IG Group makes IG Academy mobile app available in USA

The rollout of the mobile app happens shortly after the leading brokerage launched its US retail FX operations.

Electronic trading major IG Group Holdings plc (LON:IGG) continues to improve its mobile solutions. The latest version (2.9) of the IG Academy app for iOS-based devices was released earlier today, with the solution made available to traders in the United States.

The app’s rollout in the USA happens shortly after IG launched a website dedicated to its US retail Forex operations. Let’s note that this website has a section inviting traders to build their skills via IG Academy.

Let’s recall that, according to the BASIC system of the National Futures Association (NFA), IG US LLC secured a number of approvals on October 15, 2018. Back then, IG US LLC became officially registered as Retail Foreign Exchange Dealer (RFED), and Introducing Broker. It was also approved as Forex Dealer Member, Forex Firm and NFA Member.

IG believes that its retail FX offer in the US will be able to compete successfully in what is currently a limited competitive market with only three other providers. IG has the added benefit of the lead generation provided by the DailyFX website. Effective November 30, 2018, FX Publications Inc, doing business as Daily FX, became registered as NFA Member, Forex Firm, and Introducing Broker. IB is guaranteed by IG US LLC.

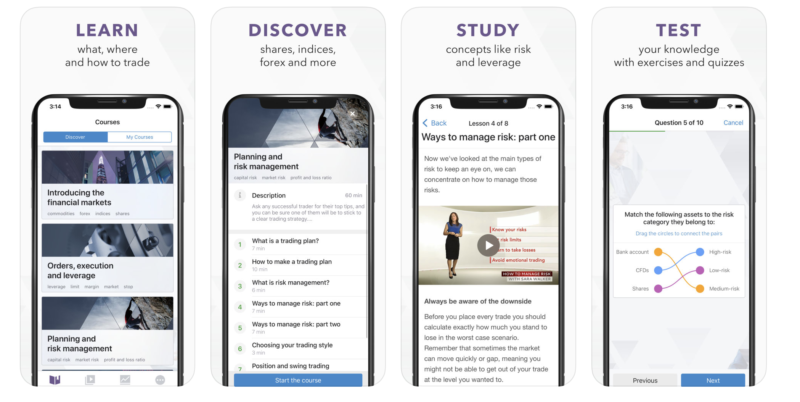

IG Academy, as its name suggests, has as its goal to teach its users how to trade straight from their phones.

Downloading the application is free of charge. Users of the solution may learn about trading financial assets such as shares, indices, Forex and commodities, and find out how to capitalise on both rising and falling markets. They can also discover how to trade using leverage, execute orders and develop a trading plan. In addition, the application offers traders a way to understand risk management and how to protect their profits or limit potential losses. From a psychological point of view, the solution enables traders to gain the confidence to decide what, when and how to trade.

In December 2018, IG made the app available in Switzerland.