led to FXCM’s exit from the US retail FX market.

FinanceFeeds has already reported on the matter – in mid-March, we noted that Forex Capital Markets LLC was still registered as Australian Financial Services Authorised Representative of FXCM Australia. That was several days after the US National Futures Association (NFA) implemented a permanent principal and a permanent membership bar against Forex Capital Markets LLC.

Today, the ASIC Connect system was updated with regards to FXCM and is now showing that the authorization of Forex Capital Markets LLC as AFS Representative had ceased.

An obvious question to ask is whether there will be another representative for FXCM Australia Pty Limited – the licensee that used to be represented by Forex Capital Markets LLC.

In the immediate aftermath of the announcement of the settlements between FXCM and the regulators, the broker noted that its non-US business will not be affected and its operations will go on as usual. Nevertheless, we see that there are structural changes at these subsidiaries and that these changes are, albeit slowly, reflected in official registers.

While we are unaware of the management changes at FXCM Australia, we are informed – thanks to UK regulatory reports, about the management changes at Forex Capital Markets Limited, also known as FXCM UK. Drew Niv and William Ahdout, who were banned from NFA membership, left FXCM UK soon after the US regulatory action against Forex Capital Markets LLC. Mr Niv has abandoned a set of director roles since the events on February 6, 2017, with the latest one being a director role at FXCM UK Merger Limited.