Gain Capital sees client assets rise in Q3 2017, plans Bitcoin trading launch

Gain Capital has just posted a solid set of metrics for Q3 2017, with some exciting novelties in store for the fourth quarter of the year, including Bitcoin trading and mobile-only trade signals app.

Online trading major Gain Capital Holdings Inc (NYSE:GCAP) has just released key metrics for the third quarter of 2017, with client assets and revenues rising, and the company managing to cut net losses. The company also reiterated its push into strategic M&A and its plans to expand its product set and distribution channels to increase geographic reach and scale.

Let’s start with the most basic numbers. The company posted a net loss of $2.6 million for the third quarter of 2017, which means that it managed to reduce the loss of $4.7 million seen in the equivalent period in 2016. Net revenues in the quarter to September 30, 2017, were up 13% year on year to $81.3 million.

Client assets increased 16% year on year, with the rise reflecting in part the integration of FXCM accounts.

Gain Capital also highlighted the results of its Convertible Senior Notes Offering. On August 22, 2017, the company completed a $92 million offering of 5.00% Convertible Senior Notes due 2022. The net proceeds from the offering were used to retire nearly all of the outstanding Convertible Senior Notes due 2018, Gain explained in today’s announcement. In connection with the offering, GAIN agreed to repurchase approximately $14.5 million of its common stock from purchasers of notes in the offering in privately negotiated transactions concurrently with the closing of the offering.

Excluding the buyback in conjunction with the Convertible Senior Notes offering, GAIN repurchased 279,612 shares of stock at an average price of $6.61 in the third quarter of 2017. Including the buyback in conjunction with the Convertible Senior Notes offering, during the third quarter, GAIN repurchased 2,402,598 shares of stock at an average price of $6.80.

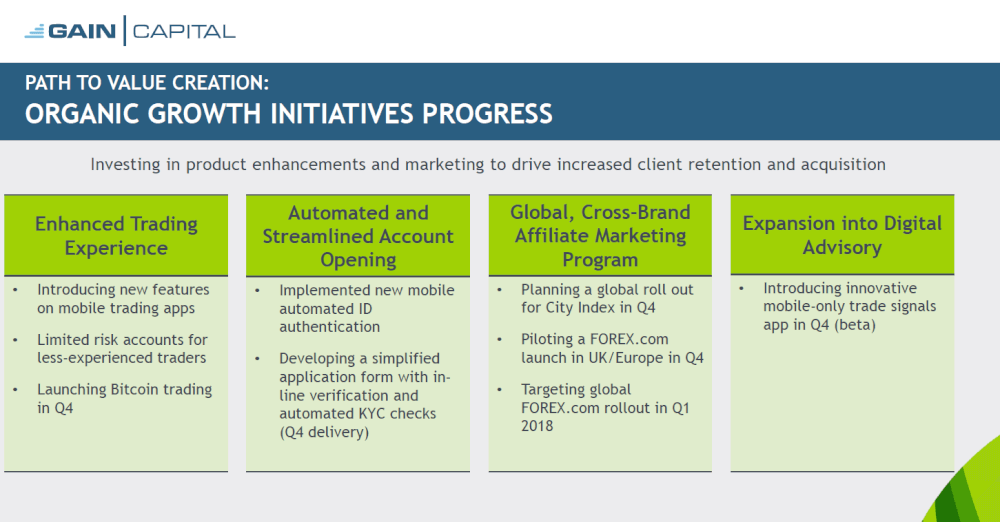

Some very interesting announcements were made by the company with regard to its future plans, as it aims to step up client retention and acquisition. The plans involve expansion into digital advisory. In particular, Gain aims to introduce an innovative mobile-only trade signals app in the fourth quarter.

Enhancements to trading experience are also in the pipeline, including the launch of Bitcoin trading in the fourth quarter of 2017.

The company also plans to bolster its affiliate marketing program.

More details will be available in the quarterly filing with the Securities and Exchange Commission.