ICE marks net income of $611m, net revenues of $1.3bn in Q4 2018

Whereas the size of the net income attributable to ICE lagged behind the results from the year-ago quarter, revenues marked a rise.

Following a set of rather strong metrics posted for the third quarter of 2018, operator of global exchanges and clearing houses and provider of data and listings services Intercontinental Exchange Inc (NYSE:ICE) has just published some robust results for the final quarter of 2018.

The consolidated net income attributable to ICE was $611 million in the final quarter of 2018, lagging behind the result posted for the year-ago quarter. Fourth quarter GAAP diluted earnings per share (EPS) were $1.07. Adjusted net income attributable to ICE was $536 million in the fourth quarter of 2018 and adjusted diluted EPS were $0.94, up 25% year-over-year.

ICE Chairman & Chief Executive Officer, Jeffrey C. Sprecher noted that 2018 marked ICE’s 13th consecutive year of record revenues – a track record which he attributed to customer demand for ICE’s risk management solutions and the investments made to enhance the Group’s technology, expand content and broaden distribution.

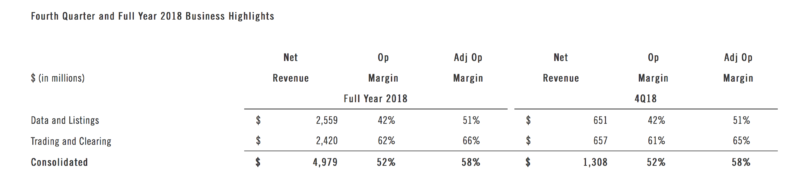

Fourth quarter consolidated net revenues were $1.3 billion, up 14% year-over-year. Data and listings revenues in the fourth quarter were $651 million and trading and clearing net revenues were $657 million, up 4% and 27% year-over-year, respectively. Consolidated operating expenses were $632 million for the fourth quarter of 2018. On an adjusted basis, consolidated operating expenses were $553 million.

Consolidated operating income for the fourth quarter was $676 million and the operating margin was 52%. On an adjusted basis, consolidated operating income for the fourth quarter was $755 million and the adjusted operating margin was 58%.

Trading and clearing net revenues amounted to $657 million in the fourth quarter of 2018, up 27% from the year-ago quarter. Trading and clearing operating expenses totalled $256 million and adjusted operating expenses were $232 million in the fourth quarter. Segment operating income for the final quarter of 2018 was $401 million and the operating margin was 61%. On an adjusted basis, operating income was $425 million and the adjusted operating margin was 65%.

Regarding the full year 2018, consolidated net revenues were $5 billion, up 7% year-over-year. Full year 2018 data and listings revenues were $2.6 billion and trading and clearing net revenues were $2.4 billion, up 2% and 14% year-over-year, respectively. Consolidated operating expenses were $2.4 billion for 2018. On an adjusted basis, consolidated operating expenses were $2.1 billion.

For the full year of 2018 consolidated net income attributable to ICE was $2 billion on $5 billion of consolidated revenues less transaction-based expenses. Full year 2018 GAAP diluted EPS were $3.43. On an adjusted basis, net income attributable to ICE for the year was $2.1 billion and adjusted diluted EPS were $3.59, up 21% year-over-year.

Consolidated operating income for the year was $2.6 billion and the operating margin was 52%. On an adjusted basis, consolidated operating income for the year was $2.9 billion and the adjusted operating margin was 58%.

In a separate announcement, ICE said its board authorized its first quarter 2019 dividend of $0.275 per share, up 15% from its previous $0.24 per share quarterly dividend in 2018.

The first quarter cash dividend is payable on March 29, 2019 to stockholders of record as of March 15, 2019. The ex-dividend date is March 14, 2019.