GAIN Capital registers net income of $77.3m in Q1 2020

“Client metrics were strong during the quarter, with a 57% year-on-year increase in clients who placed their first trade”, says GAIN’s CEO Glenn Stevens.

Online trading major Gain Capital Holdings Inc (NYSE:GCAP) has just posted a set of solid metrics for the first quarter of 2020.

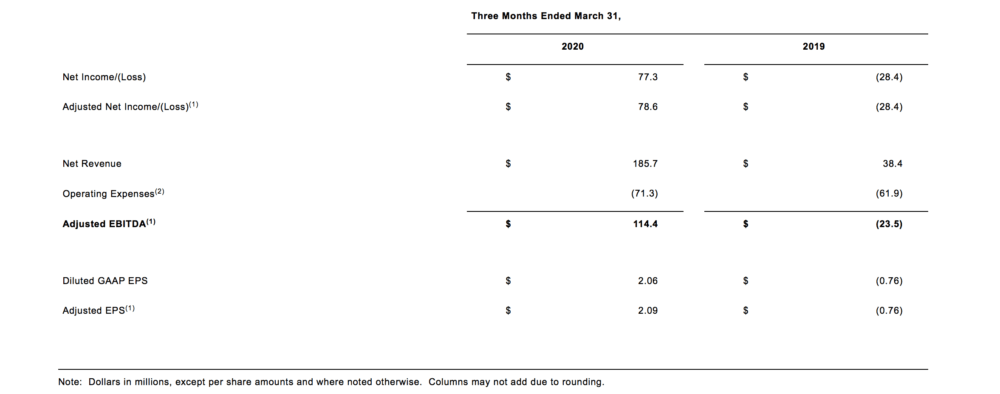

GAAP net income amounted to $77.3 million, or $2.06 per share, in the first three months of 2020. This compares with a net loss of $28.4 million incurred in the year-ago quarter.

GAAP net revenue surged to $185.7 million in the first quarter of 2020, up from $38.4 million a year earlier.

Adjusted net income totalled $78.6 million, or $2.09 per share, whereas adjusted EBITDA for the period was $114.4 million.

Retail performance during the first quarter of 2020 was supported by exceptionally high volatility caused by economic concerns over COVID-19. Trailing 3-month direct active accounts increased a record 25% over prior year to 87,349, whereas RPM reached $231, a quarterly record, with average daily volume of $11.7 billion, 52% above prior year.

“Proactive steps taken to reduce our fixed overheads, broaden the customer base and ultimately improve the Company’s operating leverage during 2019 had positioned GAIN well to benefit upon the return of volatility, which was driven to extraordinary levels by economic concerns over the impact of the coronavirus pandemic in recent months. GAIN’s March volumes reached multi-year highs, amid market conditions that were favorable to revenue capture, as well as volumes, with RPM of $231 for the first quarter,” stated Glenn Stevens, CEO of GAIN Capital.

“Client metrics were strong during the quarter, with a 57% year-on-year increase in clients who placed their first trade. Market conditions not only attracted new clients, but also engaged those who had previously opened accounts during 2019 but had not yet traded. That in turn helped improve our 3-month trailing active accounts by 25% compared to last year,” added Mr. Stevens.

GAIN’s Board of Directors declared a quarterly cash dividend of $0.06 per share of the company’s common stock. The dividend is payable on June 26, 2020 to shareholders of record as of the close of business on June 23, 2020.

The company made a brief comment regarding its acquisition by INTL FCStone, Inc, stating that the deal remains on track to complete during the third quarter of 2020.