IG Academy app becomes available in Switzerland

The latest update releases IG Academy in Switzerland.

Electronic trading major IG Group Holdings plc (LON:IGG) continues to improve its mobile solutions. The latest version (2.8) of the IG Academy app for iOS-based devices was released earlier today, with the solution gaining ground in a new market – Switzerland.

This update releases IG Academy to Switzerland. The move underlines the app developers’ efforts to improve traders’ learning experience and make the app easier to use.

The preceding version (2.7) of the IG Academy app included a set of improvements focused on webinars. That update enabled users to view webinars in their local language.

The version of the solution released in August this year came with an expanded list of languages. The broker added Swedish to the lineup, taking the number of languages in which the app is available to nine. Earlier in the summer, IG added Dutch, Italian, Norwegian and Spanish to the language list, in a move to take the solutions to a wider clientele. Let’s also note that such moves are in tune with the growing use of mobile solutions by younger clients.

IG has been keeping an eye on other features too. In an update to IG Academy released in May this year, the broker enabled traders to join live webinars with leading trading experts. Users of the solution also got to manage their marketing preferences.

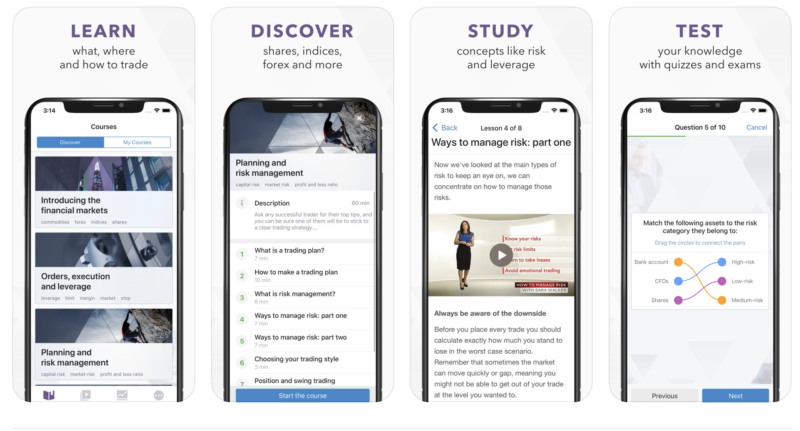

IG Academy, as its name suggests, has as its goal to teach its users how to trade straight from their phones.

Downloading the application is free of charge. Users of the solution may learn about trading financial assets such as shares, indices, Forex and commodities, and find out how to capitalise on both rising and falling markets. They can also discover how to trade using leverage, execute orders and develop a trading plan. In addition, the application offers traders a way to understand risk management and how to protect their profits or limit potential losses. From a psychological point of view, the solution enables traders to gain the confidence to decide what, when and how to trade.