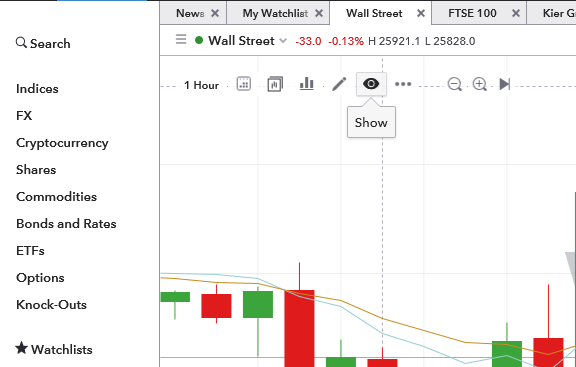

IG adds new visibility icon to platform

The new feature, which simplifies finding the “show” button, makes the platform easier to navigate.

Online trading major IG Group continues to enhance the capabilities of its new trading platform. On the back of client feedback and to make the platform easier to navigate, the brokerage has now made the ‘show’ button easier to find by adding the toggle to the top of the charts.

By clicking this button, traders will be able to customize the information that appears on their charts. These functionalities were previously available by right clicking on the graph, however due to significant and continued client use they are now only one click away.

Traders can add a number of graph features, including:

- HLOC – By enabling HLOC data, traders will be able to see the high, low, open and close prices by hovering over a candlestick on a chart.

- Drawings – the drawings button will enable traders to see or hide any drawing they may have set up. This button will make it easier to work with drawings, as traders can hide them all at the same time without having to discard each drawing individually.

- Indicators – this button will make it easier to hide all indicators that are selected, without having to delete each indicator individually.

- Open positions – by enabling open positions on a chart, traders will see a line displaying their open position(s) and the level at which it was open.

- Working orders – enabling working orders will allow traders to see any working orders they may have set up for that market as a line along its trigger price.

- Timeline – enabling the timeline will allow traders to see, at the bottom of the graph, the range of dates selected to appear on the graph.

- Price changes – enabling price changes will show the absolute change, the percentage change, the high, the low and the time frame to which it applies; all shown at the bottom of the graph.

- Price line – enabling price line will show a line across the graph where the current price is.

- Position preview – enabling position preview will allow traders to see a visual representation of a trade on the graph as traders fill in the deal ticket.

IG has also been updating its mobile solutions. The latest version (2.9) of the IG Academy app for iOS-based devices was released earlier in February, with the solution made available to traders in the United States. The app’s rollout in the USA happens shortly after IG launched a website dedicated to its US retail Forex operations. Let’s note that this website has a section inviting traders to build their skills via IG Academy.