Hong Kong’s SFC registers rise in license applications in quarter to end-June

During the April-June quarter, the Hong Kong regulator received 2,030 licence applications, up 19.6% from the same period a year earlier.

The Hong Kong Securities and Futures Commission (SFC) has earlier today published its Quarterly Report summarizing key developments during the three months to June 2018.

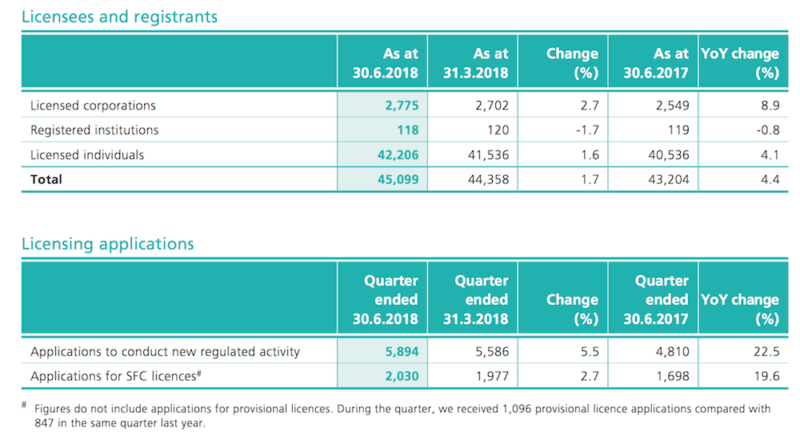

The regulator registered a rise in the number of license applicants. During the quarter, the SFC received 2,030 licence applications, up 2.7% from the preceding quarter and up 19.6% from the equivalent period in 2017. The number of corporate applications, however, dropped 10.7% from the last quarter to 75, down 6.3% year-on-year.

As at June 30, 2018, the number of licensees and registrants totalled 45,099, up 4.4% from last year, and the number of licensed corporations grew 8.9% to 2,775. Both were record highs.

These rather robust numbers stand in contrast to data for the final quarter of 2017. The SFC quarterly report for the three-month period to December 31, 2017, shows that the number of new license applications fell in quarterly terms. In the final quarter of 2017, the regulator received 1,924 licence applications, down 9.6% from the preceding quarter and up 7.7% year-on-year. The number of corporate applications rose 50.8% from the last quarter to 98, up 18.1% year-on-year.

Let’s recall that the SFC Compliance Bulletin published in May this year highlighted the growing number of Mainland entities choosing to establish or extend their financial services businesses in Hong Kong through setting up new licensed entities or acquiring existing ones.

In 2012, the Mainland overtook the United States to become the largest source of shareholder groups controlling licensed corporations (LCs), the SFC notes. According to the SFC Compliance Bulletin, about 13% of all LCs are now controlled by Mainland-based corporate shareholders, as compared to 9% in 2012.

In addition, after the November 2014 launch of Shanghai-Hong Kong Stock Connect, the number of stock exchange participants in Hong Kong has climbed steadily.