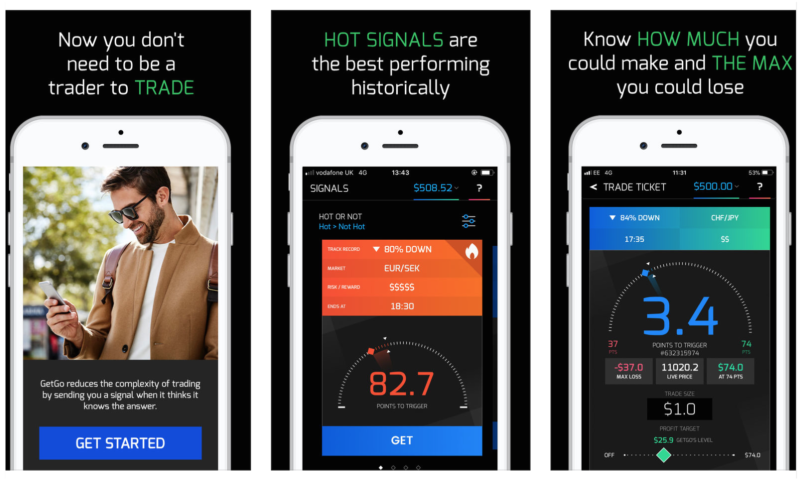

GAIN Capital’s GetGo mobile app becomes available in Australia

After the solution had to bid goodbye to the EU market due to the new ESMA rules, it becomes available in Australia.

There has been a lot of havoc around the latest ESMA rules, which imposed certain restrictions on CFD offering to retail clients as the regulator sought to introduce enhanced protections to traders. The new ESMA rules have triggered a surge in brokerages’ efforts to lure professional clients, but have had other consequences too – actual changes to offering had to be made.

The GetGo mobile app, which online trading major Gain Capital Holdings Inc (NYSE:GCAP) initially rolled out in the UK in December 2017, has been among the solutions affected by the new rules.

In late July this year, when GAIN announced its results for the second quarter of 2018, it also said GetGo is about to be withdrawn from the UK/EU market, as a result of the new ESMA/FCA rules. The app is set to be launched in other jurisdictions, the brokerage explained back then.

The creators of GetGo had previously indicated that Australia will be the next region where the app would be rolled out.

The broker has stayed true to its words, as less than a fortnight after the results announcement, the company has made GetGo available in Australia. Version 1.0.15 of the app for iOS devices and version 1.0.5 of the app for Android gadgets are the first to be made available for download in Australia.

The GetGo application harnesses the capabilities of a smart AI-enhanced algorithm to spot statistical trends in financial markets and provide users with trading signals based on historical data. GetGo’s algorithm reads through millions of data points across global indices, currency and commodities markets looking for price patterns that have led to consistent trading outcomes in the past. When it spots a pattern it thinks might repeat, it pings a user a signal. Then traders have to decide: GetGo or No-Go? And that is where the app gets its name from.